Given the exquisite precariousness of the global financial system and economy, hopes for a brief and mild downturn are wildly unrealistic. If we asked a panel of epidemiologists to imagine a virus optimized for rapid spread globally and high lethality, they’d likely include these characteristics: 1. Highly contagious, with an R0 of 3 or higher. 2. A novel virus, so there’s no immunity via previous exposure. 3. Those carrying the pathogen can infect others while asymptomatic, i.e. having no symptoms, for a prolonged period of time, i.e. 14 to 24 days. 4. Some carriers never become ill and so they have no idea they are infecting others. 5. The virus is extremely lethal to vulnerable subpopulations but not so lethal to the entire populace that it kills its hosts

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Given the exquisite precariousness of the global financial system and economy, hopes for a brief and mild downturn are wildly unrealistic.

If we asked a panel of epidemiologists to imagine a virus optimized for rapid spread globally and high lethality, they’d likely include these characteristics:

1. Highly contagious, with an R0 of 3 or higher.

2. A novel virus, so there’s no immunity via previous exposure.

3. Those carrying the pathogen can infect others while asymptomatic, i.e. having no symptoms, for a prolonged period of time, i.e. 14 to 24 days.

4. Some carriers never become ill and so they have no idea they are infecting others.

5. The virus is extremely lethal to vulnerable subpopulations but not so lethal to the entire populace that it kills its hosts before they can transmit the virus to others.

6. The virus can be spread by multiple pathways, including aerosols (droplets from sneezing/coughing), brief contact (with hotel desk clerks, taxi drivers, etc.) and contact with surfaces (credit cards, faucets, door handles, etc.). Ideally, the virus remains active on surfaces for prolonged periods, i.e. 7+ days.

7. Those infected who recover may catch the virus again, as acquired immunity is not 100%.

8. As a result of this and other features, it’s difficult to manufacture a vaccine that will reliably protect against infection.

9. The tests designed to detect the virus are inherently limited, as the virus may be present in tissue that isn’t being swabbed.

10. The symptoms of the illness are essentially identical with less contagious and lethal flu types, so people who catch the virus may not know they have the novel pathogen.

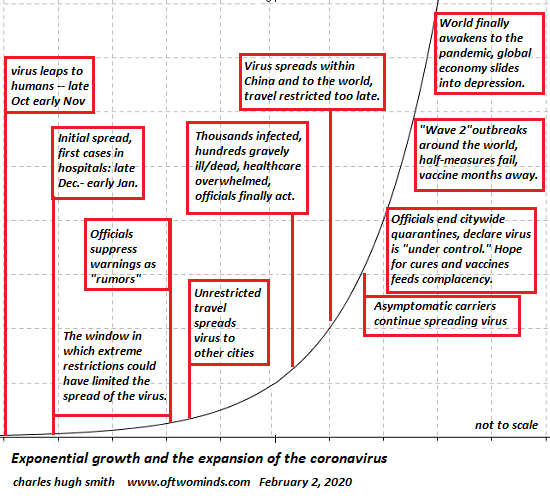

As you probably know by now, these are all characteristics of Covid-19, and this is why it is unstoppable. As we now know, millions of people left Wuhan while the epidemic was raging in January, spreading the virus throughout China and the world via hundreds of airline flights to other nations.

The situation in developing nations is similar: few if any test kits, which are not 100% reliable and so multiple tests may be required, and so there is no means to ascertain who is a carrier. No data doesn’t mean no virus.

It’s impossible to string together a benign narrative that includes these reports:

If we asked a panel of business executives to imagine a global system optimized for vulnerability to external shocks, they’d likely include these characteristics:

1. Long global suppy chains, four, five and six layers deep, so those in the top layers have no idea where parts and components actually come from.

2. Just-in-time deliveries and limited inventories dependent on complex logistics, so any shock quickly disrupts the entire network as key nodes fail.

3. A global supply chain dependent on hundreds of financially marginal factories and suppliers who do not have the means to pay employees for weeks or months while the factory is idle.

4. A global supply chain dependent on hundreds of financially marginal factories with high debts and expenses that will close down and never re-open.

5. A global consumer economy dependent on the permanent expansion of debt.

6. A global financial system with extremely limited capacity to absorb defaults as suppliers and zombie corporations (i.e. companies dependent on ever-greater borrowing to survive) fail.

7. A global economy burdened with overcapacity.

8. A global economy dependent on “the wealth effect” of rising stock and housing markets to fuel spending, so when these bubbles burst spending evaporates.

| These are precisely the characteristics of our precarious global economy, dependent on rising debt, vast speculative bubbles, vulnerable supply chains and marginal consumers and producers.

As noted here before, it doesn’t take much to break a system dependent on ever-rising debt and speculation. This chart illustrates the dynamic: when debt loads, speculative bets and expenses are all at nosebleed levels, the slightest decline triggers collapse. Put another way: the global system has been stripped of redundancy and buffers. A little push is all that’s needed to send it over the edge. |

The Rising Wedge Model of Breakdown |

| Given the exquisite precariousness of the global financial system and economy, hopes for a brief and mild downturn are wildly unrealistic. The global economy is falling off a cliff, and calling it a “recession” while debt and speculative excesses collapse is a form of denial.

When debt and speculative excesses collapse, it’s a depression, not a recession. If we can’t call things by their real name then we guarantee a wider, deeper cataclysm. |

Exponential Growth and the Expansion of the coronavirus |

Tags: Featured,newsletter