Swiss Franc The Euro has fallen by 0.06% to 1.0921 EUR/CHF and USD/CHF, December 10(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are trading lower, and bonds are mixed as the FOMC, UK election, and the US decision on the December 15 tariffs draw near. The MSCI Asia Pacific Index three-day rally ended today as only China and South Korea’s markets rose. Europe’s Dow Jones Stoxx 600 gapped slightly lower at the open. The upside momentum has faltered, and the benchmark is headed south for the third session of the past four. The S&P 500’s three-day rally ended yesterday, and the index closed on its lows. It is poised to gap lower today. Initial support may be seen a little below 3120, but more

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, Featured, NAFTA, newsletter, USD, WTO

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

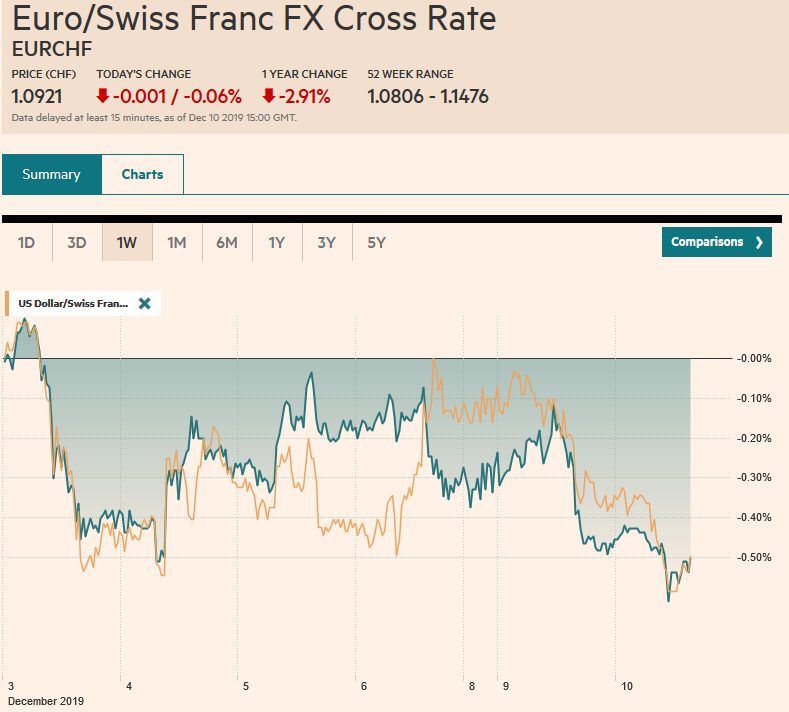

Swiss FrancThe Euro has fallen by 0.06% to 1.0921 |

EUR/CHF and USD/CHF, December 10(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

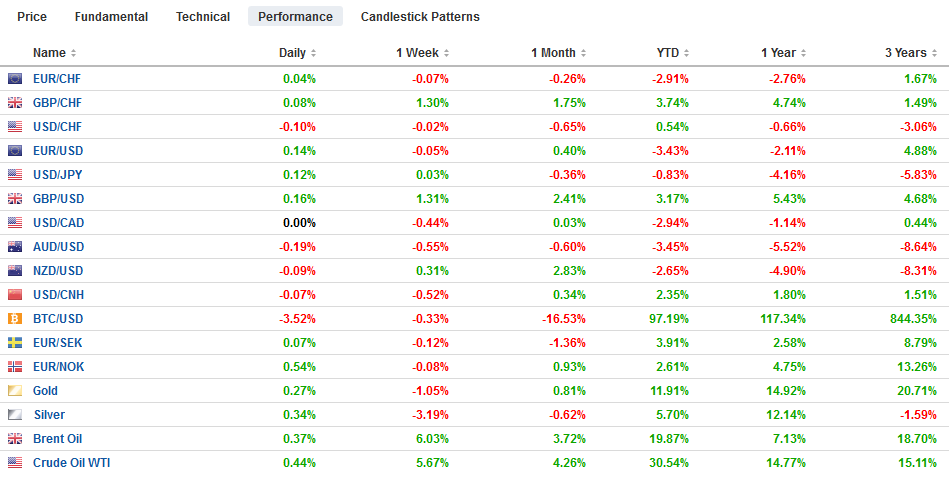

FX RatesOverview: Equities are trading lower, and bonds are mixed as the FOMC, UK election, and the US decision on the December 15 tariffs draw near. The MSCI Asia Pacific Index three-day rally ended today as only China and South Korea’s markets rose. Europe’s Dow Jones Stoxx 600 gapped slightly lower at the open. The upside momentum has faltered, and the benchmark is headed south for the third session of the past four. The S&P 500’s three-day rally ended yesterday, and the index closed on its lows. It is poised to gap lower today. Initial support may be seen a little below 3120, but more important support is seen in the 3095-3102 range. Yields pulled back in Asia, but are 1-2 bp firmer in Europe. The US 10-year is hovering around 1.80%. The dollar is a little softer against most of the major currencies, while JP Morgan Emerging Market Currency Index is trying to extend its rally for the fifth session. Gold is a couple of bucks firmer and well within its recent ranges. January WTI is softer but continues to consolidate above $58. |

FX Performance, December 10 |

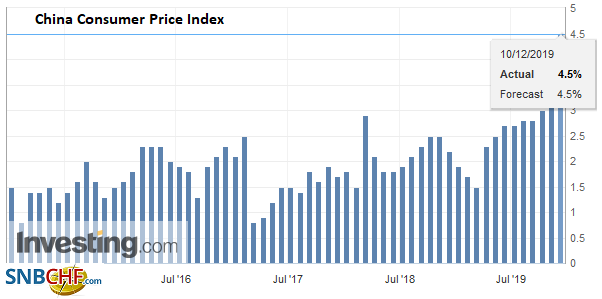

ChinaChina’s economic data showed a continued divergence between consumer and factory prices and a jump in lending last month. Consumer prices rose 4.5%, a seven-year high from a year ago in November. This was more than economists forecasts and marks an acceleration from the 3.8% pace in October. Pork prices jumped 110% over the past year and contributed 2.64 percentage points to the headline CPI. Some observers detect a potential peak in pork prices as they rose only 3.8% after a 20.1% increase in October. China appears to have stepped up its imports of pork. Core prices (excluding food and energy) was unchanged at a mild 1.4%. Producer prices are still mired in deflation, falling 1.4% year-over-year. They had dropped by 1.6% in October. The weakness of producer prices signals pressures on profits and sluggish demand. Separately, China reported a larger than expected jump in November lending after a subdued October. Bank lending doubled to CNY1.39 trillion from CNY661 bln. Aggregate financing, which includes the shadow banking, surged to CNY1.750 from CNY619 bln. |

China Consumer Price Index (CPI) YoY, November 2019(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

For the first time in nine months, the generic 10-year JGB reached the zero yield mark briefly in Tokyo today. Apparently, the zero yield brought in new buyers and sending the yield back down into negative territory before the end of the local session. The late rally came even as the five-year auction met lukewarm demand. The yield was nearly -30 bp in September. The Tankan Survey of business sentiment is due out later in the week, and some deterioration is expected. The economy appears to be contracting sharply this quarter, and these considerations will likely see the yield stay remain in negative territory, despite the new supply that the fiscal package may bring.

The dollar is going nowhere against the yen quickly. It is in about a 10-tick range above JPY108.55. Initial support is seen near the recent lows a little below JPY108.45, and upside may be capped near JPY108.85. There are $1.9 bln in options struck between JPY108.50 and JPY108.65 that expire today and a $2.5 bln option at JPY109.00. The Australian dollar is slipped despite the jump in iron ore prices above $90. It has ground lower in quiet turnover and is approaching $0.6800 after being frustrated around $0.6865 last week. A retracement objective and the 20-day moving average come in a little above $0.6800, and it may take a close below $0.6795 to confirm the downside break. The Chinese yuan is flat, with the dollar near CNY7.04.

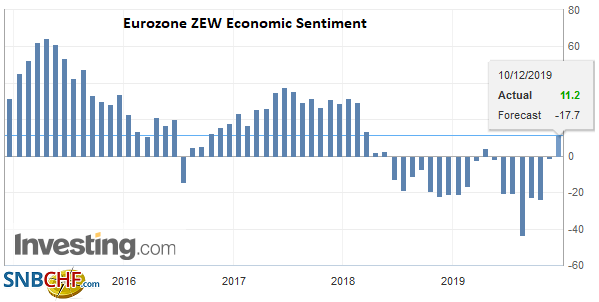

EurozoneAfter disappointing factory goods orders and industrial output data last week, Germany could use some good news, and that is what it got today in the ZEW survey. The current assessment improved to -19 from -22. This was a little better than expected and is the second consecutive improvement. That said, at the end of last year, it stood at 45.3. The expectations component was even stronger, jumping to 10.7 from -2.1. It is the second gain in a row and the third in the past four months. It is the highest since February 2018. Often, it seems the performance of the DAX is helps investor sentiment in Germany, and we note that it has strung together a three-month 10% advance in the last three months. France and Italy reported October industrial production figures ahead of the aggregate report for the EMU later this week. France surprised on the upside and Italy on the downside. French industrial output rose 0.4%, led by a 0.5% rise in manufacturing. Moreover, the September series was revised a little higher. The good news is dented a bit by threats of continued strike action in the face of Macron’s efforts to reform government pensions. Italy disappointed. Industrial output contracted by 0.3% and the 2.4% decline on a work-day adjusted year-over-year basis is the most of the year. The poorer economic performance aggravates the tensions within the governing coalition. |

Eurozone ZEW Economic Sentiment, December 2019(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

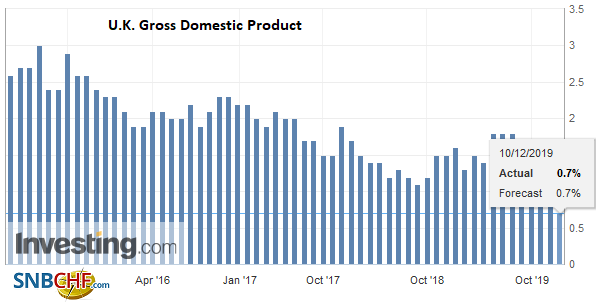

United KingdomThe UK published several economic reports today but are being overshadowed by Thursday’s election. First, October’s GDP was flat, which was a bit disappointing after the 0.1% contraction in September. Services were up more than expected (0.2% vs. flat in September), but this was blunted by weaker than expected industrial output (0.1% after -0.3% in September). There was a blowout trade deficit of GBP5.19 bln, but the September deficit was revised down to a GBP1.92 bln shortfall from GBP3.36 bln. Lastly, construction imploded, falling 2.3% in October, the largest decline since January 2018. Economists had been looking for around a 0.2% decline. The takeaway is that the UK economy remains soft, and the pressure on the Bank of England to ease policy will likely increase next year. Recall Carney is to step down by the end of January, and that means among the first things his successor may have to do is deliver a cut. The euro has edged slightly higher and edged a little above yesterday’s high before encountering sales near $1.1080. There are options for 2.4 bln euros struck between $1.1065 and $1.1070 that expire today. There is another for about 615 mln euros at $1.11 that will also be cut. The high before last week’s US jobs data was near $1.1110. Sterling remains firm, but so far is holding below yesterday’s high near $1.3180. Support is seen ahead of $1.3130. |

U.K. Gross Domestic Product (GDP) YoY, Q3 2019(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

United States

Important pieces fell into place yesterday that make passage of the USMCA a strong likelihood. Trade Representative Lighthizer presented the compromise that he struck with Pelosi to his Mexican counterpart Seade and, apparently, after some haggling, a deal was reached. The head of the largest union federation in the US, the AFL-CIO, gave his endorsement. The next, Lighthizer and Kushner will return to Mexico to sign-off on the agreement, and Canada’s Deputy Prime Minister Freeland, who as foreign minister helped negotiate the deal, will also join them. We share two observations. First, updating NAFTA was needed and could have been accomplished if the US would have remained in the TPP (Trans-Pacific Partnership). Second, the impact on the US economy is minimal and mostly from the lifting of the uncertainty. The US non-partisan InternationaL Trade Commission forecast the agreement would boost the US economy by about 0.35% and add about 176k jobs over six years. It is a win-win for the President and the Democrats. The USMCA was a priority of the administration, and this is a moderate measure when the left-wing of the party is wrestling for control. It is not certain that the bureaucratic elements of the implementing legislation will be approved by the end of the year, but it could. And if not now, then early next year.

Separately, today marks the end of the terms of two of the remaining three appellate judges at the WTO. Three are needed for a ruling. This jeopardizes the conflict resolution process. The WTO has two broad lines of business. The first is promoting global trade agreements, but this has been bogged down. The second was the adjudication of disputes, which was an improvement over its predecessor (GATT–General Agreement on Tariffs and Trade). One source of strains the WTO arguably comes from trying to incorporate China, which joined 18-years ago tomorrow. Although some argue that the WTO is not equipped to cope with China, in December 2001, when many observers feared the end of globalization after 9/11, China joining the WTO was heralded as a success. Separately, the US has been critical of what it regards as judicial over-reach by the WTO, and this goes back to at least the Obama Administration. At the same time, it is noteworthy that the US wins the vast majority of cases it brings to the WTO.

The economic calendar is light today. The only reports to note are the US productivity and unit labor cost measures, which are derived from the GDP data and typically do not move the market. The Federal Reserve meets tomorrow. No one expects a change in policy, and the updated economic forecast will likely dominate the investors’ interests. Brazil’s central bank also meets tomorrow and is widely expected to deliver another 50 bp cut in the Selic rate to 4.5%. It would be the fourth cut in H2 this year.

The US dollar is consolidating in the upper end of the range set at the end of last week against the Canadian dollar on the back of the conflicting employment reports. Support near CAD1.3230 has frayed a bit, but it has not been convincingly violated. A break of CAD1.3220 would likely signal a near-term high is in place and could spur a move toward CAD1.3180. The prospects for the USMCA is not doing the Canadian dollar much good, but it is being cited as a factor behind the Mexican peso’s continued gains. It is rising for the sixth consecutive session today and is approaching our support target in the MXN19.17-MXN19.18 area. The high yields can still attract funds to Mexico over the holiday period. This could see additional strength of the peso.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Currency Movement,Featured,NAFTA,newsletter,WTO