An upcoming referendum would change the SNB's monetary policy and the business model of commercial banks.SWITZERLAND: A TEST BED FOR RADICAL IDEASThe ‘Sovereign money’ initiative, to be voted on in June, aims at a fundamental reform of the Swiss monetary system. In a nutshell, the initiative asks that the creation of money and the granting of loans be separated by barring commercial banks from creating deposits through lending. According to the initiative’s promoters the “Swiss National Bank (SNB) should be the sole organisation authorised to create money – not only cash and coins, but also the electronic money in our bank accounts”. Moreover, the SNB would be responsible for implementing a form of ‘helicopter money’, distributing funds directly to the federal and cantonal governments and

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

An upcoming referendum would change the SNB's monetary policy and the business model of commercial banks.

SWITZERLAND: A TEST BED FOR RADICAL IDEAS

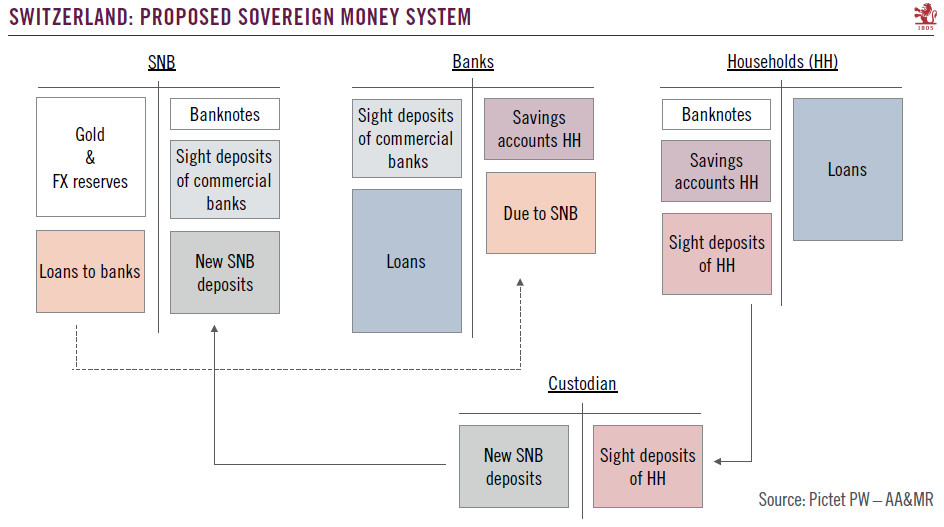

The ‘Sovereign money’ initiative, to be voted on in June, aims at a fundamental reform of the Swiss monetary system. In a nutshell, the initiative asks that the creation of money and the granting of loans be separated by barring commercial banks from creating deposits through lending. According to the initiative’s promoters the “Swiss National Bank (SNB) should be the sole organisation authorised to create money – not only cash and coins, but also the electronic money in our bank accounts”. Moreover, the SNB would be responsible for implementing a form of ‘helicopter money’, distributing funds directly to the federal and cantonal governments and even to individual citizens.

A DRASTIC CHANGE TO THE SNB’S MONETARY POLICY

Should the referendum be carried, its impact on the SNB would not be neutral. The way the SNB conducts its monetary policy would change, as it would need to target monetary aggregates, a monetary policy style the central bank abandoned in 1999. Moreover, the SNB would risk losing some of its independence, as it would be financing public expenditure directly.

PROBABILITY OF SUCCESS IS LOW, BUT…

The Federal Council (central government), the parliament and the SNB have all come out in opposition to the sovereign money initiative. On balance, our baseline expectation is that the sovereign money initiative will be rejected. However, surprises are always possible. This is why we are taking a closer look at what would happen if the sovereign money initiative were to pass.

INVESTMENT CONCLUSIONS

If the sovereign money initiative were to be accepted by Swiss voters, Switzerland would become a large-scale laboratory for an untried monetary system. The economic consequences are difficult to predict, but the country would likely plunge into a period of uncertainty. How the Swiss franc would react in the short term is not clear cut. There are two possible scenarios:

(1) If the SNB is not able to engage in FX interventions and if international investors continue to consider Swiss franc-denominated deposits as a safe haven asset, there would likely be some upward pressure on the franc.

(2) By contrast, if the SNB needs to sell its FX reserves or investors lose some of their confidence in Switzerland, the value of the franc would likely diminish. At least initially, the depreciation of the Swiss franc could benefit some Swiss equities via increased reported sales and currency effects.

Swiss banks would be hurt were the referendum to pass. The intermediary function played by banks in the monetary system would be impaired, with the risk of creating upward pressure on Swiss long-term rates. Importantly, the precise impact on Swiss assets would depend mainly on the new system’s reach and the length of transition to it.