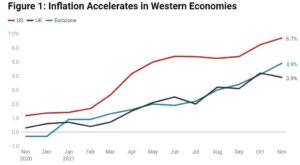

Inflation is skyrocketing in practically the entire world. Central banks are getting scared and beginning to announce the end of expansionary measures, also known as tapering.

Why do central banks find themselves in a dilemma? Why has inflation risen so much? What is a bottleneck? What does tapering mean, and how could it affect us? The objective of this article is to answer these, and other, questions.

Inflation Skyrocketing around the World

Central banks have one explicit mandate: to maintain the purchasing power of money. This is the main goal of monetary policy. Another mandate of some central banks is to sustain the level of economic activity (and it could be argued that they all have this as an implicit goal).

In developed countries, central banks’

Read More »