Since the beginning of the year, many asset classes have recorded negative or only marginally positive returns. Where do we go from here?Christophe Donay, Chief Strategist, Head of Asset Allocation & Macro Research, Pictet Wealth ManagementSince the beginning of the year, depending on currency, many asset classes have recorded negative or only marginally positive returns. In US dollar terms, US and global equity indices (MSCI World) have produced total returns of below 0.5% since 1 January, while US government and corporate bonds have negative returns.Where do we go from here when it comes to asset allocation? One faces two choices.The first choice depends on whether one has faith in a world growth engine that is humming along (thanks to a synchronised growth cycle and US tax cuts) or

Topics:

Christophe Donay considers the following as important: asset allocation, Christophe Donay, Macroeconomic outlook, Macroview, Pictet view

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Since the beginning of the year, many asset classes have recorded negative or only marginally positive returns. Where do we go from here?

Christophe Donay, Chief Strategist, Head of Asset Allocation & Macro Research, Pictet Wealth Management

Since the beginning of the year, depending on currency, many asset classes have recorded negative or only marginally positive returns. In US dollar terms, US and global equity indices (MSCI World) have produced total returns of below 0.5% since 1 January, while US government and corporate bonds have negative returns.

Where do we go from here when it comes to asset allocation?

One faces two choices.

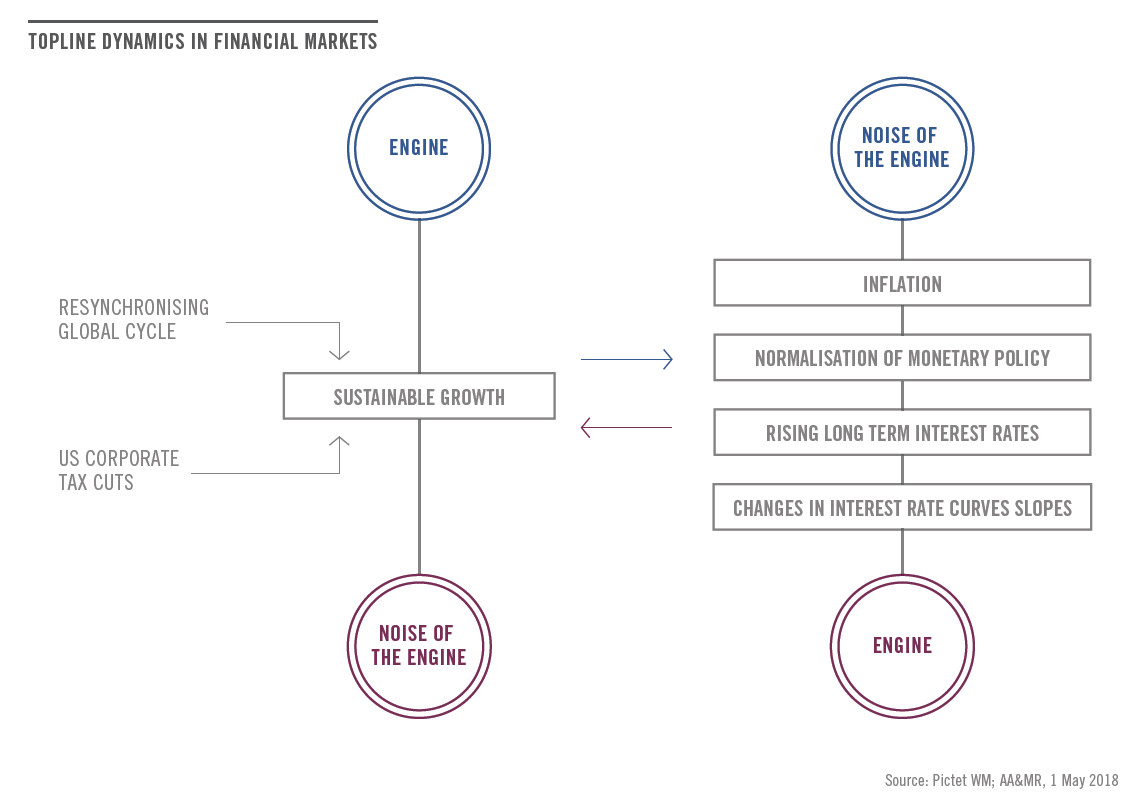

The first choice depends on whether one has faith in a world growth engine that is humming along (thanks to a synchronised growth cycle and US tax cuts) or whether one decides it is time to listen more to the noise this engine is producing (higher long-term interest rates, inflation, changes in the slope of the interest rate curve). Whether one chooses to admire the growth engine or become worried about the noises it produces will determine investment choices. We opt for the former and, for the moment, we are not changing our basic premise that resilient growth will continue to help drive risk assets.

The second choice is the direction of economic policy, especially in the US. Do recent initiatives from president Trump (the threat of increased trade tariffs on imports, a regulatory clampdown on Big Tech) constitute a decisive turn in US economic policy or simply a pre-midterm election dose of rhetoric. We plump for the latter. Our baseline scenario therefore remains that equity markets will emerge from their doubts.

We believe hard data bears out our optimism. In spite of sentiment declines, global growth is strong and resilient. We expect global GDP growth of the order of 3.9% this year and next. Corporate investment has been strangely absent in the current economic cycle, but we expect it to pick up significantly as a result of the Trump tax cuts and provide a leg up for US growth. Even in Europe, we expect a rise in corporate investment to put growth on a sounder footing.

Inflation is rising, but we believe that fears about increasing prices are overdone. Wage growth in the US is gaining some traction—but slowly with only a moderate impact on core inflation. Although inflation expectations have been rising, we are still in a sweet spot of moderate inflation and good growth.

We believe the Fed and other central banks will continue monetary policy normalisation but remain intent on not breaking an economic and market dynamic that is supporting growth and lowering unemployment. We note that the neutral (the inflation-adjusted rate when the Fed is neither adding nor withdrawing stimulus) interest rate is currently not much above zero. In spite of trade rhetoric, we also believe economic policy in the US and elsewhere will coherent remain pro-growth and focused on promoting growth.

What do these dynamics mean for different kinds of asset?

A relatively buoyant backdrop (including a drop in political tensions in Europe) is putting defensive currencies like the Swiss franc under downward pressure while the US dollar, offering higher yields than either the franc or the euro, is becoming an attractive carry currency again.

We are also watching the term premium (the bonus investors received for the added risk of owning long-term bonds). This could rise as growth accelerates in the US in the current quarter.

While not part of our central scenario, a sustained rise in inflation could lead us to change our forecast for Treasury bonds. Indeed, we are already seeing a 10-year US Treasury yield at 3%, the level we forecast for the end of the year. We have always insisted we could see overshoots, as inflation expectations rise.

Equities have not been showing any clear direction of late. Whereas the behaviour of other asset classes is in agreement with our view that we will see more growth and more inflation, equity markets have still not yet managed to separate the wheat from the chaff. Presently, even though earnings growth is running at over 20% in the US, equities are in a funk about new regulations of tech giants and trade wars. A lessening in such fears could allow equities to pick up momentum again.

At the same time, we recognise that valuations remain above their long-term average, meaning there is no room for disappointment. For example, the difference between earning yields and the yield offered by short-term bonds has become stretched. In short, while we believe the current environment still offers potential for equities, this potential is fragile. Corporate credit remains subject to rising long-term interest rates and spread movements. We believe spread and rates tension are more pronounced for euro credits than for their US peers.