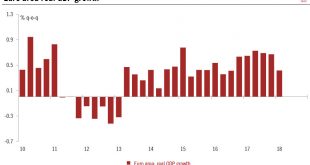

The euro area economy’s loss of momentum in Q1 derived largely from temporary factors. We remain construction on the cyclical outlook.Euro area real GDP expanded by 0.4% q-o-q in Q1, or 1.7% in annualised terms, according to Eurostat’s flash estimate. This comes after an upwardly revised figure of 0.7% q-o-q in Q4 2017. Although this first estimate could be subject to statistical revisions, it confirms that the euro area economy lost some momentum in Q1.This Q1 flash estimate confirms that...

Read More »House View, April 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation While macroeconomic and corporate fundamentals still favour risk assets, challenges have been steadily increasing and a lot of good news is already priced into valuations. We sold part of our equity overweight during the early March rally. Even though we have become more prudent about equities’ short-term...

Read More »On the lookout for further rise in 10-year yield

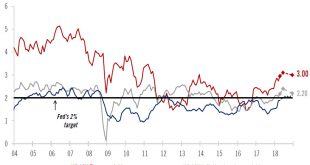

We still expect US 10-year yield to end 2018 at around 3.0%, but risks of a rise to 3.5% have increased.The 10-year Treasury yield broke through the key 3% threshold last week– as we had expected it would at some stage in our central scenario. We are sticking to this central scenario, which sees the 10-year Treasury yield ending the year at around 3%, but with some spikes above this level in Q2 and Q3 due to inflation fears.The central scenario (to which we assign a 55% probability) for US...

Read More »Euro weakness should prove temporary

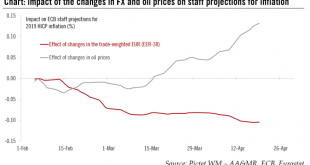

Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.21501.2550 trading range, which had been in place since 18 January. Reasons for this decline can be found in the growth differential and monetary policy divergence. Indeed, moderation in leading indicators (from elevated levels) in the euro area and a cautious ECB (given muted...

Read More »M&A buoyant so far this year

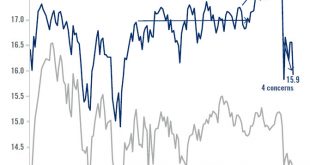

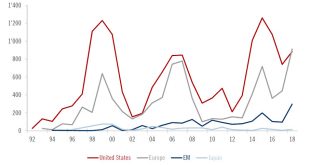

M&A activity has started the year strongly, especially in Europe, with cash-only deals to the fore as funding conditions continue to tighten.So far this year equity returns have been fairly disappointing and market volatility has significant increased compared with 2017. However, disappointment has been driven neither by poor economic conditions nor by a worsening of company fundamentals, and mergers and acquisitions (M&A) remain supportive. The acceleration of M&A in some...

Read More »Bank of Japan stays put, as expected

With moderate inflation momentum in Japan, we expect the BoJ to keep its monetary policy unchanged in 2018, although the possibility of a policy adjustment in 2019 might be rising.At its latest monetary policy meeting on April 27, the Bank of Japan (BoJ) decided to keep its current monetary easing programme intact.Under its yield curve control (YCC) policy, the BoJ applies a negative interest rate of -0.1% to the policy-rate balances in the current accounts held by financial institutions at...

Read More »The ECB’s steady hand

Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment. Indeed, Mario Draghi described the recent “moderation” in growth as the result of a pullback in sentiment from elevated levels, with economic...

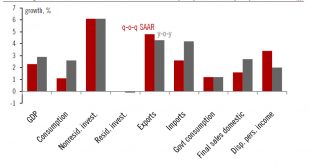

Read More »Deceleration in US GDP growth should prove transitory

Economic growth in the US slowed in Q1, but we expect a sharp rebound in Q2 as household consumption and corporate investment pick up.US Q1 GDP grew 2.3% q-o-q SAAR, slowing from 2.9% in Q4. Part of the deceleration was due to ‘residual seasonality’, we think, and was therefore technical.We expect US private consumption to rebound sharply in Q2, and, with investment growth likely to stay firm, we think Q2 GDP growth could head towards 3.5-4.0%.The Q1 employment cost index wage reading was...

Read More »Euro weakness should prove temporary

We see US dollar’s strength against the euro as likely to peak around the middle of the year.Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.2150-1.2550 trading range, which had been in place since 18 January.Reasons for this decline can be found in the growth differential and monetary policy divergence. Indeed, moderation in leading indicators (from elevated levels) in the euro area and a cautious...

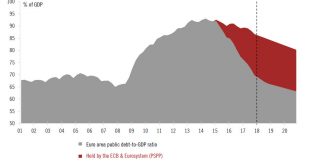

Read More »Europe chart of the week – public debt

Changes in quantitative easing will have profound implications for euro area debt dynamics.This week’s Eurostat releases revealed that public finances continue to improve in most euro area member states. As a result of falling deficits, low interest rates and stronger nominal growth, the ratio of euro area government debt to GDP fell to a six-year low of 86.7% in Q4 2017.Although sovereign debt sustainability remains shaky in countries like Italy, it is fair to say that we have moved from...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org