Turkey central bank meets September 12 and is expected to cut rates 275 bp. With Erdogan talking about single digit rates and inflation, it’s clear that rates are headed significantly lower. At some point soon, we think the risk/reward for investing in Turkey will send investors fleeing for the exits.POLITICAL OUTLOOK President Erdogan sacked central bank Governor Murat Cetinkaya on July 6, ostensibly for not cutting rates quickly enough. In early August, several high-ranking central bank officials were fired, including chief economist Hakan Kara. Others that were fired include the central bank’s head of research, the banking department chief, and the risk management chief. Who needs all these senior positions when President Erdogan is running monetary

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Turkey central bank meets September 12 and is expected to cut rates 275 bp. With Erdogan talking about single digit rates and inflation, it’s clear that rates are headed significantly lower. At some point soon, we think the risk/reward for investing in Turkey will send investors fleeing for the exits.POLITICAL OUTLOOK

President Erdogan sacked central bank Governor Murat Cetinkaya on July 6, ostensibly for not cutting rates quickly enough. In early August, several high-ranking central bank officials were fired, including chief economist Hakan Kara. Others that were fired include the central bank’s head of research, the banking department chief, and the risk management chief. Who needs all these senior positions when President Erdogan is running monetary policy. |

|

| Erdogan said last weekend that Turkey will soon cut rates to single digits, and that inflation will soon follow. He is under the misguided notion that high interest rates cause high inflation. There’s not a lot to add to this except to point out the obvious that he is wrong. However, it appears that he is trying to duplicate the credit-fueled boom of his early years.

Treasury Secretary Mnuchin said the US is still mulling sanctions on Turkey for its purchase of Russian missile defense systems. The US has already halted sales of F-35 fighter jets to Turkey, but more can be done to punish Turkey. Interior Minister Soylu said there were no plans to remove opposition mayors in Ankara and Istanbul. Dozens of elected mayors have been removed recently by the government on security grounds, with Soylu saying those removed had been collaborating with the separatist PKK. This is bad optics, as the removals were not carried out via any sort of judicial process. However, it is par for the course. Erdrogan’s former Deputy Prime Minister Ali Babacan announced a new political party to challenge the ruling AKP. Babacan is well-respected, serving as economic czar for Erdogan from 2009-2015 and as Foreign Minister from 2007-2009. He resigned from the AKP back in July, citing “deep differences” with the party that he helped Erdogan launch back in 2001. Babacan is not the only one breaking with the AKP. Last week, the AKP expelled former Prime Minister Ahmet Davutoglu and his allies. There is reportedly some bad blood between Babacan and Davutoglu, and so the two factions are unlikely to unite, at least for now. What is clear is that Erdogan’s imperial presidency is alienating many of his traditional allies. |

|

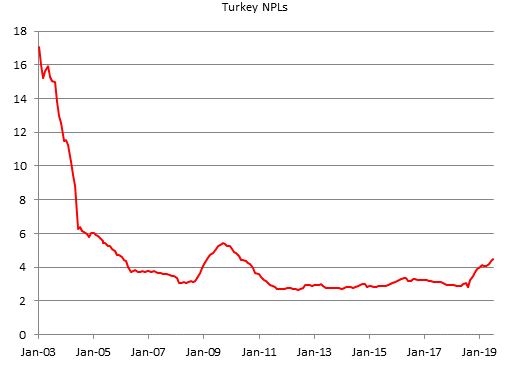

| The central bank recently announced a new sliding scale for commercial bank reserve requirements. Basically, the more a bank lends out, the lower its reserve requirements will be. If this seems counterintuitive, that’s because it is. A Turkish bank is rewarded for taking riskier lending behavior by having to keep less in reserves as insurance, not more. This is simply a train wreck waiting to happen.Indeed, non-performing loans (NPLs) have been rising steadily since August 2018. Over this period, NPLs as a share of total loans has nearly doubled from 2.85% to 4.47% in July. This is the highest rate since May 2010 and will likely rise further as lending standards are eased. The banking sector is seemingly headed for another potential crisis due to ongoing policy mistakes. As we shall see below, the lack of central bank independence coupled with lax banking sector regulation has plagued Turkey in the past. This appears to be coming full circle. |  |

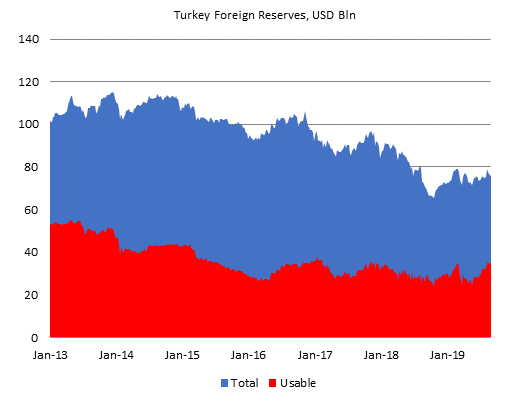

A BRIEF HISTORY LESSONThe Ottoman Empire was allied with Germany in WWI. After the defeat of the so-called Central Powers in 1918, the Ottoman Empire was occupied and partitioned by the victorious Allied Powers. Its Middle Eastern territories were largely carved up between the UK and France. The occupation led to the so-called Turkish War of Independence from 1919-1923. The Turkish National Movement led the fight for independence. In turn, that movement was led by Mustafa Kemal Pasha, a senior military officer that was instrumental in the Ottoman victory at the Battle of Gallipoli in 1915. In 1919, he organized and led a resistance movement. By 1921, a series of military victories allowed him to establish a provisional government in Ankara. The Allied Powers agreed to withdraw. The Ottoman Empire was officially abolished in 1922, with a new Republic of Turkey established the following year. The Grand National Assembly was formed, and Mustafa Kemal Pasha became the first President of the Republic. The country embarked on series deep social, political, and economic reforms. Primary education became free and compulsory, while full universal suffrage was introduced in 1934. In 1935, Mustafa Kemal Pasha was given the honorary surname Ataturk, meaning “Father of the Turks.” As part of the economic reforms, the Central Bank of the Republic of Turkey (CBRT) was established in 1931. Despite nominal independence, the central bank simply existed to monetize (print money) ongoing government budget deficits for most of its existence. This led to prolonged periods of high inflation during those early years. Legislation passed in 1970 that established a more formalized structure and policy framework for the central bank. The post of Governor was established that more closely followed international norms, along with a new decision-making Board of Directors. However, the central bank was still basically a piggy-bank for the government. It wasn’t until 2001 that formal and binding independence was granted to the central bank. At that time, Turkey was experiencing a severe financial crisis from 2000-2001 that was brought on by systemic banking sector weakness. The industry had been deregulated without introducing sufficient regulatory oversight or supervision. The four largest state-owned banks accounted for around 30% of the entire banking sector and were increasingly relied upon to finance government spending. Furthermore, the banking system was highly dependent on foreign funding. Besides this currency mismatch, the system also faced a large structural maturity mismatch by being too reliant on short-term financing. Thus, one major bank facing a cut-off in interbank funding quickly turned into a system-wide liquidity crisis which in turn morphed into a currency crisis. The economic chaos of 2000-2001 paved the way for the landslide election victory by Erdogan’s AKP in November 2002. ECONOMIC OUTLOOK The economy is in recession. The IMF expects GDP to contract -2.5% this year before growing 2.5% next year and 3.6% in 2021. GDP contracted -1.5% y/y in Q2 vs. -2.4% y/y in Q1. GDP grew 1.6% q/q in Q1 and 1.3% q/q in Q2 and so the economy is climbing out of recession. However, we believe Erdogan’s recently stated goal of 5% GDP growth next year is way too unrealistic. Price pressures are falling. CPI rose 15.0% y/y in August vs. 16.6% y/y in July and is the lowest rate since May 2018. PPI rose 13.4% y/y in August vs. 21.7% in July and is the lowest since January 2018, which points to lower price pressures in the pipeline. At this point, the 3-7% target range has been rendered meaningless. At the last policy meeting July 25, all rates were cut 425 bp vs. 250 bp consensus. That led the real policy rate to fall to 3.1% that month. However, lower inflation in August boosted the real policy rate to 4.7%. Another large cut in the nominal rate this month would effectively push the real rate back towards zero. If so, we do not think Turkish assets will remain attractive at those levels. Turkey central bank meets Thursday and is expected to cut rates 275 bp to 17.0%. Market is all over the place, however, with analysts looking for cuts of 125, 175, 200, 225, 250, 275, 300, 375, and 400 bp. With the lira remaining surprisingly stable, we suspect the bank will deliver a dovish surprise with a larger than expected cut. However, we do not believe Erdogan’s professed plans for single digit interest rates and inflation will come to fruition anytime soon. The central bank’s next quarterly inflation report is due out October 31. In the last report released July 31, the central bank’s inflation forecasts for end-2019, end-2020, and end-2012 were 13.9%, 8.2%, and 5.4%, respectively. The new inflation forecasts could hold some clues to monetary policy going forward. The next policy meetings after this week are October 24 and December 12. How fast and how much rates come down will be dictated by market reaction, which up until now has been muted. The external accounts have improved sharply. The 12-month total trade deficit has narrowed every month since June 2018. Exports have slowed but import demand has collapsed. Furthermore, the 12-month total current account moved into surplus in June for the first time since November 2002 and is expected to climb further into surplus in July. The IMF sees the current account moving to surplus of 0.7% of GDP this year from -5.7% in 2018 before moving back to a modest deficit of -0.4% in 2020. Note that after the 1994 crisis, the current account moved from a deficit equal to -3.6% of GDP in 1993 to a surplus equal to 2% of GDP the next year. After the 2001 crisis, the current account moved from a deficit equal to -3.7% of GDP in 2000 to a surplus equal to 1.9% of GDP the next year. Gross foreign reserves fell sharply ahead of the June Istanbul election do-over but have since recovered. Reserves were $79.1 bln in February but then fell to $73.4 bln in June. Gross reserves have since recovered to $75 bln in July and $75.8 bln in July, the highest since the February peak. At this level, they still cover less than 3 months of imports and are equivalent to about 45% of the stock of short-term external debt. Usable reserves net out commercial bank FX deposits at the central bank. These hit a new low of $24.7 bln in mid-May before recovering to nearly $35 bln in August. This still shows even greater external vulnerability. Lastly, Turkey’s Net International Investment Position is still a rather high -48% of GDP. |

|

Press reports back in June suggest usable reserves are even lower than reported. The central bank reportedly engaged in some currency swaps with commercial banks to inflate its foreign reserves. Rather than the $28 bln reported for usable reserves in June, reports suggest that the true number was below $16 bln. Frankly, both numbers are simply awful. However, the real takeaway is that the institutional framework appears to be breaking down further in Turkey.

INVESTMENT OUTLOOK

The lira continues to underperform. In 2018, TRY fell-28% and was behind only the worst performer ARS (-50.5%). So far in 2019, TRY is -8.6% and is ahead of only the worst performer ARS (-33%). Our EM FX model shows the lira to have VERY WEAK fundamentals, and so we expect this underperformance to continue.

USD/TRY is trading near 5.7860, the highest level since September 3. The September 2 high near 5.8620 is nearing and a break of that level sets up a test of the June 14 high near 5.9330. Looking farther out, the May highs near 6.1515 and 6.2455 should come into focus.

Turkish equities are outperforming for a change. In 2018, MSCI Turkey fell -20.5% and compared to -17.4% YTD for MSCI EM. So far in 2019, MSCI Turkey is up 10.5% vs. a 5.8% gain for MSCI EM. Given ongoing risks to the economy, we expect Turkish equities to start underperforming. This supports the UNDERWEIGHT in our EM Equity Allocation model. The banking sector remains particularly vulnerable.

Turkish bonds are outperforming. The yield on 10-year local currency government bonds is -198 bp YTD and behind only the best EM performer the Philippines at -243 bp. With the central bank likely forced to cut rates aggressively, we think Turkish bonds can continue to outperform over the near-term. Over the longer-term, we believe a loss of confidence in Turkish monetary policy will plant the seeds for eventual underperformance in Turkish bonds.

Our own sovereign ratings model showed Turkey’s implied rating fell a notch this quarter to B/B2/B. As such, we think Turkey faces even stronger downgrade risks to its B+/B1/BB- ratings.

Tags: Articles,Emerging Markets,Featured,newsletter