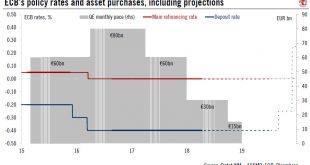

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle. Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance. Still, downside risks have risen to the point where another open-ended QE...

Read More »PMIs point to downside risk to near term euro area growth

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago. The deterioration...

Read More »ECB: contingency plans

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle.Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance.Still, downside risks have risen to the point where another open-ended QE extension can no longer be ruled out, albeit at a slower pace, in order to...

Read More »US chart of the week – Still some capacity

Growth in US capex may be skewed toward the booming energy sector, while manufacturing still has spare capacity.A key question for this year’s US macroeconomic outlook is whether firms become less stingy about investment (capex). The December 2017 tax cuts have fuelled hopes for a long-awaited acceleration in US capex, as they de facto lower the cost of capital. The tax boost to collective business sentiment, the so-called ‘animal spirits’, is supposed to be an additional impetus to capex...

Read More »PMIs point to downside risk to near term euro area growth

Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising.Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the...

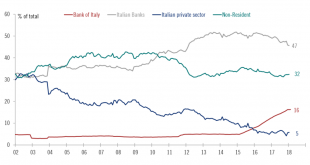

Read More »Eurosceptic Italian government faces a reality check

More than two months after the general election, the Italian political impasse seems close to being broken, with the League and the Five Star Movement (M5S) likely to form a government. M5S and the League together have a majority in both the upper and lower houses. After several document leaks this week, a final common programme was published today. The document needs the approval of party members. The focus will shift...

Read More »China-US trade war on hold

A significant softening of the US stance increases the likelihood of reaching a final agreement.Two weeks after the US-China talks in Beijing, the two countries held another round of trade negotiations in Washington DC on 17-18 May. After the meetings, delegations on both sides released a joint statement that was brief but constructive in tone. In essence, China has agreed to significantly increase its imports of American goods and services to reduce the US trade deficit with China, to...

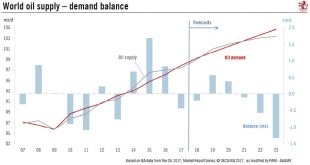

Read More »Oil price forecast revised up

Tensions surrounding oil supplies from Iran and Venezuela are destabilising the supply/demand balance.The decision by Donald Trump to withdraw from the nuclear agreement with Iran in early May constitutes a major geopolitical shift. Iran is the world’s seventh-largest world oil producer, exporting 1.1 million barrels per day (mbd). At this stage, it is unclear how Iranian exports will be affected, but taken together with the crisis in Venezuelan oil production, it could cause significant...

Read More »Europe chart of the week – Italy’s fiscal buffers

The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis.The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction targets, although at this stage we still expect negotiations to result in...

Read More »Europe chart of the week – Italy’s fiscal buffers

The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis. The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org