USD/CHF clings to 0.9890 after unemployment data. A four-day-old symmetrical triangle limits the pair’s near-term moves. 200-HMA adds to the support while 0.9920 limits the upside. USD/CHF remains largely unchanged after the headline job data as it trades near 0.9890 ahead of Monday’s European session open. August month seasonally adjusted Unemployment Rate for Switzerland matches 2.3% forecast and prior. Hence, the pair is more likely to continue within immediate...

Read More »Is The Negativity Overdone?

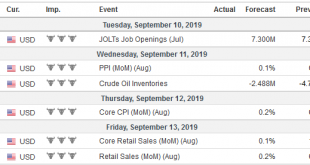

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009. And there’s more to come. As Bloomberg reported late last week: Over the next 12 months, interest-rate swap markets have priced in around 58 more...

Read More »FX Daily, September 9: Market Sentiment Still Constructive

Swiss Franc The Euro has risen by 0.52% to 1.0944 EUR/CHF and USD/CHF, September 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The improvement of investor sentiment seen last week is carrying over into the start of the new weeks. Global equities are firm as are benchmark yields. Asia Pacific equities advanced, except in Hong Kong, where Chief Executive Lam’s promise to formally withdraw the controversial...

Read More »FX Weekly Preview: Gaming the ECB and Putting the Cart Before Horse in the Brexit Drama

The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that. Italy has a new government, but a prolonged honeymoon is unlikely for this unlikely union. Face-to-face talks between the US and China are better than no talks but hardly indicates an end to...

Read More »EM Preview for the Week Ahead

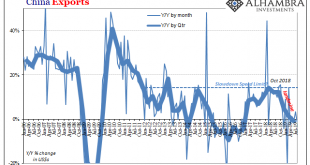

Despite some positive developments last week, we think the three key issues for risk assets have not been resolved yet. Hong Kong protests continue, while reports suggest the US and China remain far apart. Even Brexit has likely been given only a three month reprieve. We remain negative on EM until these key issues have been ultimately resolved. China reports August money and loan data this week but no data has been set. With the recently announced cuts in...

Read More »SNB Jordan: Cannot say how long negative interest rates will last

. SNBs Jordan on the wires The Swiss national banks Jordan is on the wires saying: He cannot say how long negative interest rates will last Negative rates are necessary for now Interest rate spreads like important role for exchange rates The USDCHF is trading higher today. It currently trades at 0.9861. The 100 hour moving average stalled the rally at 0.98737 today. The 200 hour moving average at 0.98479 was rebroken to the upside earlier. That is now support....

Read More »These Are Not Signs of a Healthy Market

If these three charts reflect a “normal” “healthy” Bull market, then why are they so uncommon? The implicit narrative of the latest rally in stocks is that this is just another normal rally in the ongoing 10-year long Bull market. Nice, but do these three charts look “normal” to you? Let’s take a quick glance at a daily chart of the S&P 500 (SPX), a weekly chart of TLT, the exchange-traded fund of the US Treasury 20-year bond, and silver. In other words, let’s...

Read More »New 100 Swiss Franc Note Coming Soon

Recently, the Swiss National Bank (SNB) unveiled the new 100 franc banknote. Only one note missing – © Janusz Pieńkowski | Dreamstime.com The note’s design is inspired by Switzerland’s tradition of humanitarianism, represented on the note by water. The note remains blue but is much smaller than the existing one, making it easier to fit into wallets. The note is the last one in Switzerland’s ninth series of notes to be updated. Updating the series began in April 2016...

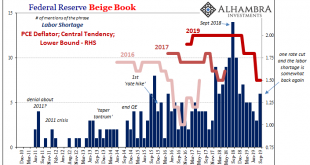

Read More »Just Who Was The Intended Audience For The Rate Cut?

Federal Reserve policymakers appear to have grown more confident in their more optimistic assessment of the domestic situation. Since cutting the benchmark federal funds range by 25 bps on July 31, in speeches and in other ways Chairman Jay Powell and his group have taken on a more “hawkish” tilt. This isn’t all the way back to last year’s rate hikes, still a pronounced difference from a few months ago. The common forecast relies entirely on the subjective...

Read More »FX Daily, September 06: Focus Shifts to North American Jobs Before Turning Back to Europe next Week

Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org