The US dollar’s surge alongside gold has eclipsed the equity market rally as the key development in the capital markets. Even the traditional seemingly safe-haven yen was no match for the greenback. The dollar appeared to have been rolling over in Q4 19, as the sentiment surveys in Europe improved, Japanese officials seemingly thought the economy could withstand a sales tax increase, and data suggested the Chinese economy was gaining some traction. However, 2020 has begun with new divergence. The Covid-19 virus has not only crippled the Chinese economy, but its share size and magnitude of its integration in the global supply chains have far-reaching knock-on effects. Asia-Pacific economies that were increasingly reliant on Chinese input and demand are the most

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Debt, Deficit, Featured, Germany, newsletter, US, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The US dollar’s surge alongside gold has eclipsed the equity market rally as the key development in the capital markets. Even the traditional seemingly safe-haven yen was no match for the greenback. The dollar appeared to have been rolling over in Q4 19, as the sentiment surveys in Europe improved, Japanese officials seemingly thought the economy could withstand a sales tax increase, and data suggested the Chinese economy was gaining some traction.

However, 2020 has begun with new divergence. The Covid-19 virus has not only crippled the Chinese economy, but its share size and magnitude of its integration in the global supply chains have far-reaching knock-on effects. Asia-Pacific economies that were increasingly reliant on Chinese input and demand are the most vulnerable. Estimates suggest that the world’s second-largest economy is operating well less than 50% of capacity. Indeed, the extension of the stoppages and disruptions boosts the likelihood that the Chinese economy contracts in Q1. The supply chain disruptions are adversely impacting Japanese and Korean automakers. German automakers derived a substantial share of their profits from China, and car sales continue to weaken. Volkswagen, for example, has ceased production at a third of its 33 plants in China, which accounts for around half of its total production. Chinese autos sales in the first half of February were off 92% from a year ago.

Japan’s sales tax increase in October and the typhoons dealt the world’s third-largest economy a significant blow and a deep quarterly contraction of 1.5%. Despite government efforts to soften the blow through incentives to consume, the impact was nearly as much as the previous hike. This self-inflict shock, coupled with the slowing of China and the typhoons, left the Japanese economy vulnerable. Japan’s exposure to China, through trade and tourism, maybe a sufficient knock for the fragile economy to lead to a contraction here in Q1. It would be the second consecutive quarterly contraction, a rule of thumb often used to mark a recession, and underscores the fact negative interest rates do not prevent economic downturns.

Arguably the tightening of Japan’s fiscal policy through the tax increase was partly offset by the other fiscal incentives to blunt the contractionary impulse. Yet measures appeared to have minimal impact at best. The tax, which has been increased in a few steps, was initially foisted on Japan by multilateral institutions but took on a political life of its own in Japan beyond the economic arguments. Pundits and journalists shake their heads at what appears to be a self-defeating policy. However, German’s reluctance to use fiscal policy is seen as not just folly but dangerous, as well.

The European Central Bank, the IMF, and many American and British economists do not understand why Germany is not borrowing money at negative interest rates to fund public investment. Even the German Bundesbank has accepted that the fetish over the “black zero,” which both parties of the coalition government have supported in word and deed, is doing harm. Often, the conversations have an air of “America is from Mars, and Europe is from Venus.” Little illustrates this insight, like the appreciation that “guilt” and “debt” are derived from the same word in German and Dutch. In America, in contrast, debt and bankruptcy have been liberated from moral stigma. It is about using OPM or other people’s money. The ability to service one’s debt has become the issue, not the debt itself. Between student loans, mortgages, auto loans, and credit cards, Americans spend most of their lives in debt.

The magnitude of the Trump Administration’s tax cuts and spending increases during a non-recessionary period seems virtually unprecedented. However, it did not boost growth for more than a couple of quarters. It failed to lift US productivity, spur capital expenditure, accelerate wage increases, or boost or growth potential. Nor did it help its major trading partners, like Canada, Mexico, China, or Europe.

Yet, somehow if Germany would just borrow more money and boost public investment EMU’s problems would be ameliorated. It is not immediately evident that if Germany jettisoned the “black zero” and ran a small deficit that it necessarily would aid the periphery in Europe, let alone the United States. It would do little to lift Italy out of what appears to be a prolonged stagnation. It would do little to counter the strikes and social push back against French President’s Macron’s neoliberal labor and pension reforms, for example, or help resolve the deadlock following the recent Irish election. It would not help forge an agreement on the EU’s seven-year budget, or help complete the monetary and banking union.

In international economic relations, the role of creditor and debtor are key. Traditionally, the burden of adjustment is on the debtor. Think about Bretton Woods. The US (Harry Dexter White) took the classic creditor position, and the UK (John Maynard Keynes) represented the debtors’ interest in the post-war financial order. The bancor, an international reserve asset that Keynes proposed instead of the gold-dollar regime, which is not too dissimilar from BOE Governor Carney’s recent proposals of a digital reserve asset that is not a national currency.

Or consider the burden of adjustment under Bretton Woods. It was entirely placed on the debtor. It to change its policy settings, intervene and/or accept a devaluation. The innovation under the European Exchange Rate Mechanism is that it obligated the creditor/surplus countries to bear some of the adjustments, too (such as intervention).

The US is no longer the world’s creditor, which is a significant way that Pax Americana is unlike Pax Britania or Pax Romana. American debt is the coin of the realm. Even under Bretton Woods, the US insisted on the mark, franc, and yen appreciate, rather than the dollar depreciate. As a debtor, the US self-interest, naturally, is to blame the creditor and seek their adjustment. As a consequence of the combination of US monetary and fiscal policy in the context of the policies being pursued in the other major center, global imbalances are rising, and the strength of the dollar appears to be one shock absorber.

With the US having successfully negotiated trade agreements with South Korea, Japan, Canada, Mexico, and China, the Trump Administration’s trade focus is turning to Europe. Complementing the criticism of its European trade practices is the attack on the fiscal stances of a few EMU countries. Yet, the US current account deficit is, by definition, a result of the imbalance between savings and investment. What America’s right and left have in common is a penchant for externalizing its problems and attributing its challenges to foreign mischief.

US policymakers and America’s chattering class that provide its narrative have begun an offensive. The trade confrontation element is well known. It needs little comment, but to say that in the Phase 1 deal with China, the US abandoned its traditional emphasis on a rules-based settlement in favor of an outcome-oriented approach. It represents a reversion back to a zero-sum approach and strengthens those forces seeking to defect from the free-trade regime.

Another front in the offensive is the moral, righteous criticism of countries that keep their expenditures aligned with their revenues. They are chastised for what historically is understood as fiscal prudence and living within one’s means. Many of these creditor countries in Europe have stronger and broader social safety nets than America, and in other ways, offer a larger basket of goods to its residents and citizens. They have higher tax burdens than the US. Also, they have fewer monopolies that facilitate lower consumer prices for essential modern goods, internet access, health care, and higher education. In addition, they rely considerably less on their penal system for social control.

Surely the driver of the US imbalance with the world is America’s own fiscal policy–last year a 4.7% budget deficit as a percentage of GDP. And this during an economic expansion with historically low levels of unemployment. Many economists see the deficit rising toward 5% of GDP. Without addressing the real culprit, Americans complaining about Germany’s fiscal policy appears as a self-serving way to deflect attention: talk about how bad the 2019 German budget surplus of 1.2% of GDP rather than the US deficit that dwarfs it in both dollar terms and broader impact.

Even if Germany boost its spending and even if this raised growth, the US current account deficit would not necessarily be reduced one red cent. Isn’t this what has been confirmed in 2019 trade figures? The smaller US bilateral trade deficit with China was offset by larger bilateral deficits elsewhere. And as economic activity shifted because of tariffs, other countries move into US cross-hairs, like Vietnam and Malaysia.

To be sure, the US fiscal excesses do not meaningfully explain why last year, Germany had a current account surplus of 7.3% of GDP. Germany exports around 40% of all the goods and services it produces (GDP). Its reliance on foreign aggregate demand to employ German labor and capital arguably reflects a fundamental domestic imbalance and suppressed domestic demand,

There are good internal economic and political reasons for Germany’s political and economic elite to endorse stimulus measures. The two main parties have seen their public support fall sharply in recent years and are at risk of being outflanked by the AfD on the right and the Greens on the left. The cost of the fiscal prudence has been to starve the country from modernizing and moving toward sustainable infrastructure. A thoughtful effort could boost Germany’s economic competitiveness. New efforts to close the income and wealth gap could also boost domestic demand and reduce German dependence on exports and thereby blunt the criticism levied against it.

The eurozone’s flash February PMI suggested that new recession fears may be overblown. Across businesses rising domestic orders seemed to offset weakness from abroad, and the labor market remains resilient. The composite PMI rose to 51.6, its best since last August. However, it could only have modest impact on the euro because after the simply dreadful industrial output figures, real sector data is needed to validate the soft data of surveys and sentiment.

United States

Most of the critical US economic data for January have beaten expectations, and judging from the Empire and Philly Fed surveys and weekly jobless claims, the upside momentum has carried into February. Yet the market rightly looks past it. If the Fed cuts in Q2 as we expect, it will be like last year, as insurance against the global risks. The US 30-year bond yield is below the Fed’s 2% inflation target and fell to record lows below 1.90% ahead of the weekend. The 10-year yield is almost 10 bp below the 3-month bill yield. The new divergence story got pushed back against by contrasting February PMI reports. The US was unexpectedly weak, with the composite falling to seven-year lows (49.6 vs. 53.3 in January). Both manufacturing (50.8 vs. 51.9) and services (49.4 vs. 53.4) disappointed. The eurozone’s was better than expected. |

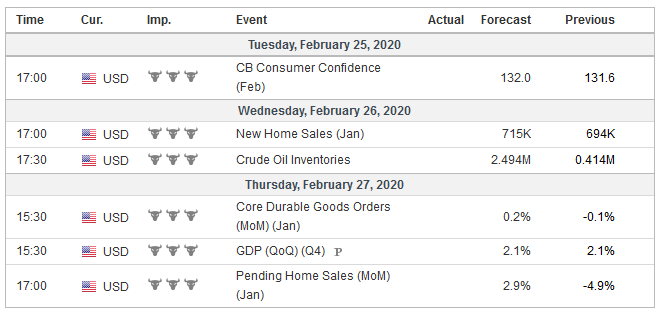

Economic Events: United States, Week February 24 |

JapanJapan will provide hard data for January: jobs, retail sales, and industrial production. The reports come at a pivotal time for the yen. As is well known, the yen tends to appreciate when US yields and/or stocks fall, though the correlations are not stable. The yen is used as a funding currency to purchase higher-yielding or more volatile assets (risk). When the risk asset is sold, the funding currency is repurchased. It is the signal, but of course, speculative operators can anticipate and piggyback those flows. This creates an echo around the signal. To distinguish the two is like telling the difference between a wink, a twitch, and someone mimicking one or the other. Context is key. In any event, the usual drivers of the yen did not seem particularly influential last week as the dollar soared to almost JPY112.25 from about JPY109.65 a couple of days earlier. Fears that Japan’s ties with China would deliver a sharp punch to the economy, through supply-chain disruptions, drying up of tourism and less demand for Japanese-made goods seemed to eclipse its so-called safe-haven appeal. We expect the yen’s traditional drivers to re-emerge, and in this context, it would suggest that the dollar is more likely to carve out a new range rather than continuing to accelerate. Vol is rich if this is assessment is correct. One-month vol finished last week above its 200-day moving average (~5.7%) and the 6%-threshold for the first time since mid-October. |

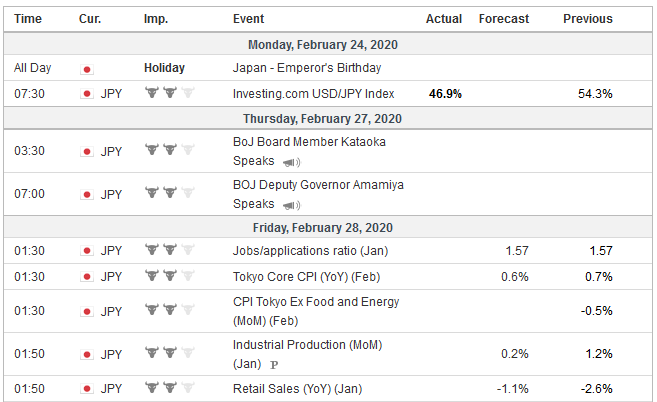

Economic Events: Japan, Week February 24 |

ChinaChina reports its official PMI at the end of the week. There is no question the direction, and the magnitude is subject to dispute. The risk is asymmetrical in that few numbers will likely capture the impact of the images in the social media of the lockdown, which some estimates suggest is impacting more than 120 mln people. The methodology of the reports of contagion in China is further confusing and underscores the underlying distrust. Even if there is a strong rebound in China beginning as early as Q2, it is unlikely to arrest the shift in the global supply chains spurred by the US-China trade conflict. Public health issues need reliable and accessible information, and this is, arguably, a critical weakness in Beijing’s model. However, rather than use this as an opportunity to address it, it appears General Secretary Xi will make no concessions, which was signaled by the expulsion of the Wall Street Journal reporters and the talk of a crackdown on VPNs and removal of tweets that advocated free speech. If another country faced China’s challenges, still high US tariffs on most of its goods, the fragile banking system, a coronavirus that has stalled its economy, the currency would have been sold-off. The yuan has fallen by 1.2% this month, and the offshore yuan slipped by 0.5%. These are rather modest moves. Consider that the Japanese yen fell 1.75% last week alone. The greenback was sold after the disappointing US PMI, and it may signal a near-term high is in place against the yuan, stopping a little short of the CNY7.05 target. |

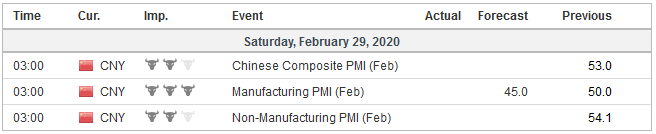

Economic Events: China, Week February 24 |

Tags: #USD,China,debt,deficit,Featured,Germany,newsletter,US