Recent dollar strength coupled with rising US rates have weighed on gold and silver. The latter looks attractive but there are few obvious catalysts for gold.The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms.At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing on non-yielding gold, but the decline in the greenback was acting as a tailwind for gold priced in dollars. Unfortunately for precious metals, the recent broad strength of the US dollar is now also sending a negative signal.This could continue in the short term. With the risk we see spikes in the US

Topics:

Luc Luyet considers the following as important: gold prices, Macroview, Precious metal trends, silver prices

This could be interesting, too:

Dave Russell writes Gold Hits New All Time Highs

Stephen Flood writes Why we couldn’t be happier that gold is boring

Stephen Flood writes More energy blows are dealt to Europe, causing a cold chill to be even colder

Stephen Flood writes Will Silver Prices Go Up to 0?

Recent dollar strength coupled with rising US rates have weighed on gold and silver. The latter looks attractive but there are few obvious catalysts for gold.

The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms.

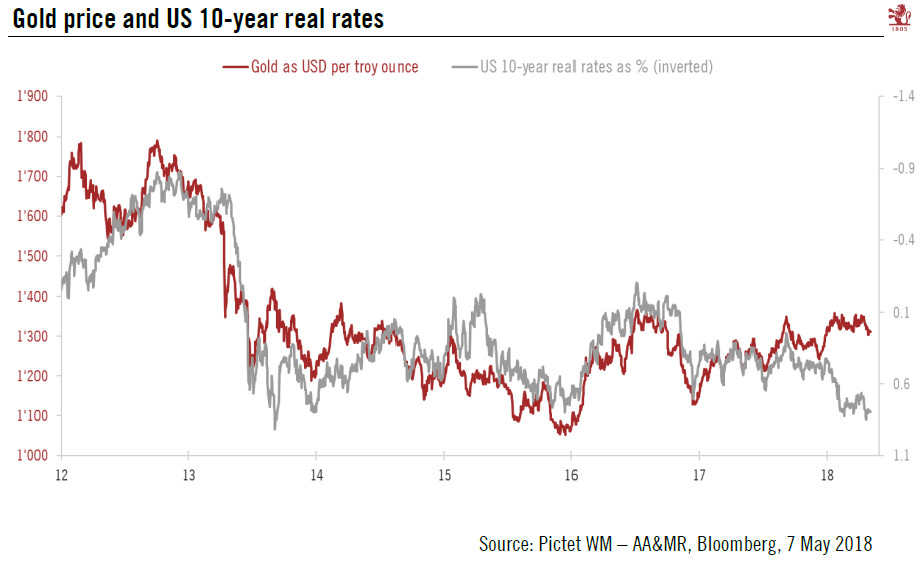

At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing on non-yielding gold, but the decline in the greenback was acting as a tailwind for gold priced in dollars. Unfortunately for precious metals, the recent broad strength of the US dollar is now also sending a negative signal.

This could continue in the short term. With the risk we see spikes in the US 10-year Treasury yields above 3%, gold might trade below the USD1300 per ounce threshold that has held since the start of the year. However, to the extent that any spikes in US rates are linked to inflation fears and dollar strength is temporary, we see the downside potential for gold as relatively limited from current levels.

At the same time, demand for gold as a hedge against inflation is unlikely to come into play anytime soon as US inflation would have to rise substantially from current levels to trigger a sustained impact on gold prices. We think gold price should remain rather trendless over the remainder of this year as the effects of US real rates and the dollar, the main directional drivers, cancel each other out. Our end-of-year projection is for a price of USD1325 per troy ounce.

As for silver, its ongoing underperformance remains puzzling and seems to be due to a lack of interest among investors. Overall, however, we continue to prefer silver over gold as the synchronisation in global growth should be supportive of the industrial component of silver demand. Although we acknowledge that investment appetite could remain lacklustre, it seems that the worst is behind us and a re-rating of silver compared with gold remains overdue.