Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little. It begins with the most substantive progress on Brexit in months, but also entails a possible new tariff truce between the US and China. Indeed, we irreverently...

Read More »Zurich homes market in highly overvalued territory, says UBS

© Ppvector | Dreamstime.com Every quarter UBS, a bank, publishes its real estate bubble index, a report that covers real estate prices in 24 cities around the world. In the third quarter of 2019, Munich was listed as the most overvalued housing market in the world. Bubble risk was highest in Munich, Toronto, Hong Kong and Amsterdam. Frankfurt, Vancouver and Paris. London moved out of bubble risk territory while Paris and Frankfurt entered the risk zone for the first...

Read More »EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect. Brexit negotiations have accelerated but we note that any deal must...

Read More »Why Switzerland ranks near the top of the 2019 global competitiveness ranking

Solar Impulse 2 – an example of Swiss innovation – © Ryan Fletcher | Dreamstime.com Switzerland made the the top 5, after dropping from 4th to 5th, in this year’s World Economic Forum (WEF) Global Competitiveness Index. Switzerland’s decline was largely due to a down weighting of a factor where it is strong, according to WEF’s Saadia Zahidi. The Global Competitive Index measures performance in 114 areas that influence a nation’s productivity. Productivity, a measure...

Read More »The Ultimate Heresy: Technology Can’t Fix What’s Broken

Technology can’t fix what’s broken, because what’s broken is our entire system.. The ultimate heresy in today’s world isn’t religious or political: it’s refusing to believe that technology can not only solve all our problems, it will do so painlessly and without any sacrifice. Anyone who dares to question this orthodoxy is instantly declared an anti-progress (gasp!) Luddite, i.e. a heretic in league with the Devil. Even worse, if that’s possible, is declaring that...

Read More »Fed Chair Powell’s Inescapable Contradiction

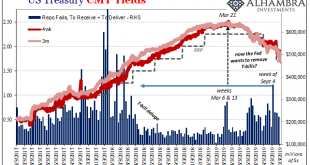

Under the Influence “This feels very sustainable.” – Federal Reserve Chairman Jerome Powell, October 8, 2019 Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best...

Read More »EU removes Switzerland from tax haven list

© Neydtstock | Dreamstime.com In December 2017, the European Union (EU) set up a blacklist and a grey list of tax havens, countries it deemed were being used to help companies and wealthy individuals reduce their tax bills. Switzerland ended up on the grey list. Nations on these lists faced reputational damage and stricter controls on financial transactions with the EU. On 10 October 2019, the European Commission reviewed the lists and removed Switzerland from the...

Read More »Never Attribute To Malice What Is Easily Explained By Those Attributing Anything To Term Premiums

There will be more opportunities ahead to talk about the not-QE, non-LSAP which as of today still doesn’t have a catchy title. In other words, don’t call it a QE because a QE is an LSAP not an SSAP. The former is a large scale asset purchase plan intended on stimulating the financial system therefore economy. That’s what it intends to do, leaving the issue of what it actually does an open question. The SSAP is what’s coming next. A small scale asset purchase plan...

Read More »Cashflow crisis looms over UN in Geneva

The liquidity problem affects the UN’s main hubs like the Geneva headquarters, which employs 5,000 permanent staff. (UN Photo / Jean-Marc Ferré) The United Nations is facing a serious cashflow crisis, as 63 states – including its largest contributor, the United States – have not paid their annual dues. In Geneva, officials at the UN’s European headquarters (UNOG) are considering ways to cut costs, while the host nation looks on anxiously. The statement by UN...

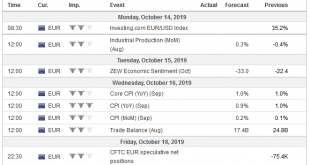

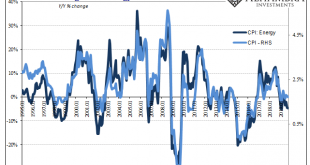

Read More »CPI Changes On Energy: The Inflation Check

After constantly running through what the FOMC gets (very) wrong, let’s give them some credit for what they got right. Though this will end up as a backhanded compliment, still. After having spent all of 2018 forecasting accelerating inflation indices, from around New Year’s Day forward policymakers notably changed their tune. Inflation pressures that were in December 2018 building underneath leading officials to fear a harmful breakout, by January 2019 they were...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org