Beta-driven Fantasy The decade long bull market run, aside from making everyone ridiculously rich, has opened up a new array of competencies. The proliferation of ETFs, for instance, has precipitated a heyday for the ETF Analyst. So, too, blind faith in data has prompted the rise of Psychic Quants… who see the future by modeling the past. Gandalf, quant of Middle-Earth, dispensing sage advice. [PT] For the big financial outfits, optimizing systematic – preprogrammed...

Read More »Why Government Should not Fight Deflation

For most experts, deflation is considered bad news since it generates expectations of a decline in prices. As a result, they believe, consumers are likely to postpone their buying of goods at present since they expect to buy these goods at lower prices in the future. This weakens the overall flow of spending and in turn weakens the economy. Hence, such commentators hold that policies that counter deflation will also counter the slump. Will Reversing Deflation Prevent...

Read More »Avenir Suisse erteilt Schweizer Staatsfonds klare Absage

Kein Sparschweinchen aus SNB-Pfründen. (Bild: Shutterstock.com/ valeriiaarnaud) Das Vermögen von Norwegens erfolgreichem Staatsfonds hat die Billionen-Franken-Schwelle geknackt und erntet entsprechende mediale Aufmerksamkeit. Dies lässt auch in der Schweiz Forderungen nach einem ähnlichen Konstrukt aufleben, um vorhersehbare AHV-Finanzierungslücken dereinst zu decken. Als vielversprechender Finanzierungsfavorit gilt die Schweizerische Nationalbank (SNB), die für die...

Read More »More than 100 members of Extinction Rebellion convicted in Switzerland

Extinction Rebellion Switzerland’s Facebook cover photo In September 2019, groups of people belonging to the group Extinction Rebellion blocked two road bridges in Lausanne. Local police cleared the bridges by removing, in some cases carrying, protesters away. On 7 November 2019, 117 of the people involved in the bridge protests were convicted and fined for breaking Switzerland’s penal code, according to RTS. One person was convicted of violence and the rest of...

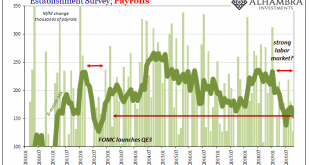

Read More »Red Flags Over Labor

Better-than-expected is the new strong. Even I’m amazed at the satisfaction being taken with October’s payroll numbers. While you never focus too much on one monthly estimate, this time it might be time to do so. But not for those other reasons. Sure, GM caused some disruption and the Census is winding down, both putting everyone on edge. The whisper numbers were low double digits, maybe even a negative headline estimate. Markets had been riding pure pessimism...

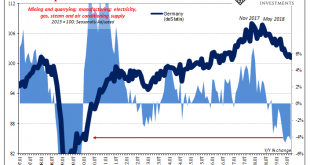

Read More »A Perfect Example of the Euro$ Squeeze

Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate. Four percent doesn’t sound like much, but in the context of German IP it is well within recession territory....

Read More »The Wave of Negative Rates Starts to Recede

Negative yields on long-term European government bonds took financial markets by storm earlier this year but are starting to fade away as investors express renewed optimism about global economic growth. The yield on 10-year bonds issued by the French and Belgian governments turned positive Thursday for the first time since mid-July. Other European countries that experienced negative long-term rates for the first time, including Ireland, Spain and Portugal, have also...

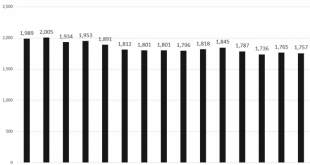

Read More »Ocasio-Cortez is Wrong: We’re Not Working 80-Hour Weeks Now

It has become nearly commonplace for pundits and politicians to claim that Americans are working more than ever before; that they’re working more jobs, and working longer hours — all for a lower income. During the Democratic debates this summer, for instance, Rep. Tim Ryan of Ohio claimed “the economic system now forces us to have two or three jobs just to get by.” Kamala Harris made similar comments. These claims echo statements from Elizabeth Warren in Alexandria...

Read More »Negativzinsen: Für KMU überwiegen weder Kosten noch Nutzen

Schweizer Unternehmen sind wenig abhängig vom Wechselkurs, da nur die wenigsten exportieren. (Bild: Shutterstock.com/guruxox) Auch fünf Jahre nach der Einführung von Negativzinsen zur Schwächung des Frankenwechselkurses durch die Schweizerische Nationalbank (SNB) deutet nichts darauf hin, dass diese Phase der Geldpolitik bald dzu Ende gehen wird. UBS hat deshalb das Thema zum Schwerpunkt ihrer halbjährlich durchgeführten Unternehmensumfrage gemacht und 2’500...

Read More »Swiss payments system aims to link bitcoin and retailers

Spending cryptocurrencies in shops is proving a difficult nut to crack. (© Keystone / Christian Beutler) Prominent European payment infrastructure provider Worldline has teamed up with financial services firm Bitcoin Suisse to allow cryptocurrency enthusiasts to spend their bitcoin in Swiss shops. Worldline last year took over SIX Payment Services, the former arm of the Swiss stock exchange group that provides payment card terminals in 85,000 Swiss retail outlets....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org