We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam? My very first day on the job, as an intern my first boss told me to prepare myself. I was embarking on a career in the most absurd industry...

Read More »The Experts Have No Idea How Many COVID-19 Cases There Are

In the early days of the COVID-19 panic—about three weeks ago—it was common to hear both of these phrases often repeated: “The fatality rate of this virus is very high!” “There are far more cases of this out there than we know about!” The strategy of insisting that both these statements are true at the same time has been used by politicians to implement “lockdowns” that have forced business to close and millions to lose their jobs. For instance, on March 12, Ohio...

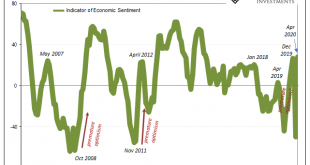

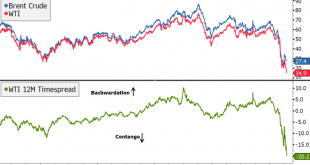

Read More »FX Daily, April 21: Oil Drilled Below Zero, Equity Rally Stalls, Greenback Advances

Swiss Franc The Euro has risen by 0.05% to 1.0516 EUR/CHF and USD/CHF, April 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Oil’s wild ride has been joined by two other developments that are keeping investors off-balance. First, reports suggest that North Korea’s Kim Jong-Un maybe in critical condition after surgery. He apparently was absent from last week’s events celebrating his grandfather. The concern is...

Read More »Is Venezuela’s gold a liability for Switzerland?

Switzerland is home to some of the world’s most important gold refineries. The Swiss authorities say they regularly monitor the origin and transactions of this metal to ensure that they are legal and transparent. (Keystone / Martin Ruetschi) Venezuela is illegally mining and trading in gold, and Switzerland could be one of its clients, according to Swiss media reports. swissinfo.ch spoke to law enforcement, customs and financial authorities to find out whether they...

Read More »Rothbard on Why We Need Entrepreneurs

In his Man, Economy, and State, Murray N. Rothbard investigates not only the role of the capitalist but also that of the entrepreneur in a market economy. Rothbard uses the theoretical concept of the evenly rotating economy (ERE) to compare the role of the capitalist to that of the entrepreneur. Entrepreneurs earn profits in so far as they successfully correct the maladjustments in the real economy and move it closer to the ERE without ever attaining that state....

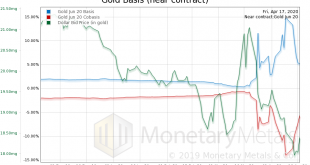

Read More »Crouching Silver, Hidden Oil Market Report 20 Apr

The price of gold has been up steadily for the last 30 days (with a few zigs and zags), now re-attaining the high it achieved prior to the big drop in March. Gold ended the week at $1,662. Alas, it’s not quite the same story in silver, whose price drop was bigger. Now its price blip is smaller. Silver ended the week at $15.19. One does not need to look to the gold-silver ratio, which is currently off the charts, to see that the world has gone mad. Silver, it has long...

Read More »Dollar Firm as Equities and Oil Start the Week Under Pressure

The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln; the extra fiscal stimulus will add to downward ratings pressure on the US Chicago Fed National Activity Index for March will be reported; late Friday, Moody’s downgraded Mexico a notch to Baa1 with negative outlook The debate about re-opening...

Read More »Coronavirus called a ‘decisive test’ for the UN system

A journalist attends a Covid-19 briefing at the World Health Organization (WHO) in Geneva on March 6. WHO has played a leading role in fighting the virus, amid criticism. (Martial Trezzini/Keystone) The pandemic is testing the limits of the United Nations system, say Geneva and New York-based experts, amid funding challenges and an ongoing blame game between the United States and China. The UN is marking its 75th anniversaryexternal link this year. What could have...

Read More »Surviving Covid-19: the Swiss economy’s strengths and weaknesses

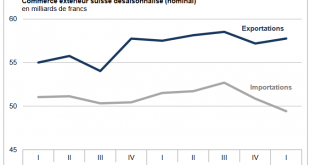

Closed shops, cancelled flights, shut construction sites: the pandemic is causing the Swiss economy to lose an estimated CHF4-5 billion a week (Keystone) The current pandemic will plunge the world economy into recession, at least in the first part of the year. What tools does Switzerland have to minimise the economic and social damage of this crisis? And what factors could jeopardise the prospects for an economic recovery? The CHF10 billion ($10.3 billion) in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org