According to Federal Reserve chairman Jerome Powell, disinflation is now taking hold.

Yes, the very same person who had to walk back his ridiculous pronouncements in 2021 and 2022 that inflation was “transitory” now wants us to believe that inflation is in the process of steadily declining.

Powell delivered a quarter-point rate hike on Wednesday. He also delivered remarks widely interpreted by markets as dovish. He suggested the Fed was close to declaring victory over inflation.

“It is gratifying to see the disinflationary process now getting underway,” Powell said.

He forecasted “slower growth, some softening in labor market conditions, and inflation moving down steadily, but not quickly.”

The Fed’s focus is shifting from fighting inflation to trying to engineer

Articles by Stefan Gleason

Fed Admits It CAN’T Tame Inflation, Promises More Economic Pain Anyway

September 3, 2022Federal Reserve chairman Jerome Powell is talking tough and warning of more interest rate pain to come. At the same time, Fed officials are now admitting that their sized-up rate hikes won’t even be sufficient to tame the price inflation they have helped create.

That’s because fiscal policy under the Joe Biden administration has gone off the rails.

Over the weekend, the Federal Reserve Bank of Kansas City released to the public a white paper titled “Inflation as a Fiscal Limit” for purposes of shifting more blame to elected officials.

The paper states that this year’s inflation spike “could not have been averted by simply tightening monetary policy. The conquest of post-pandemic inflation requires mutually consistent monetary and fiscal policies to avoid

Should Investors Fear Fed Rate Hikes?

January 28, 2022The prospect of Federal Reserve rate hikes continues to rattle Wall Street and cloud the outlook for precious metals.

On Wednesday, the central bank strongly signaled it will raise its benchmark Fed funds rate for the first time in three years – likely at its March policy meeting.

Policymakers noted that inflation is running “well above” target and also claimed a “strong labor market” justifies a degree of monetary tightening.

“There’s quite a bit of room to raise interests without threatening the labor market,” Fed chairman Jerome Powell said, adding, “wages are moving up at the highest pace they have in decades.”

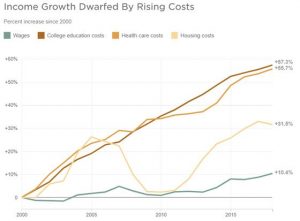

FACT CHECK: Mostly False!

Price inflation overall is moving up at the highest pace in decades. Wages have certainly been rising in nominal terms as

Fed’s Stunning Inflation Abdication; Gold Gearing Up

November 6, 2021When will precious metals markets finally make their move?

It’s a question that has frustrated many investors in 2021. Gold and silver prices have remained stubbornly rangebound for the past several months.

There is no way to know exactly when this consolidation period will end. Long-term investors would be wise to hold their core positions regardless of market conditions (and grow them when feasible).

However, there are signs both technical and fundamental that point to a major directional move coming in the relatively near future.

One of them flashed on Wednesday following the Federal Reserve’s latest policy announcement. As expected, officials said they plan to begin withdrawing some of their “emergency” stimulus in the face of surging inflation pressures in

The Inflation Tax Is Bearing Down on Investors Too

October 6, 2021The post-COVID inflation surge that was supposed to be “transitory” is looking a lot more permanent.

On Friday, the Bureau of Economic Analysis Friday released data on Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred inflation gauge.

“The PCE price index for August increased 4.3 percent from one year ago, reflecting increases in both goods and services,” according to the report. “Energy prices increased 24.9 percent and food prices increased 2.8 percent.”

Those numbers reflect the biggest increase in 30 years.

Even when excluding food and energy, the PCE index jumped 3.6% from one year ago – well above the Fed’s own long-term 2% objective.

Fed chairman Jerome Powell has stated he is willing to tolerate above-target inflation for an

The Fed’s ‘Dangerous’ Path Toward Debt Monetization

October 1, 2021A prominent U.S. Senator just called the head of the nation’s central bank “dangerous.” Unfortunately, the true dangers of U.S. monetary and fiscal policy were lost on everyone involved.

On Tuesday, Federal Reserve Chairman Jerome Powell testified before the Senate banking committee, where Senator Elizabeth Warren led the left wing of the Democratic Party’s attack.

“Over and over, you have acted to make our banking system less safe. And that makes you a dangerous man to head up the Fed, and it’s why I’ll oppose your renomination,” Warren sniped.

Notwithstanding Powell’s controversial personal investments in markets directly impacted by Fed interventions, he’s currently expected to be renominated to his Fed position by President Joe Biden, at the recommendation of

Biden’s Dangerous Inflation Denials

July 25, 2021[unable to retrieve full-text content]President Joe Biden is in denial about inflation. This week he superficially addressed the problem by admitting the obvious – that prices have been rising rapidly this year – while denying that the inflation surge represents anything out of the ordinary.

Read More »Stefan Gleason: The Big Inflation Scam

April 18, 2021[embedded content]

Tom welcomes Stefan Gleason, president of Money Metals Exchange, to the show. The idea of sound money is something that holds it’s value over time in contrast to fiat currencies. The market has chosen gold and silver over thousands of years as the money that sustains and preserves purchasing power.

They focus on improving public policy at the state level via the Sound Money Defense League. There are more options for improving laws at a state level than at the Federal level, and they have had several successes. To that end, they have created a Sound Money Index that measures differences between states regarding policies like sales taxes. He outlines why sales taxes on investments like bullion is a silly idea.

He discusses how inflation affects

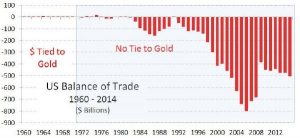

Rising Debt Means a Weaker Dollar

April 11, 2021Americans appear to be growing more concerned about the skyrocketing national debt level – officially $28.1 trillion and counting.

The Peter G. Peterson Foundation’s monthly Fiscal Confidence Index recently shed five points, dropping to a level of 47, in the wake of the Biden Administration’s latest $2 trillion stimulus package.

That $2 trillion bill is simply piled on top of already massive budget deficits.

And it adds furthers to concerns over the country’s currency, the Federal Reserve Note “dollar.”

Federal debt is currently the largest as a percentage of the economy since World War II. Given that no amount of tax hikes will yield enough capital to cover the debt, the nation now finds itself on an unsustainable trajectory towards bankruptcy.

The only viable

Fed Recommits to Misleading the Public About Inflation

December 19, 2020Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline?

On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future.

Fed officials also vowed to keep pumping cash into financial markets.

Following Fed chairman Jerome Powell’s remarks, the wavering U.S. Dollar Index turned down – hitting a fresh new low for the year. Gold gained modestly on the day while silver got a bigger boost to close solidly above $25/oz, promptly heading to $26/oz the day following.

Precious metals markets have been basing out over the past several weeks. They are struggling to attract safe-haven demand amid record runs in stocks and Bitcoin.

How sustainable the bull market in equities will be heading into

Media Celebrates after Trump’s Pro-Gold Fed Nominee Gets Blocked

November 20, 2020It was only after he entered politics that President Donald Trump began to fully grasp the bias, dishonesty, and fakeness that runs throughout the so-called mainstream media.

But gold bugs and sound money advocates have long known to distrust the reporting of establishment news sources.

Journalists’ anti-gold and anti-Trump biases converged this week as the Senate took up President Trump’s nomination of Judy Shelton to the Federal Reserve Board.

Shelton, a fierce Fed critic and past supporter of a gold standard, drew intense opposition from Senate Democrats. She also faced opposition from Republicans Lamar Alexander, Susan Collins, and Mitt Romney.

A path to her confirmation appeared to exist earlier this week, but that path was blocked, at least temporarily, on

A New World Monetary Order Is Coming

November 4, 2020Image from Zerohedge

The global coronavirus pandemic has accelerated several troubling trends already in force. Among them are exponential debt growth, rising dependency on government, and scaled-up central bank interventions into markets and the economy.

Central bankers now appear poised to embark on their biggest power play ever.

Federal Reserve Chairman Jerome Powell, in coordination with the European Central Bank and International Monetary Fund (IMF), is preparing to roll out central bank digital currencies.

The globalist IMF recently called for a new “Bretton Woods Moment” to address the loss of trillions of dollars in global economic output due to the coronavirus.

In the aftermath of World War II, the original Bretton Woods agreement established a world

The Fed’s Quest for Higher Inflation: What Could Go Wrong?

October 11, 2020The Federal Reserve is warning investors in no uncertain terms that higher rates of inflation are coming. Yet markets, for the most part, have disregarded that warning.

Bond yields, for example, remain well below 2% across the entire duration range. Stock market valuations continue to reflect a sanguine outlook for inflation. And crude oil futures suggest limited upside pressure on prices.

It seems the Fed has a credibility problem.

In August, Fed Chairman Jerome Powell announced that the central bank would begin targeting an inflation “average” of 2%.

By the Fed’s measures, inflation has been running below 2% in recent years. So getting to a 2% average in the years ahead will require above 2% inflation for a significant period.

In September, St. Louis Fed

WARNING: The U.S. Banking System ISN’T as Strong as Advertised

June 22, 2020Despite a year of tumult on Wall Street and Main Street, the banking system seems to be holding up remarkably well… for now.

Whereas previous financial crises were marked by a surge in bank failures, hardly any have gone under so far in 2020. The Federal Deposit Insurance Corporation (FDIC) reports that only 1% of FDIC-insured banks are on the “problem list” for financial weakness.

“Banks are safe,” according to FDIC chair Jelena McWilliams. “There are no concerns for depositors.”

No concerns? We beg to differ.

First quarter earnings for banks and savings institutions plummeted 69.6% compared to the year prior, based on the FDIC’s own data. Meanwhile, risks in the mortgage and corporate debt markets continue to mount amid an uncertain post-lockdown economic

What’s Next, Trillion-Dollar Coins?

May 1, 2020The massive set of stimulus measures rolled out last month by the Treasury Department and Federal Reserve has left many Americans wanting more… and politicians scheming for new ways to dole out additional trillions in cash.

Most taxpayers have already received their $1,200 “stimulus” payments. However, that one-time payment will do little to repair the long-term financial health of the 26 million (and rising) who are newly unemployed.

And it surely won’t bail out all the small business owners who were callously deemed “non-essential” and forced to shut down during this pandemic.

A national WalletHub survey found that 84% of Americans want another stimulus check.

The idea of getting free money is understandably appealing, especially during times of extreme economic

All of the Economic Recovery Models Will Be Wrong Too

April 14, 2020“All of the projection models were wrong. All of them,” admitted New York Governor Andrew Cuomo in an interview last week with MSNBC.

Governor Cuomo had been issuing frantic demands for tens of thousands of ventilators… that turned out not to be needed as the rate of new hospitalizations for COVID-19 infections in New York plunged with surprising speed.

Governor Cuomo had warned America that New York City was the canary in the coal mine, that other cities would soon suffer similar death rates.

Deeply flawed infection models have led

to economic and societal devastation.

And based on models cited by Dr. Anthony Fauci just a few days ago, the United States was expected to rack up around 200,000 deaths from the virus – or more than 2 million if we failed to

Read More »After Fed Disappoints, Will Trump Initiate Currency Intervention?

August 3, 2019Following months of cajoling by the White House, the Federal Reserve finally cut its benchmark interest rate. However, the reaction in equity and currency markets was not the one President Donald Trump wanted – or many traders anticipated.

The Trump administration wants the Fed to help drive the fiat U.S. dollar lower versus foreign currencies, especially those of major exporting countries.

Instead, the U.S. Dollar Index rallied throughout July ahead of the expected rate cut and continued rallying after Fed chairman Jerome Powell made it official on Wednesday.

In fact, the Federal Reserve Note broke out to its highest level since early 2017.

The Fed also announced it would end its balance sheet reduction program a

Monetary Metals Don’t Need a “Gold Standard” Proxy System

July 20, 2019President Trump moved recently to nominate an avowed sound money advocate, Judy Shelton, to the Federal Reserve Board. That triggered a flurry of superficial and derisive references in the controlled media to Shelton’s past support of a gold standard.

For example, CBS News described her as “a believer in the return to the gold standard, a money policy abandoned by the U.S. in 1971.” According to the story, “mainstream economists believe it’s a fringe view.”

As the “mainstream” media portrays sound money advocates, we apparently are nostalgic for the monetary system that existed all the way up until 1971.

Being backward looking by nature, our driving purpose in life is apparently to salvage that “abandoned” system.

Big Tech, Big Banks Push for “Cashless Society”

June 28, 2019The War on Cash isn’t a conspiracy theory. It’s an open agenda. It’s being driven by an alignment of interests among bankers, central bankers, politicians, and Silicon Valley moguls who stand to benefit from an all-digital economy.

Last week, Facebook – in partnership with major banks, payment processors, and e-commerce companies – launched a digital currency called Libra. Unlike decentralized, free-floating cryptocurrencies, Libra will be tied to national fiat currencies, integrated into the financial system, and centrally managed.

Critics warn Libra is akin to a “spy coin.” It’s certainly not for anyone who wants to go off the financial grid.

Many of the companies involved in Libra (including Facebook itself)

Trump’s Backdoor Power Play to Rein In the Fed

September 21, 2018“Just run the presses – print money.”

That’s what President Donald Trump supposedly instructed his former chief economic adviser Gary Cohn to do in response to the budget deficit. The quote appears in Bob Woodward’s controversial book Fear: Trump in the White House.

Trump disputes many of the anecdotes Woodward assembled. But regardless of whether the President used those exact words, they do reflect an “easy money” philosophy that he has expressed many times before.

Trump Likes Low Rates, Loose Money

President Trump has described himself as a “low interest rate person.”

Donald Trump

This past summer, Trump launched a very public attack on the Federal Reserve’s rate hiking campaign. He wants it to stop because it’s

How Trump Can Bring Outside-the-Box Thinking to Bear on the Fed

December 9, 2016The Fed operates in secret, creates inflation, and bails out Wall Street. – Click to enlarge

President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous.

On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically motivated.

Trump also called for the Federal Reserve to be audited.

Fed officials worry the Trump presidency represents a unique threat to the Fed’s closely guarded “independence.” Sound money proponents, meanwhile, are hopeful that some long overdue reforms of the monetary system could begin to take shape.

The first item on the new president’s Fed agenda will be to appoint two members to the Board of Governors. The seven-seat Board currently has two vacancies that can be filled immediately.

The Board of Governors exerts direct influence over monetary policy and can push the Fed chair toward adopting a consensus opinion.

Trump Can Appoint Two New Fed Members Now and Replace Yellen Soon

Janet Yellen is likely to stay on as the public head of the Fed at least until her term expires in February 2018. (Trump could potentially ask her to step down, but he cannot unilaterally fire her.

How Trump Can Bring Outside-the-Box Thinking to Bear on the Fed

December 9, 2016The Fed operates in secret, creates inflation, and bails out Wall Street. – Click to enlarge

President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous.

On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically motivated.

Trump also called for the Federal Reserve to be audited.

Fed officials worry the Trump presidency represents a unique threat to the Fed’s closely guarded “independence.” Sound money proponents, meanwhile, are hopeful that some long overdue reforms of the monetary system could begin to take shape.

The first item on the new president’s Fed agenda will be to appoint two members to the Board of Governors. The seven-seat Board currently has two vacancies that can be filled immediately.

The Board of Governors exerts direct influence over monetary policy and can push the Fed chair toward adopting a consensus opinion.

Trump Can Appoint Two New Fed Members Now and Replace Yellen Soon

Janet Yellen is likely to stay on as the public head of the Fed at least until her term expires in February 2018. (Trump could potentially ask her to step down, but he cannot unilaterally fire her.

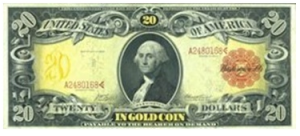

What Can Gold Do for Our Money?

May 19, 2016One of the chief virtues of a gold standard is that it serves as a restraint on the growth of money and credit. It makes runaway government deficit spending and major monetary catastrophes such as hyperinflation practically impossible.

Opponents of a gold standard can’t defend the political malpractices that are enabled by a fiat currency regime. So instead they spin a narrative about how gold supposedly hampers the economy.

According to Keynesian economics, spending boosts the economy while savings contracts it.

Keynesians put the cart before the horse. Savings and investment drive the economic productivity that enable consumers to enjoy a high standard of living. But Keynesians believe the economy only booms when demand is artificially pumped up by debt, government spending programs, and perpetual currency depreciation (inflation) engineered by central bankers.

A gold standard produces deflation, its opponents charge, which incentivizes consumers to save money rather than spend it. Of course, what they call “deflation” is really just price stability. Over time, gold (and gold-backed money) maintains its purchasing power – neither gaining nor losing real value against other raw materials. When the U.S. pursued sound money policies from the post Civil War period into the early 1900s, consumer price levels were virtually flat; yet real economic growth soared.

How Unsound Money Fuels Unsound Government Spending

May 2, 2016Sound money advocates are often hit with the charge of being “doom and gloomers.” Yes, we do warn that unsound monetary policies enable unsustainable fiscal commitments, which will lead eventually to a currency crisis.

Sound money advocates are also often portrayed as party poopers. Yes, we do seek to take away the bottomless punch bowl of easy money and replace it with something more solid.

However, we are not pessimists or killjoys by nature. To the contrary, we are quite optimistic about the ability of genuinely free markets to generate ever greater levels of prosperity for ever greater numbers of people. To advocate hard money, as in a gold and/or silver standard, is simply to be a hard-nosed realist about the dangers of giving governments the power to issue unbacked fiat currencies.

The case for hard money is based on the proposition that real wealth is generated by productive activity in the real economy. When governments and central banks assume the power to set interest rates artificially low, to expand the supply of money and credit at will, and to bail out “too big to fail” financial institutions, they are engaging in massive wealth transfers. They are stealing purchasing power away from productive workers in the real economy and transferring it to bankers and bureaucrats.

As the late economist and Nobel Laureate Friedrich A.

The Path to the Digital Gold Standard

January 15, 2016Several Republican presidential candidates are floating the idea of returning to some form of a gold standard in the U.S., although none have gone into any great detail. So, how might a modern gold standard work?

It’s a question that requires us to do more than just look to the past with an eye toward “restoring,” “bringing back,” or “returning to” gold-backed money. Sound money advocates need to also think creatively about how to adapt hard money principles to the current and future needs of a dynamic and digital-based economy.

Don’t get me wrong, the long history of gold and silver being used as money going back to ancient times still matters. The basic principles behind sound money are timeless. Computer technology may make it easier than ever for central banks to create and manipulate digital fiat currency units, but easy doesn’t mean honest.

For better or worse, the digital economy is here to stay. It can be mostly for the better. There is nothing inherently dishonest about e-commerce or smartphone payments, and there is no reason why gold and silver can’t integrate into these and future systems.

In fact, the digital economy opens up a world of new opportunities for free-market alternative currencies to take hold.