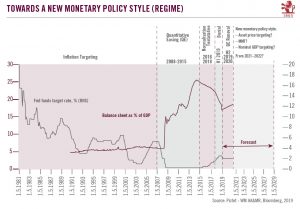

As central banks try (yet again) to bolster faltering growth and inflation, it is important to grasp how the ‘style’ and aims of monetary policy-making have changed over time and how they need to evolve in the future.

The world is being disrupted by structural trends such as populism, demographic and climate change and technological innovation. Likewise, with previous approaches producing fewer results, we believe it is time to envisage monetary policies that address these sources of disruption more directly.

We observe five different phases of monetary policy making since 1980.

Combatting inflation (1980-2008) By far the longest phase saw the Fed push through large, swift increases in the federal funds rate under Paul Volcker. The policy was a success on its own

Articles by Christophe Donay

New monetary policies for new challenges

August 15, 2019As central banks try (yet again) to bolster faltering growth and inflation, it is important to grasp how the ‘style’ and aims of monetary policy-making have changed over time and how they need to evolve in the future.The world is being disrupted by structural trends such as populism, demographic and climate change and technological innovation. Likewise, with previous approaches producing fewer results, we believe it is time to envisage monetary policies that address these sources of disruption more directly.We observe five different phases of monetary policy making since 1980.Combating inflation (1980-2008) By far the longest phase saw the Fed push through large, swift increases in the federal funds rate under Paul Volcker. The policy was a success on its own terms, with US inflation

Read More »Markets face a tug of war

July 31, 2019With a lot of good news already priced in, but technicals painting a less rosy picture, equities could struggle to make headway in the short term.The world economy and financial markets are being influenced by two opposing forces engaged in a tug of war. On one side are trade tensions and an ageing economic cycle, factors that are eroding business confidence and holding back corporate investment, raising questions about an impending recession. On the other are central banks, which are pulling out all the stops to prolong the expansion.After cutting rates at the end of July, the Federal Reserve (Fed) could decree a second 25 basis point rate cut before the year is out. Similarly, we expect the European Central Bank to deliver a comprehensive easing package in September, with the

Read More »Avenues worth exploring in strategic asset allocation

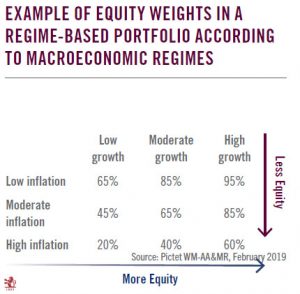

May 30, 2019The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic asset allocation to boost portfolio returns.

Using macroeconomic regimes for asset allocation

We have identified three broad growth and inflation regimes. Analysis of the combined macroeconomic regimes shows a high degree of correlation between these regimes and asset returns.

Using growth and inflation

Avenues worth exploring in strategic asset allocation

May 29, 2019The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic asset allocation to boost portfolio returns.Using macroeconomic regimes for asset allocationWe have identified three broad growth and inflation regimes. Analysis of the combined macroeconomic regimes shows a high degree of correlation between these regimes and asset returns.Using growth and inflation data stretching back to the end of World War Two, we have developed a

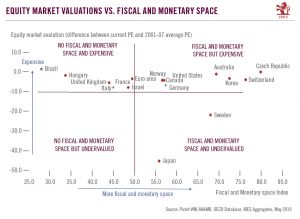

Read More »Policy space may help only a few markets

May 24, 2019Risk markets where there is room to loosen policy but are undervalued look more attractive than those where the authorities have room to manoeuvre but markets are expensiveAt this mature stage of the business cycle, it makes sense to consider the possible next steps in economic policy, given that we believe it is likely that central banks and governments will do their utmost to prop up the bull equity market as well as economic growth. (This will be especially true in the US as the 2020 presidential election looms into view).Given that interest rates are already at historic lows and accumulated debt is high, there does not seem to be much room for the authorities to loosen policy further. However, the situation varies from country to country. According to our analysis, countries like

Read More »Taking account of regime shifts

February 8, 2019Understanding what economic regime we are in and for how long before we transition to a different one is vital for any strategic asset allocation.Predicting the returns for different asset classes is the Holy Grail of asset allocation. The problem is that risk premiums and returns are instable over time. According to our analysis, over the long term (our data stretches back 115 years) there is a 90 percent probability of achieving an annual average return of 8 percent with a 60/40 portfolio. But that probability declines sharply as the time span shortens. Once the standard deviation reaches a certain point, one could argue that to speak of an “average” is meaningless and that investment success over a reasonable time horizon becomes a matter of luck. By the same token, one could argue

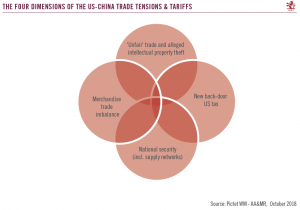

Read More »US-China Relations: A ‘politics bull trend’ creates a fertile ground for trade tensions

October 22, 2018As the US vies to maintain world leadership beyond commerce, its policies will continue to create waves for markets.Today we are witnessing a redefinition of international relations and a new, although likely unstable, global equilibrium. The trade dispute unfolding today between the US and China should be seen in light of shifting structural trends that have developed over the last few decades. We expect rationality will eventually prevail, but the outlook is muddled by the Trump administration’s unpredictable political agenda. Our core scenario remains that the conflict between the US and China will remain contained and limited to trade, with the door still open for negotiation. We expect the US will follow its current course, eventually extending tariffs to all Chinese imports, but

Read More »Innovation shock reshapes economic dynamics

October 10, 2018Head of Asset Allocation & Macro Research and Chief Strategist with Pictet Wealth Management, Christophe Donay shares his thoughts on the perennial relationship between innovation and economic growth.When analysing the current economic regime and assessing the potential for a shift in that regime, it is vital to take innovation into account. Demographic trends and productivity gains are commonly identified as the two main drivers of real economic growth. And innovation is a critical contributor to productivity growth. Robert J Gordon, in his masterful study, The Rise and Fall of American Growth, considers that the strong growth performance of the US in the decades that preceded the 1970s oil shock could be mainly explained by a leap in productivity, which in turn was due to innovations

Read More »Mr. Donay goes to Washington*

June 6, 2018Meetings on Capitol Hill in mid-May with a series of top (mostly Republican) officials, congressmen and economic advisors provided insight into where the Trump presidency is going, trade tensions and the November mid-term election .*With apologies to Frank Capra.Christophe Donay, Head of Asset Allocation & Macroeconomic Research, Pictet Wealth Management.Meetings I had in Washington in May touched on four main themes: i) economic policy; ii) trade policy; iii) US politics; and iv) energy and innovation.i. Economic policy. The top economic policy officials I met in the Trump administration are overwhelmingly strong advocates of supply-side economics. A second wave of tax reform (following the first wave, announced last December) was evoked by many officials, to be unveiled before the

Read More »The world growth engine is humming

May 7, 2018Since the beginning of the year, many asset classes have recorded negative or only marginally positive returns. Where do we go from here?Christophe Donay, Chief Strategist, Head of Asset Allocation & Macro Research, Pictet Wealth ManagementSince the beginning of the year, depending on currency, many asset classes have recorded negative or only marginally positive returns. In US dollar terms, US and global equity indices (MSCI World) have produced total returns of below 0.5% since 1 January, while US government and corporate bonds have negative returns.Where do we go from here when it comes to asset allocation? One faces two choices.The first choice depends on whether one has faith in a world growth engine that is humming along (thanks to a synchronised growth cycle and US tax cuts) or

Read More »Geopolitical and political risks –some important challenges ahead

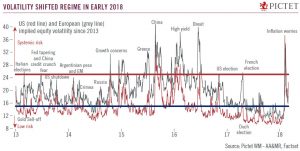

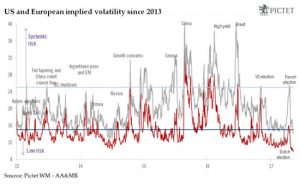

March 8, 2018Alongside our core scenario for this year, we have a downside one which includes political and geopolitical developments that could contribute to increased market volatility in the months ahead.Over the past year and more, market fundamentals have managed to overcome the occasional, short-term bouts of volatility triggered by political and geopolitical factors. But we cannot dismiss the possibility that these factors will impinge more forcefully on economies and financial markets in the period ahead.Many of the sources of risk and uncertainty are connected to the relative decline in the power of the US, its increasing unilateralism under Donald Trump, and the crisis in global governance. The most immediate sources of global instability continue to be found in places such as the Middle

Read More »A spectacular return to pure supply-side economics

February 2, 2018While expects debate the effects of the Trump tax reforms, it is probably the most important economic policy decision of recent decades.Since the sub-prime crisis 10 years ago, the US economy has been stuck in a growth regime that is modest by past standards, with deflationary pressures persisting in spite of an historically low unemployment rate. It is against this backdrop that the tax reform finally ratified in the last days of 2017 was greeted as a ‘Christmas present’ by financial markets after a year of false dawns under the Trump administration.The US tax overhaul represents probably the most important economic policy decision taken anywhere in the world in recent decades — the last supply-side reforms of any magnitude go back almost 40 years to the Reagan era. Given that government

Read More »Increasing growth visibility would reassure investors

November 23, 2017The world economy goes into 2018 with strong momentum, but policy makers could do more to improve visibility and risk asset valuations leave no room for disappointment.The current growth phase of the economic cycle started almost nine years ago in the U.S. and some emerging countries, making it the second-longest period of expansion in modern American history after the 1960s. But, increasingly, the question of whether a new recession is imminent or not has been coming up in discussions about scenarios for the year ahead.We don’t believe a recession is looming. As in previous years, our base scenario excludes a major shift in the economic cycle in the U.S. or the beginnings of a bear market. The lengthiness of the current expansion is not sufficient on its own to trigger a recession. Only

Read More »The populist tide may be yet to peak

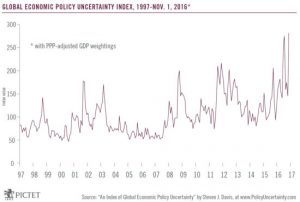

May 23, 2017Populism could remain a feature of politics in the western world, with the resultant volatility likely to have wide-ranging implications for investors.Populist parties have been on the rise in Western democracies in recent years. They have already achieved two landmark successes, with Brexit and Trump, and are threatening breakthroughs elsewhere. We see six main drivers of the populist surge: rising economic insecurity, globalisation, a technological innovation shock, cultural backlash, broader socio-economic change, and fragmentation of information sources.Populist parties have evolved to broaden their appeal. Broadly, they tend to espouse some mix of the following views: anti-immigration/nativist, protectionist, anti-austerity, anti-establishment, authoritarian and anti-EU. Beyond their economically insecure core constituency, their message can resonate more widely.The factors that have led to the rise of populism are unlikely to abate in the foreseeable future—and a renewed economic crisis could give populists a further boost. With populist parties now a permanent feature of the Western scene, political uncertainty for investors, although it may ebb and flow, will be higher than in the 1990s, when pro-market views dominated.

Read More »The populist wave may be yet to peak

May 23, 2017Populism could remain a feature of politics in the western world, with the resultant volatility likely to have wide-ranging implications for investors.Populist parties have been on the rise in Western democracies in recent years. They have already achieved two landmark successes, with Brexit and Trump, and are threatening breakthroughs elsewhere. We see six main drivers of the populist surge: rising economic insecurity, globalisation, a technological innovation shock, cultural backlash, broader socio-economic change, and fragmentation of information sources.Populist parties have evolved to broaden their appeal. Broadly, they tend to espouse some mix of the following views: anti-immigration/nativist, protectionist, anti-austerity, anti-establishment, authoritarian and anti-EU. Beyond their economically insecure core constituency, their message can resonate more widely.The factors that have led to the rise of populism are unlikely to abate in the foreseeable future—and a renewed economic crisis could give populists a further boost. With populist parties now a permanent feature of the Western scene, political uncertainty for investors, although it may ebb and flow, will be higher than in the 1990s, when pro-market views dominated.

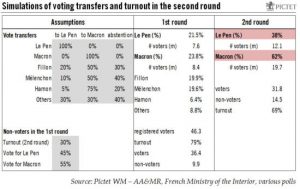

Read More »Macron victory still raises questions for markets

April 24, 2017The market implications of Emmanuel Macron’s win are likely to prove positive but short lived as the focus will quickly shift to the legislative elections in June.The first round of the French presidential election has come as a relief for markets as a pro-European, reformist candidate came first and now looks very likely to win the second round. For once, opinion polls were fairly accurate in capturing voting intentions and last-minute momentum. But the result of the first round is not prompting us to make any change to our base scenario for growth and inflation and Emmanuel Macron’s probable victory in the second round on 7 May still raises a number of political, economic and market questions.First, while we expect Macron to be elected president with possibly over 60% of the vote versus 40% for Le Pen, it remains to be seen how he will form a government and who will be his prime minister. He may spend the next two weeks trying to gather moderate right and left wing politicians around him ahead of the parliamentary elections in June.Economically, we know Macron is in favour of European integration and structural reforms, but his programme still needs fleshing out. He seems to represent a combination of mild Keynesianism and supply-side economics.

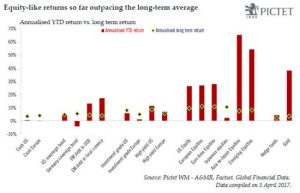

Read More »Reality check means markets face a pause

April 6, 2017Risk assets had an exceptionally strong first quarter, but a repeat performance will require overcoming numerous obstacles.The first quarter was an exceptional one for risk assets—so exceptional that it is difficult to see how their performance can be repeated in the present quarter without some strong catalysts. According to our analysis, annualised returns on equities in the first quarter were up to three times higher than their historic average in the case of developed-market equities, and six times higher in the case of emerging-market ones.There are four areas that hold out the potential for disappointment, but also for more positive outcomes: politics, fiscal policy, economic data, and the role of central banks.First, on the political front, the coming weeks will be dominated by polls in different European countries, most notably the presidential election in France. Although nothing can be excluded, our core scenario holds as improbable the most extreme outcomes (such as ‘Frexit’). The same cannot be said about the US. With his bid to ‘repeal and reform’ Obamacare blocked, attention has swiftly turned to President Trump’s ambitious plans for tax cuts and reform as well as significant infrastructure spending, the second item sustaining market hopes at present.

Read More »Geopolitics and investing: assessing rising instability

January 5, 2017With the rise of emerging powers and the relative decline of the US, geopolitical instability is increasing and the world is moving out of a unipolar order towards a predominantly one.We believe US-China competition will be the overriding geopolitical issue in the coming years. History suggests there is a strong chance that China’s rise will not be incorporated peacefully. Three forms of geopolitical competition between China and the US could dominate the next decade: over international governance, territorial dominance and supplies of raw materials.Along with competition between China and the US we see a number of other key geopolitical flashpoints: tensions between Russia and the West; the Middle East; India-Pakistan tensions; North Korea; Africa; terrorism; immigration and the rise of populism in the US and Europe. Overshadowing all of this is uncertainty over US foreign policy after Donald Trump’s election as US president.Geopolitics is often given insufficient attention by investors, mainly because it is a non-quantifiable risk: distinguishing geopolitical ‘noise’ from events that will seriously impact markets is difficult, and over time markets have shown considerable resilience to geopolitical events. But geopolitics can still trigger major shocks.This is why geopolitics is progressively gaining importance for investors, bringing both risks and opportunities.

Read More »UK’s Brexit vote to have wide repercussions, changes economic & market scenarios

June 24, 2016By referendum, UK voters have decided the UK should leave the EU. This result leads us to alter our economic and market forecasts Looking at the referendum result in terms of macroeconomics, financial markets and politics, our views are as follows:Macroeconomics. The vote for Brexit is, we believe, likely to reinforce a recent loss of momentum in parts of the UK economy. We believe the result of the referendum will hit consumer and business confidence, at least in the short term. Business investment, already fragile, will be hurt, and so will credit growth. Capital outflows are to be envisaged; the UK’s current account balance will be hurt, as will government finances. As a consequence, our baseline scenario is for real UK GDP growth of the order of 1.3% this year and 0.9% in 2017, well below our expectation earlier this year that UK GDP would grow by 1.8% in 2016 and by 2.0% in 2017. In addition, a sharp drop in sterling can be expected to lead to a rise in imported inflation that will offset any weakness in domestic inflation, at least in the short term.We now believe real growth in the euro area could be 1.5% this year instead of the 1.8% rate we had been forecasting. And we expect the euro area economy to expand by 1.3% rather than 1.7% in 2017.

Read More »Bond yields under pressure

June 13, 2016But investors should keep in mind that yields on government bonds could easily spike Global bond yields have plunged to new lows in recent days, as markets have switched to ‘risk off’ mode. This is just the latest manifestation of a trend: sovereign bond yields have been under downwards pressure for several years. Central bank QE and economic uncertainty are partly to blame. But investors should remember that sovereign bonds are not risk-free assets. And yields could easily jump over the summer.A sign of the timesAs global economic growth has lacked momentum over the past few years, and inflationary pressure have been muted, interest rates on sovereign bonds have been pushed lower and lower — and increasingly into negative territory.Around USD8trn out of USD23trn of DM sovereign bonds currently have negative yields, or over one-third[1]. Around half of the sovereign bonds in negative territory are Japanese, but this is not just a localised phenomenon. German bonds account for more than 12% of the total amount of sovereign bonds with negative interest rates. As of market close on 10 June, the country’s sovereign bonds were “in the red” up to 9 years maturity—and at 0.02%, the 10-year Bund was on the brink[2].

Read More »Conditions are ripe for rebound on equity markets

February 2, 2016Macroview

We see signs that the sell-off is bottoming out, and believe that the triggers for a rebound are coming into place.

On 26 January, we explained that we expected the turmoil on global equity markets to abate in the near future. Several of the possible triggers for a rebound on equity markets that we identified are now materialising:

Policy support from central banks. The Bank of Japan (BoJ) unexpectedly announced last week that it is cutting interest rates into negative territory. The European Central Bank (ECB) has indicated that it will further loosen monetary policy, probably at its March meeting. The People’s Bank of China (PBoC) is providing fresh liquidity injections to support growth. Although we do not expect the US Fed to change course on raising interest rates, it at least expressed concern in its statement this week about the implications of developments for risks to the outlook.

Oil prices may have found a floor. The oil price has rebounded from a low of USD28/barrel on 20 January to USD30.5/b today, up by 9%, suggesting that a floor may have been reached.

Sentiment indicators support a rebound. The extreme bearishness of statistical and survey-based contrarian market sentiment indicators also suggests that conditions are ripe for a rebound (as illustrated for example in the chart below).

The reasons behind the turmoil on global markets

January 26, 2016The absence of deterioration in economic fundamentals suggests that conditions now look ripe for a rebound in equity markets.

Equity markets have had their worst start to the year since 1897, following on from bouts of elevated volatility in 2015, and currency markets have also seen major disruption.

But elevated market volatility this year was not unexpected and economic fundamentals are little changed. Conditions now look ripe for a rebound.

What’s worrying markets? Recent market volatility has four major drivers:

Monetary policy running out of steam. The Fed lacks a clear model following the end of QE, which creates uncertainty, and other central banks’ QE is too weak to sustain financial markets. As a result, central banks’ ability to repress financial volatility has decreased. Markets are not yet ready to digest the Fed’s tightening cycle.

The fall in commodities’ prices. Although lower oil prices benefit consumers, prices have dropped below the threshold (probably around USD40/b) where the negatives in terms of financial disruption start to outweigh the positives. EM currencies have slumped, especially for commodity-producers, creating the risk of a financial crisis (most notably in Brazil). And oil companies’ difficulties have pushed up US high-yield spreads sharply.

Concerns about China.

US monetary policy: rate lift-off, finally, but the saga will continue

December 17, 2015As we had expected, the Fed raised short-term interest rates yesterday for the first time in almost a decade, increasing the target range for the federal funds rate by 25 basis points to 0.25-0.50%.

The Fed has finally moved interest rates up from their historic lows. Market reaction has been muted, since the much-trailed hike was fully priced in across asset classes. But, as we have long stressed, attention will now shift to the pace and timing of further tightening, which will create further market instability in 2016.

After yesterday’s decision, the focus will now move to what comes next. We expect the pace of tightening to be very gradual, with only a further two 25-basis point increases in 2016, taking the target range to 0.75-1.00% by the end of the year. This is a slower than the consensus, which is for three rate rises in the coming year. We think that tightening monetary conditions as a result of a stronger dollar and widening corporate bond spreads will deter the Fed from moving more aggressively.

Moreover, the Fed has stressed that policy remains data-dependent, and that it will pay particular attention to inflation as measured by PCE (personal consumption expenditure). This is currently at just 1.3%, well below the 2% target. The evolution of US inflation in the coming year will be a key variable for markets.

2016 macroeconomic and strategic alternative scenarios

November 23, 2015Macroview

Last week, on November 18th, we published our key takeaways for our 2016 macroeconomic and strategic scenario.

In the following post, we feature the conditions under which two alternative scenarios for 2016 , one positive and one negative, could materialize. Please see our “Macroeconomic and Strategic Scenario for 2016: Key takeaways” post for a detailed overview.

Upside risks for a positive alternative scenario

Greater acceleration of economic growth in Europe, driven by stronger-than-expected credit and/or fiscal expansion.

Central bank and market liquidity driving an expansion of valuation multiples for DM equities, pushing them well into excess territory.

A stronger impact of innovation on global economic growth and a positive turn in earnings momentum.

A rise in oil prices, which would probably boost corporate profits in the energy sector and trigger positive momentum.

Any of these risks would allow for an expansion of valuation ratios and bolster equity markets.

Downside risks for a negative alternative scenario

A policy error in China that causes growth to fall below the 6.7% target.

A stronger-than-expected upturn in inflation, driven by a rise in wage growth above productivity growth in the US, showing the Fed to be behind the curve.

Political destabilisation in Europe, with the impact of the migration crisis exceeding expectations.

Secular outlook for the global economy and financial markets: key takeaways

November 20, 2015Macroview

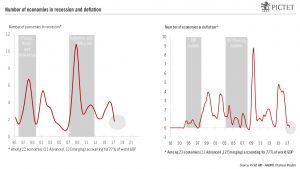

There is an ongoing debate about whether the world is facing secular stagnation and deflation.

In the inflation/deflation debate, we are in the deflationist camp. If economic mechanisms are left unchecked, deflationary forces will rise. DM central banks will struggle to hit their 2% inflation targets.

The inflation targeting monetary policy style of the 1990s and early 2000s was followed by the quantitative easing (QE) style after the 2008-11 US subprime and euro area debt crises.

Uncertainty prevails over the next monetary policy style that central banks, led by the Fed, will adopt. In the meantime, central banks target implicitly asset prices.

In the secular stagnation/growth debate, we are in the growth camp.

We believe a radical innovation shock will sustain growth.

Seven key sectors have the potential to play a leading role in the next wave of radical innovation: the internet, IT/information and dataprocessing, automation, transport, energy, life sciences and smart materials.

Emerging economies are increasingly heterogeneous. Their common characteristic is a process of transition, over several years, from an export-based model to one driven by domestic demand.

During this phase, emerging markets will be a source of economic and financial risks, rather than growth.

Expected returns of asset classes are low by historical standards.

Macroeconomic and Strategic Scenario for 2016: Key takeaways

November 18, 2015Macroview

In 2016, we forecast global economic growth of 3.3%, slightly better than in 2015. This will be a ‘goldilocks’ environment (not too hot, not too cold), that allows continued supportive monetary policy.

Macroeconomy

US real GDP growth will be above potential at 2.5% (against potential growth of 1.8%), but with an absence of momentum. Growth will be driven by domestic demand.

Euro area growth will accelerate modestly, to 1.8%, from an estimated 1.5% in 2015. Domestic demand is picking up — particularly in the periphery — supported by credit growth, which has turned positive and will reach about 2%. The euro area could deliver a positive surprise.

In Japan, Abenomics is having only mixed success and a major take-off is not in prospect. Inflation and real economic growth will remain subdued.

Emerging economies are in a delicate transition phase, as they need to switch their economic model from exports towards domestic demand, and a number of large economies are struggling: Brazil, for example, will remain in recession. However, there are some bright spots: India is picking up.

Growth in China should stabilise at around 6.7%, supported by the authorities’ stop/go policies.

In the ongoing debate about risks of inflation vs deflation, we are in the deflationist camp, in that we think economic trends point to deflation if left to their own devices.

The markets’ pole star is fading

November 11, 2015Published: 11th November 2015

Download issue:

Since 2009, major central banks such as the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BoJ) and others have largely determined the trends in the major asset classes of both emerging and developed countries: equities, sovereign and corporate bonds, and currencies. Investors found their guiding light in the central banks. Markets are once again likely to find themselves under their influence in 2016, but without as much clarity or reliability as before.

For some time, we have employed a dual analytical framework for interpreting the actions of central banks. The first aspect concerns the nature of the monetary regime within which markets evolve. In other words, the decisions and communication of central banks together determine the trends in conventional variables such as economic growth, inflation, earnings growth, etc. The second aspect concerns the way in which the monetary regime created by central banks responds to three factors: desynchronisation, heterogeneity and non-cooperation. Desynchronisation because the Fed is gradually withdrawing from its programme of quantitative easing, while the ECB is beginning and the BoJ accentuating it. Heterogeneity because neither the ECB nor the BoJ share the style of monetary policy adopted by the Fed to guide market expectations (‘forward guidance’).

Bond yields are heading up

November 10, 2015Yields on DM sovereign bonds are catching up with the wider equity market rally, as fears about deflation have dissipated and a first Fed rate rise is now likely in December.

The rebound in equity markets has played out as expected since the beginning of October, after excessively negative perceptions about the global economy, notably China, abated. Data continue to confirm broadly robust global economic fundamentals, even if growth lacks momentum.

The S&P 500 has now moved back into the trading range (roughly between 2050 and 2120) that it occupied from February to August, while the Stoxx 600 has reached the lower bound of its range for the same period (around 380 to 410). Falls this week in anticipation of a Fed rate rise in December are unlikely to herald a major reversal; conversely, further gains will be limited for as long as downward revisions to earnings forecasts continue.

Bond yields catch up with the rally Sovereign bonds lagged the equity market rebound, with yields on 10-year US Treasuries initially rising only gently. Until recently, fears about deflation, linked in part to lower oil prices, were still dampening long-term interest rates.

But this changed with very strong job creation data in the US last week, which, in conjunction with hawkish comments from Janet Yellen, considerably increased the likelihood of a Fed rate rise in December.

Financial markets likely to rebound further

October 21, 2015Macroview

Economic cycles are desynchronised; monetary policies are also desynchronised and noncooperative; corporate earnings have been downgraded; and uncertainty has compressed valuation ratios.

Concerns about China’s slowdown and the Fed’s impending interest rate rise have loomed especially large. The result has been volatile and shaky markets.

However, the recent market correction has been driven by perceptions rather than reality. Economic fundamentals have not deteriorated and, indeed, remain reasonably robust in core economies.

We think therefore that positive news in the coming months – from China, the US and Europe – could relieve negative perceptions and allow markets to rebound in the fourth quarter.

Indeed, the rebound started at the beginning of October and is already well advanced.