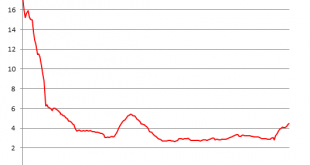

Doing more of what’s failed for ten years will finally fail spectacularly.. It was a huge relief to see the charts of the Baltic Dry Index (BDI) and the U.S. retail sector ETF (RTH): both have soared to the moon, signaling that both the U.S. and global economies are booming: the BDI is widely regarded as a proxy for global shipping, which is a proxy for global trade and economic activity. Batic Dry Index, 2018-2019 - Click to enlarge Amazon is 18% of the RTH...

Read More »EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

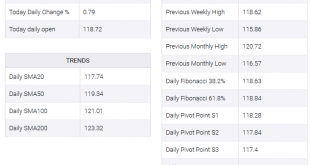

EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today. EUR/JPY is currently trading at...

Read More »Cool Video: Thoughts on ECB

A few hours after the ECB announced a new package of monetary accommodation, I joined a discussion on CNBC Asia with Nancy Hungerford and Sir Jegarajah. Here is a clip of part of our discussion. I make two points. The first is about the euro’s price action. What impressed me about it was that the euro posted an outside up day, trading on both sides of the previous day’s range and closing above its high. When Sri and I were talking early in the Asian morning, there...

Read More »Dollar Soft as Risk Sentiment Stoked Ahead of US Retail Sales

US-China relations appear to be thawing Trading was volatile after the ECB decision; we are still dollar bulls EM has benefitted from the shift in the global backdrop this week The US data highlight is August retail sales Vietnam cut rates 25 bp to 6.0%; Turkey reported July current account and IP The dollar is mostly softer against the majors ahead of the US retail sales data. Sterling and Swissie are outperforming, while Kiwi and Loonie are underperforming. EM...

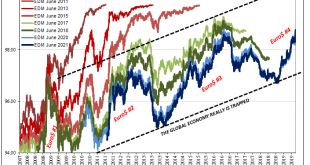

Read More »The Inevitable Bursting of Our Bubble Economy

All of America’s bubbles will pop, and sooner rather than later. Financial bubbles manifest three dynamics: the one we’re most familiar with is human greed, the desire to exploit a windfall and catch a work-free ride to riches. The second dynamic gets much less attention: financial manias arise when there is no other more productive, profitable use for capital, and these periods occur when there is an abundance of credit available to inflate the bubbles. Humans...

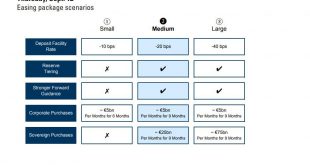

Read More »Since 2014, European Banks Have Paid €23 Billion To The ECB… And Now Face Disaster

Earlier this morning, there was an added wobble in European bond prices after an unconfirmed MNI report said the ECB could delay the launch of QE on Thursday and make it data dependent. While skeptics quickly slammed the story, saying it was just a clickbait by MarketNews… About this MNI story on a possible delay in ECB QE announcement: 1) No substance, including from the ECB “sources” 2) Let’s hope the story is as accurate as the previous ones — Frederik Ducrozet...

Read More »USD/CHF technical analysis: 0.9890 is the level to beat for sellers

USD/CHF fails to sustain the bounce off key support-confluence including 200-HMA and 38.2% Fibonacci retracement. A downside break highlights the 61.8% Fibonacci retracement level while 200-DMA caps the upside. Failures to sustain the bounce off 200-hour moving average (HMA) and 38.2% Fibonacci retracement of latest run-up drag the USD/CHF back to the key support-confluence while taking rounds to 0.9900 ahead of Friday’s European open. Should prices slip below 0.9890...

Read More »Tobacco consumption costs Switzerland 5 billion francs a year

© Mcwilli1 | Dreamstime.com Health care in Switzerland is funded by a mixture of taxes and health insurance premiums. Much of the insurance premiums paid are compulsory with no discounts offered to non-smokers. According to figures recently published by the Swiss association for smoking, the annual direct medical costs of smoking are CHF 3 billion (2015), or CHF 350 per person. This sum represents 3.9% of Switzerland’s total annual health spending. Tobacco use is the...

Read More »Your Unofficial Europe QE Preview

The thing about R* is mostly that it doesn’t really make much sense when you stop and think about it; which you aren’t meant to do. It is a reaction to unanticipated reality, a world that has turned out very differently than it “should” have. Central bankers are our best and brightest, allegedly, they certainly feel that way about themselves, yet the evidence is clearly lacking. When Ben Bernanke wrote for the Washington Post in November 2010 announcing somehow the...

Read More »Turkey Monetary Policy Planting Seeds of Future Crisis

Turkey central bank meets September 12 and is expected to cut rates 275 bp. With Erdogan talking about single digit rates and inflation, it’s clear that rates are headed significantly lower. At some point soon, we think the risk/reward for investing in Turkey will send investors fleeing for the exits.POLITICAL OUTLOOK President Erdogan sacked central bank Governor Murat Cetinkaya on July 6, ostensibly for not cutting rates quickly enough. In early August, several...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org