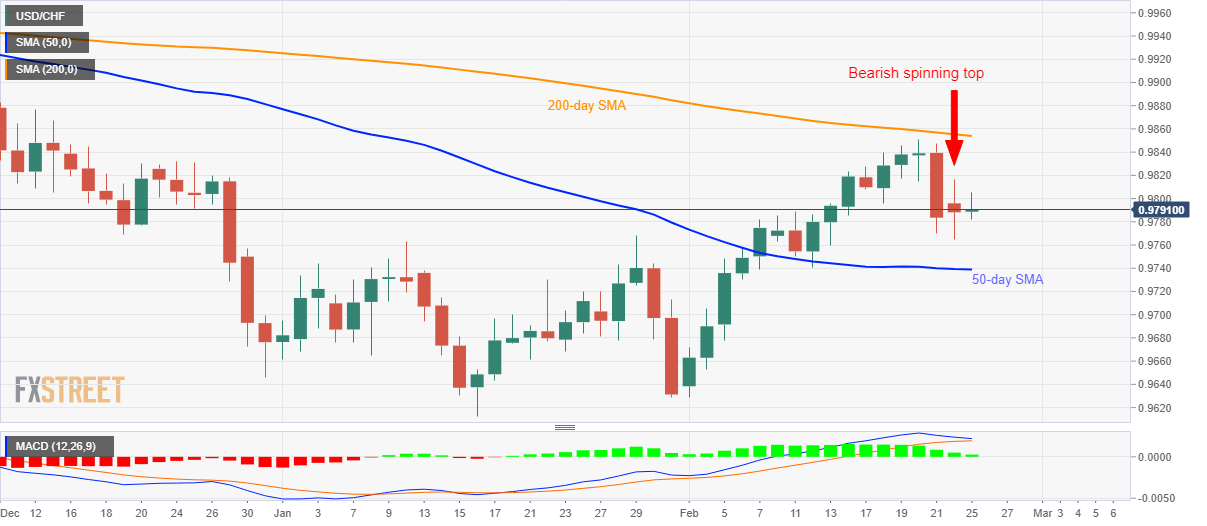

USD/CHF snaps two-day losing streak. Bearish candlestick formation, sustained trading below 200-day SMA favor further selling. Bullish MACD, 50-day SMA question the bears. USD/CHF registers fewer moves while trading around 0.9790 during the pre-European session on Tuesday. The daily chart forms a bearish candlestick pattern but bullish MACD and 50-day SMA could limit further declines. That said, the bears will be more powerful to aim for 0.9700 if breaking a 50-day SMA level of 0.9740 on a daily closing basis. During the quote’s further declines below 0.9700, the month-start top near 0.9670 and the January month bottom surrounding 0.9612 can offer intermediate halts to 0.9600 round-figure. Alternatively, the pair’s rise beyond Monday’s top of 0.9816 negates the

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

USD/CHF registers fewer moves while trading around 0.9790 during the pre-European session on Tuesday. The daily chart forms a bearish candlestick pattern but bullish MACD and 50-day SMA could limit further declines. That said, the bears will be more powerful to aim for 0.9700 if breaking a 50-day SMA level of 0.9740 on a daily closing basis. During the quote’s further declines below 0.9700, the month-start top near 0.9670 and the January month bottom surrounding 0.9612 can offer intermediate halts to 0.9600 round-figure. Alternatively, the pair’s rise beyond Monday’s top of 0.9816 negates the bearish candlestick formation, which in turn could trigger the quote’s recovery targeting a 200-day SMA level of 0.9854. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

Trend: Sideways

Tags: Featured,newsletter,USD/CHF