EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today. EUR/JPY is currently trading at 119.65 having ranged between a low of 117.55 and 119.82, whipsawed over the ECB announcements before gaining bullish traction towards the 2nd August spike high at 119.87. ECB QA is likely to be with us for a considerably long time The main take away from today’s ECB policy announcements is that QA is

Topics:

Ross J Burland considers the following as important: 4) FX Trends, 4.) FXStreet, CHF/JPY, EUR/CHF, EUR/JPY, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

- EUR/JPY rallies hard following hawkish ECB cut and trade war optimism.

- EUR/JPY tracking positive sentiment in financial and commodity markets.

While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today.

EUR/JPY is currently trading at 119.65 having ranged between a low of 117.55 and 119.82, whipsawed over the ECB announcements before gaining bullish traction towards the 2nd August spike high at 119.87.

ECB QA is likely to be with us for a considerably long time

The main take away from today’s ECB policy announcements is that QA is likely to be with us for a considerably long time considering policy is explicitly linked to the central bank’s inflation target while it is up to the individual nations to offer fiscal stimulus. However, with only a 10bps rate cut and €20bn/month of QE, some observers feel this was not enough.

“We don’t think that the ECB has delivered enough. We think it will have to deliver at least two more 10bps rate cuts in December and March, as well as to augment the pace of QE to €40bn/month in March once the global macro environment worsens further,” analysts at TD Securities argued.

EUR/USD key technical thresholds held, in both directions – What this means is the Swiss National Bank are likely to refrain from too much intervention for the time being considering the euro has not broken the lower boundaries on a slightly disappointing outcome from the ECB.

EUR/JPY bulls pile in, CHF/JPY caps EUR/CHF’s advanceThe SNB declined to comment about the possible implications for its own monetary policy. Denmarks National bank cut its key policy rate by 10bp to minus 0.75% after the ECB’s announcements. EUR/JPY has rallied the furthest and CHF/JPY has continued higher by 0.70%. “This lack of a strong directional cue suggests investors will pivot quickly to next week’s FOMC meeting for guidance. The ECB’s policy measures may be “adequate”, but we think that leaves the market in need of fresh catalysts to provide more of a push to escape recent ranges,” analysts at TD Securities explained. |

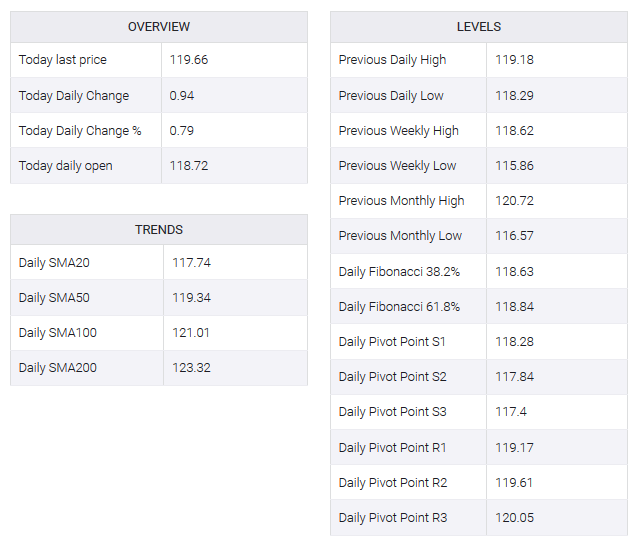

EUR/JPY levels(see more posts on EUR/JPY, ) |

Tags: CHF/JPY,EUR/CHF,EUR/JPY,Featured,newsletter