Communication from European central banks over the last few weeks has been consistent with a more cautious stance and, in some cases, is likely to lead to delays in their monetary policy normalisation plans. Each situation is different, with a loss in economic momentum, subdued underlying inflation, and political risks playing a role to varying degrees in the euro area, the UK, Switzerland and Sweden. At the same time,...

Read More »US employment keeps climbing, but wage growth disappoints

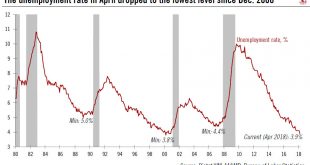

There was little in the April non-farm payroll report to divert the Fed from its gradualist approach to rate hikes.The US labour market continues on a familiar pattern: employment momentum remains robust, but wage growth is still disturbingly lacklustre.In April, 164,000 payrolls were added and the three-month average was a solid 208,000/month. The unemployment rate dropped to 3.9%, the lowest since December 2000 (although this was partly due to a drop in the labour-force participation...

Read More »Euro area growth: somewhere between hard and soft data

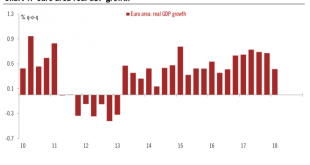

According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.4% q-o-q in Q1 2018 (1.7% q-o-q annualised, 2.5% y-o-y), in line with consensus expectations (0.4%) and down from an upwardly revised figure of 0.7% q-o-q for Q4 2017. The implications of the growth slowdown on ECB staff projections should remain limited, in our view. In March, they had pencilled in 0.7% q-o-q GDP growth for Q1, but...

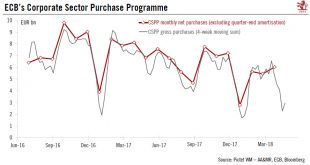

Read More »Europe chart of the week – Corporate Sector Soft Patch

The ECB is adjusting its corporate bond purchases to take account of market conditions, including the recent fall in issuance.Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bond purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop...

Read More »House View, May 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationIn spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration.Volatility is still higher than last year, and has increased noticeably in the bond market once again. We have been taking measures to calibrate our...

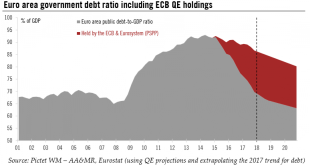

Read More »Europe chart of the week – public debt

This week’s Eurostat releases revealed that public finances continue to improve in most euro area member states. As a result of falling deficits, low interest rates and stronger nominal growth, the ratio of euro area government debt to GDP fell to a six-year low of 86.7% in Q4 2017. Although sovereign debt sustainability remains shaky in countries like Italy, it is fair to say that we have moved from self-defeating...

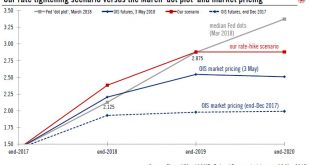

Read More »Fed not deviating from rate-hiking routine

At its latest meeting, the Fed showed it remained cool-headed about inflation risks. It should not deviate from its gradualist approach of one rate hike per quarter.The Federal Reserve meeting of 1-2 May 2018 brought no surprises. As the Fed kept rates unchanged (i.e., the Fed’s interest rate on excess reserves still at 1.75%), as widely expected, the focus was on the post-meeting statement for possible signals on future rate hikes. There was no press conference.The question was how the Fed...

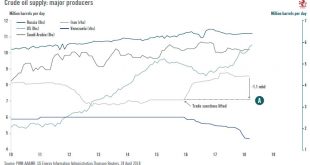

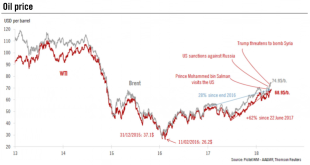

Read More »Where next for oil prices?

On 19 April, the price of a barrel of oil reached USD69.56 for West Texas Intermediate (WTI) and reached USD75.27 for Brent, today, the highest price since 2014. Since 9 April, oil prices have been significantly above their longterm fundamental equilibrium value. Three factors explain what has happened: Geopolitics. Between Saudi Arabia’s Prince Mohammed bin Salman visit to the US at end March, new US sanctions against...

Read More »Policy normalisation may be delayed in Europe

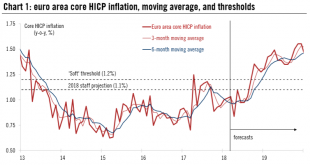

Taking stock of recent dovish shifts in European central banks’ communication and reaffirming our broadly constructive macro outlook.The European Central Bank (ECB) does not seem overly concerned about the soft patch in the economy in Q1 and appears willing to collect more data before they start discussing the timing and modalities of the next policy steps. We expect the ECB to hint at an imminent end to asset purchases at its June meeting, but to wait until July to announce the modalities...

Read More »US chart of the week – Shaky ground

US residential construction is growing solidly, but the apartment sub-segment is showing signs of softening.US construction is doing broadly fine, echoing the solidity of the US business cycle. On a y-o-y basis, construction was up 3.9% in March and 5.5% y-o-y in Q1 2018. Construction outperformed nominal GDP, which was up 4.8% y-o-y in Q1.The main engine is the residential market, up 7.8% y-o-y in Q1. Nonresidential construction is growing less rapidly (+3.8% y-o-y in Q1), dampened...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org