In the coming months, we expect that many quality emerging-market investments will be oversold, as investors ‘sell first and ask questions later’.Emerging market (EM) debt has been suffering lately, posting a disappointing performance year-to-date. While we expect that at some point this sell-off will offer compelling opportunities for investors who have the patience to ride out the storm, we still recommend caution as, on a shorter horizon (the coming three months), US Treasury yields could spike above 3% due to inflation fears, thus sustaining the US dollar rally. Any further decline in EM currencies risks additional interest rate rises by EM central banks. This could prove particularly detrimental to EM debt, as credit spreads would widen further and sovereign yields in local currency

Topics:

Laureline Chatelain considers the following as important: Emerging market credit spreads, Emerging market currencies, Emerging market debt, Emerging market sell-off, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In the coming months, we expect that many quality emerging-market investments will be oversold, as investors ‘sell first and ask questions later’.

Emerging market (EM) debt has been suffering lately, posting a disappointing performance year-to-date.

While we expect that at some point this sell-off will offer compelling opportunities for investors who have the patience to ride out the storm, we still recommend caution as, on a shorter horizon (the coming three months), US Treasury yields could spike above 3% due to inflation fears, thus sustaining the US dollar rally.

Any further decline in EM currencies risks additional interest rate rises by EM central banks. This could prove particularly detrimental to EM debt, as credit spreads would widen further and sovereign yields in local currency rise in concert with policy rates.

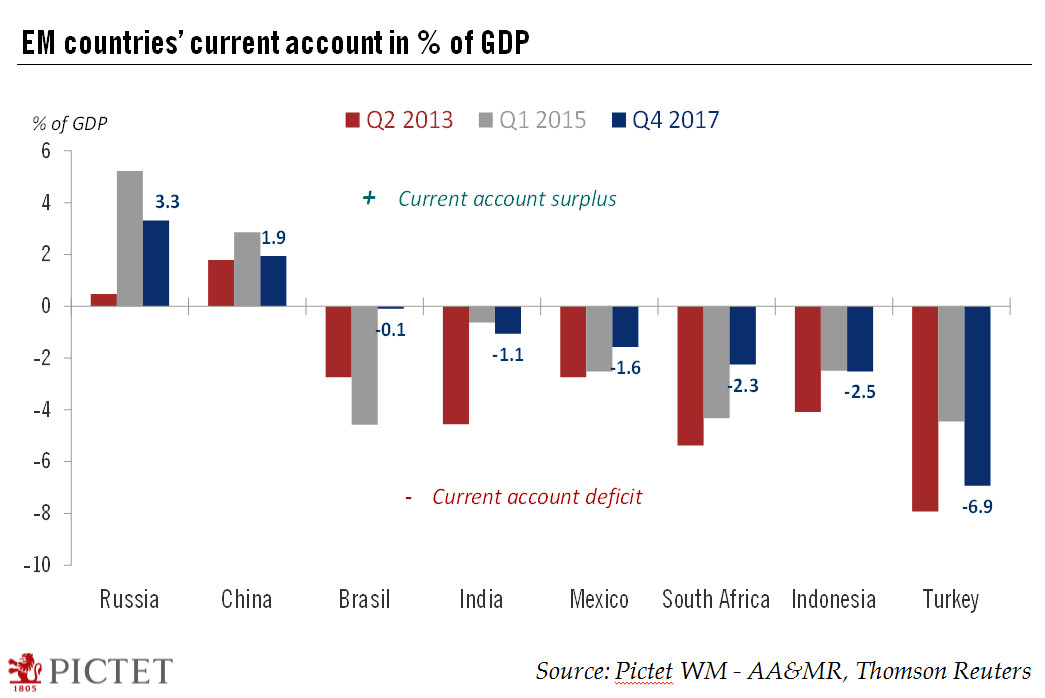

Countries with large current account deficits run the risk of seeing meaningful deterioration in their financial stability. Turkey, Indonesia and South Africa stand out as being the most at risk from the rebound in the US dollar, explaining the rise in credit spreads they have experienced since the beginning of the year.

Yet our view that further upside potential for US Treasury yields and for US dollar appreciation is limited should relax the upward pressure on EM yields. We have a target of 3.0% on the 10-year Treasury yield for end-2018 and we expect the US dollar to moderately weaken in the second half of 2018.

A very important driver for EM credit spreads and sovereign local currency yields is the health of the global economy and EM central banks’ monetary policy. We remain confident in the health of the global economy and expect global GDP growth of around 3.9% in 2018 and 2019.

Despite this short-term challenge, we remain cautiously optimistic on EM debt. We will carefully monitor EM central banks’ actions and the developments in trade negotiations involving the US, but as we see limited upside for US Treasury yields and the US dollar, we expect the rise in EM yields to slow to the end of 2018. Moreover, global growth and trade are still robust despite Trump’s protectionist rhetoric. Hence, we expect that at some point EM debt will again offer compelling opportunities. For example, select EM credit spreads could soon become attractive again after their recent widening. In fact, the sovereign credit spread (in USD) is now above the US high-yield spread.