An Example of Strong Single Stock Seasonality Many individual stocks exhibits phases of seasonal strength. Being invested in these phases is therefore an especially promising strategy. Today I want to introduce you to a stock that tends to advance particularly strongly at this time of the year: Novo Nordisk. The Danish pharmaceutical group supplies a broad range of products and is a global market leader in diabetes drugs. Danish drug company Novo Nordisk Novo...

Read More »EUR/CHF: SNB does not find love in prices – Rabobank

The Swiss National Bank (SNB) has the mandate to maintain CPI inflation near 2% on a yearly basis but is currently running at just 0.2%. CHF’s strength is not welcomed by SNB, economists at Rabobank reports. Key quotes “The strong performance of the CHF can be associated with Switzerland’s robust fundamentals which ensure that the currency is considered by many investors to be store of value. While there have been a wide number of exogenous factors which have sparked...

Read More »FX Daily, February 14: Investors Continue to Look Past the Coronavirus

Swiss Franc The Euro has risen by 0.24% to 1.0641 EUR/CHF and USD/CHF, February 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are heading into the weekend, still trying to look past the coronavirus despite the new cases in Hubei. Tokyo was a notable exception in the Asia Pacific region, as the other major equity markets, like in Hong Kong, China, Taiwan, South Korea, and Australia,...

Read More »Swiss Producer and Import Price Index in January 2020: -1.0 percent YoY, unchanged MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

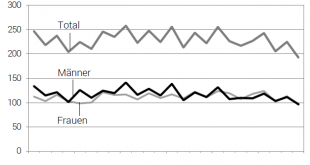

Read More »Swiss Labour Force Survey in 4rd quarter 2019: 0.9percent increase in number of employed persons; unemployment rate based on ILO definition falls to 3.9percent

13.02.2020 – The number of employed persons in Switzerland rose by 0.9% between the 4th quarter 2018 and the 4th quarter 2019. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined from 4.6% to 3.9%. The EU’s unemployment rate based also decreased from 6.6% to 6.2%. These are some of the results of the Swiss Labour Force Survey (SLFS). Download press release: 4th quarter 2019: 0.9% increase in number of...

Read More »USD/CHF Price Analysis: Greenback grinding up vs. Swiss franc, clings to 2020 highs

USD/CHF is slowly advancing printing fresh 2020 highs by a few pips. The rising wedge formations can limit the upside on USD/CHF. USD/CHF daily chart USD/CHF is printing new 2020 highs while the quote is trading below the 100/200-day simple moving averages suggesting an overall bearish momentum. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart After USD/CHF broke below the rising wedge pattern the market made a retest...

Read More »Création d’une page dédiée à la Monnaie

Cet post a pour but de vous informer de la création d’une page dédiée à la Monnaie. Vous la trouverez à cette adresse: https://lilianeheldkhawam.com/monnaie-dossier/ Monnaie et globalisation marchent main dans la main. Elles sont intimement liées à l’avènement du Nouveau Monde. C’est par la Monnaie que se décide l’avenir que ses créateurs voudront bien accorder à l’humain dans une société qu’ils veulent hautement rationalisée. Quelle place offriront-ils aux...

Read More »Thiam ‘proud’ of his record as he departs Credit Suisse

Thiam gave no indication of which job he will next take. (Keystone / Ennio Leanza) Outgoing Credit Suisse chief executive Tidjane Thiam said he was proud of what he has achieved at the bank as it delivered strong 2019 results and a promising start to this year. Thiam handed in his resignation last week after losing the confidence of the board following a spying scandal that had seriously damaged the bank’s reputation. Thursday was Thiam’s last day in office. The bank...

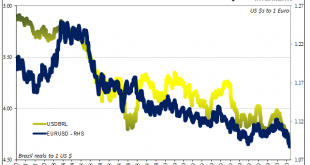

Read More »You Shouldn’t Miss The Cupom

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes. There were rumors that Banco (central) do Brasil was intervening or was going to intervene in its local currency markets, which may be an important signal. More of swaps that aren’t really currency swaps (which you can read about...

Read More »Gold Coins Worth £80,000 Found In Retiree’s Drawers In Cottage: “It Was Mind-Blowing. I Felt Like a Pirate in a Grotto”

Lot No 210, a 1937 coin set comprising gold sovereigns and £5 coins in a leather case, which sold for £8,000. Photograph: Wotton Auction Rooms ◆ Gold coins including gold sovereigns found in drawers of deceased retiree’s cottage sell at auction for £80,000 ◆ British gold coins including gold sovereigns from the Royal Mint found in drawers and cupboards of cottage fetch £80,000; one British gold sovereign found in a sugar bowl ◆ Auctioneer John Rolfe expected little...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org