Recent data suggest that the ‘Texas boom’ is continuing. The outlook for the state remains very robust thanks to rising oil prices.From a macroeconomic perspective, Texas is, in our view, the pivotal state to watch this year. Texas has been a major driving force of US growth lately, propelled by the domestic energy boom – the epicentre of which is the Permian Basin that straddles Texas and New Mexico.In Q4 2017 (latest data available), oil-rich Texas, which accounts for 9.0% of US GDP – making it the second biggest US state by GDP after California – grew a particularly solid 4.5% y-o-y, dwarfing nationwide growth of 2.6%.Recent employment data suggests that activity in Texas accelerated further in Q1 2018, mirroring the ongoing rise in oil prices, and surging local oil production. Texas’

Topics:

Thomas Costerg considers the following as important: Macroview, Texas oil production

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Recent data suggest that the ‘Texas boom’ is continuing. The outlook for the state remains very robust thanks to rising oil prices.

From a macroeconomic perspective, Texas is, in our view, the pivotal state to watch this year. Texas has been a major driving force of US growth lately, propelled by the domestic energy boom – the epicentre of which is the Permian Basin that straddles Texas and New Mexico.

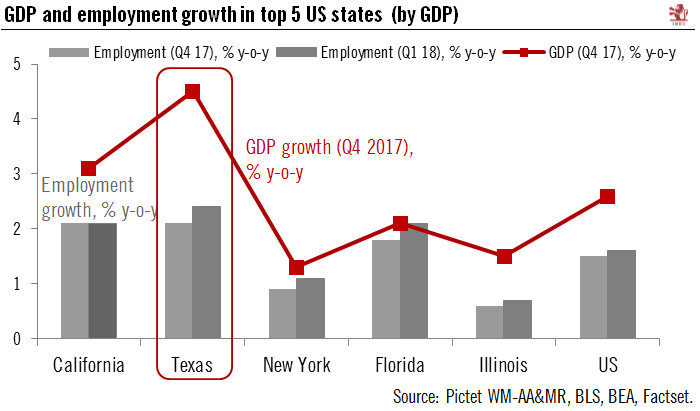

In Q4 2017 (latest data available), oil-rich Texas, which accounts for 9.0% of US GDP – making it the second biggest US state by GDP after California – grew a particularly solid 4.5% y-o-y, dwarfing nationwide growth of 2.6%.

Recent employment data suggests that activity in Texas accelerated further in Q1 2018, mirroring the ongoing rise in oil prices, and surging local oil production. Texas’ employment grew 2.4% y-o-y in Q1 2018 from 2.1% in Q4 2017 . This is much higher than the growth of nationwide employment, which rose 1.6% y-o-y in Q1 and 1.5% in Q4.

The boom in Texas is also a reminder that the sharp rise in oil prices has an ambivalent effect on US growth. The US oil/GDP relationship has evolved in recent years as domestic oil production has risen from c. 5mb/d in 2008 to 10.5mb/d in April 2018. The solid economic growth in Texas is reverberating positively on the rest of the country. Big oil-consuming states like California seem to be able to ‘swallow the pill’: employment there grew a still-solid 2.1% in Q1 2018, showing no meaningful hit to growth from rising oil prices.

However, the increasing dependence of the US economy on Texas, and the rising gap in growth with other, more manufacturing-oriented states like New York and Illinois, needs to be watched. We would prefer to see more broad-based GDP growth.