Forget about trade wars, or even the eurodollar’s ever-present squeeze on China’s monetary system. For the Communist Chinese government, its first priority has been changed by unforeseen circumstances. At the worst possible time, food prices are skyrocketing. A country’s population will sit still for a great many injustices. From economic decay to corruption and rising authoritarianism, the line between back alley grumbling and open rebellion is usually a thick...

Read More »Central Banks May Be Driving Us Toward More Waste, More Carbon Emissions

Christine Lagarde, the new president of the European Central Bank (ECB), has added a new green dimension to monetary policymaking. The charming Frenchwoman signaled that the ECB could buy green bonds, possibly as part of the reanimated bond purchase program (a form of QE). This could reduce the financing costs of green investment projects. If interest rates were negative, the green bond purchases would even amount to a subsidy for climate-friendly investment. This...

Read More »FX Daily, December 11: Sterling Holds Firm Despite Tighter Poll

Swiss Franc The Euro has risen by 0.12% to 1.093 EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets continue to tread water as investors await this week’s key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde’s first ECB meeting at the helm. Global equities continue...

Read More »Bank savers feel sting from negative interest rates

The Swiss franc is in such high demand that the central bank is imposing charges on stockpilers. (© Keystone / Gaetan Bally) Swiss savers are being made to pay for global demand for the franc. The number of bank customers being charged negative interest rates on their deposits is on the rise – and shows no sign of reversing. The problem for domestic savers stems from the popularity of the Swiss currency. Amid economic uncertainty worldwide and a paucity of return on...

Read More »Swiss seek compromise amid ‘lack of will’ at climate talks

The Swiss “office” at COP25 (swissinfo.ch) This year, the signal from the scientific community has been loud and clear on climate change: something needs to be done, and soon. But leadership at the United Nations’ annual climate conference appears less clear-cut, and the head of the Swiss delegation is frustrated by hesitation to move ahead. At the vast congress center in the outskirts of the Spanish capital where this year’s UN climate talks are taking place,...

Read More »Disposable (Employment) Figures

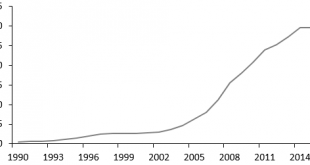

If last month’s payroll report was declared to be strong at +128k, then what would that make this month’s +266k? Epic? Heroic? The superlatives are flying around today, as you should expect. This Payroll Friday actually fits the times. It wasn’t great, they never really are nowadays (when you adjust for population and participation), but it was a good one nonetheless. November 2019, according to the BLS, was the first month since January to register better than...

Read More »The destruction of civilization – implications of extreme monetary interventions

When I was asked to write an article about the impact of negative interest rates and negative yielding bonds, I thought this is a chance to look at the topic from a broader perspective. There have been lots of articles speculating about the possible implications and focusing on their impact in the short run, but it’s not very often that an analysis looks a bit further into the future, trying to connect money and its effect on society itself. Qui bono? Let...

Read More »The BIS Misses An Opportunity To Get Consistent With The Facts

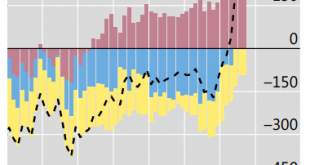

Much has been made about the repo market since mid-September. Much continues to be made about it. The question is why. It is now near the middle of December and repo looks dicey despite repo operations and a not-QE small-scale asset purchase intended to increase the level of bank reserves. Always the focus on “funds” which may be available. It was John Adams who took on the task of defending several British soldiers on trial for the Boston Massacre. A wholly...

Read More »Gold $1600 In 2020 as Case for Diversifying into Gold ‘as Strong as Ever’ – Goldman

Gold will climb to $1,600 over the next year – Goldman◆ Goldman is still forecasting that gold will climb to $1,600 over the next year due to investment demand. ◆ Investors should diversify their long-term bond holdings with gold, citing “fear-driven demand” for the precious metal – Goldman Sachs Group Inc. ◆ “We still see upside in gold as late cycle concerns and heightened political uncertainty will likely support investment demand” for bullion as a defensive...

Read More »FX Daily, December 10: Capital Markets: Still Seems to be the Calm before the Storm

Swiss Franc The Euro has fallen by 0.06% to 1.0921 EUR/CHF and USD/CHF, December 10(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are trading lower, and bonds are mixed as the FOMC, UK election, and the US decision on the December 15 tariffs draw near. The MSCI Asia Pacific Index three-day rally ended today as only China and South Korea’s markets rose. Europe’s Dow Jones Stoxx 600 gapped slightly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org