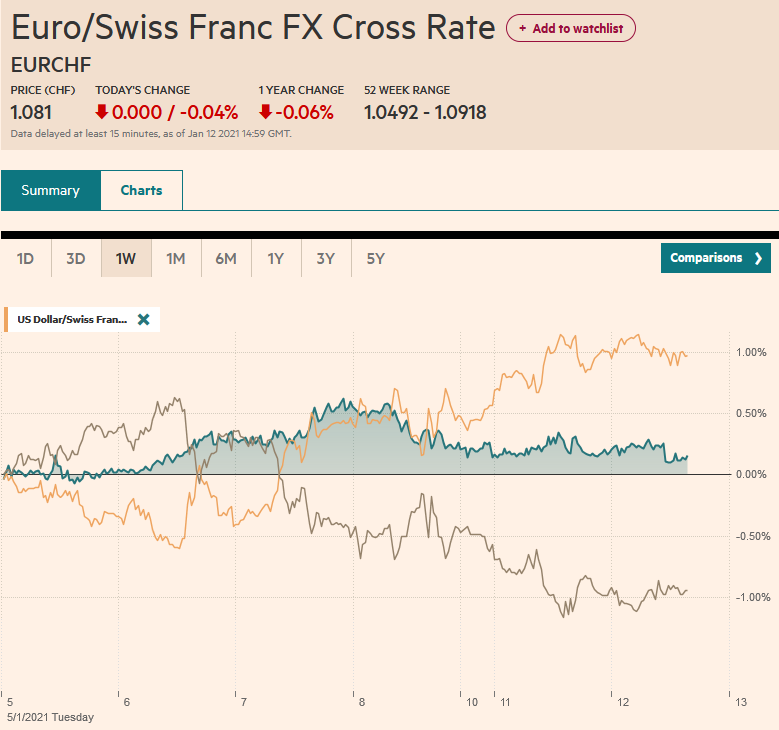

Swiss Franc The Euro has fallen by 0.04% to 1.081 EUR/CHF and USD/CHF, January 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets were stabilizing today after dramatic moves yesterday. Equity markets are recovering, and the dollar is paring yesterday’s gains. Most equity markets in the Asia Pacific region rose, though Taiwan, South Korea, and Australia were notable exceptions. Europe’s Dow Jones Stoxx 600 is posting a small gain, which, if retained, would be the fifth gain in seven sessions. US shares are higher after snapping a four-day advance yesterday. Benchmark 10-year yields are mostly firmer 3-4 bp among the Antipodeans, and 1-3 bp in Europe, where political anxiety is seeing

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, 4.) Marc to Market, Currency Movement, Featured, Federal Reserve, Italy, Japan, newsletter, Politics, USD

This could be interesting, too:

Investec writes Federal parliament approves abolition of imputed rent

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Swiss FrancThe Euro has fallen by 0.04% to 1.081 |

EUR/CHF and USD/CHF, January 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The capital markets were stabilizing today after dramatic moves yesterday. Equity markets are recovering, and the dollar is paring yesterday’s gains. Most equity markets in the Asia Pacific region rose, though Taiwan, South Korea, and Australia were notable exceptions. Europe’s Dow Jones Stoxx 600 is posting a small gain, which, if retained, would be the fifth gain in seven sessions. US shares are higher after snapping a four-day advance yesterday. Benchmark 10-year yields are mostly firmer 3-4 bp among the Antipodeans, and 1-3 bp in Europe, where political anxiety is seeing Italian bonds underperform. The 10-year Treasury yield is hovering around 1.15%. The dollar is trading lower against the major currencies, led by sterling, the Australian dollar, and the Norwegian krone (0.4%-0.6%), while the yen, Swiss franc, and euro are posting minor upticks (less than 0.15%). Emerging market currencies are also mostly firmer against the greenback, and the JP Morgan Emerging Market Currency Index is higher for the first time in four sessions. Gold is snapping a four-day drop, its longest in a couple of months. After falling to around $1817.50 yesterday, it is trading back above $1860 in Europe. Oil prices are firm, and the February WTI contract is pushing above $53 a barrel, a new 10-month high. |

FX Performance, January 12 |

Asia Pacific

Japan reported a larger than expected November current account surplus of JPY1.878 trillion after a JPY2.144 surplus in October. About half of the miss can be accounted for by trade surplus, which did not narrow as much as projected. The trade surplus (on a BoP basis) was JPY616.1 bln, down from JPY971.1 bln in October, but more than the JPY474 bln economists projected. Exports rose by 4.3%, accelerating from 2.5% in October. Imports, however, were softer at 0.3%, down from 3.0%.

With the balance of payments data, Japan reports portfolio flows. It showed that trust banks, dominated by Government Pension Investment Fund, shifted from stocks to bonds. Of the JPY5.1 trillion invested in foreign bonds in November, the US government, including local and agency bonds, accounted for JPY3.7 trillion. The US purchases were more than 10-times larger than October’s purchases. Japanese investors were also notable buyers of European bonds and reduced the buying of Canadian and Australian bonds. In Europe, Japanese investors bought the most UK Gilts since 2014 (~JPY288 bln) and bought French and Italian bonds after holdings were pared in October. They were small sellers of Dutch bonds for the second month in a row.

China manages the dollar-yuan rate, but it also tracks the yuan against a basket of (24) currencies (CFETS). Against the basket, the yuan is at its highest level since last March. Recall that at the end of last year, Chinese officials announced that the dollar’s share in the basket would be trimmed to 21.59% from 22.40%, while the euro’s share would increase to 17.40% from 16.34%. Separately, reports suggest Chinese authorities have instructed financial institutions to limit efforts to secure offshore financing (overseas entities fx deposits and interbank borrowing)

The dollar has been confined to about a quarter of a yen range above JPY104.10. The dollar is slightly heavier for the first time in five sessions. There is an option for $1.2 bln at JPY104 that expires today. Resistance is seen in the JPY104.30-JPY104.40 area. The Australian dollar is firm but within yesterday’s range (~$0.7665-$0.7770). It reached $0.7740 in the European morning but appears to have stalled. Initial support is now seen near $0.7700. The dollar’s reference rate was set at CNY6.4823, which was a little higher than expected. The dollar is trading near CNY6.46 after finishing last week near CNY6.4745.

Europe

Italy’s politics is the main talking point in Europe today. Prime Minister Conte is expected to present new plans for EU funds to the cabinet later today. Former Prime Minister Renzi’s small party has two ministers in the coalition government. He has threatened to withdraw them as an expression of dissatisfaction with Conte’s efforts. Ostensibly, this could topple the government. However, there are a few alternatives, including a new government from the existing parliament. Much work needs to be done, including giving formal approval to the EU budget and Recovery Fund. The new reforms of the legislative branch, which includes a reduction by about a third of the seats, would be implemented. The delegation of parliamentary tasks of the smaller size has not been fully worked out. This would add to the uncertainty and paralysis amid an economic and public health crisis.

The pandemic continues to ravage Europe, and the social restrictions and lockdowns will have strong economic knock-on effects. A contraction in Q4 20 and Q1 21 is likely. Today, Merkel warned that Germany may need another 10 weeks of lockdown. Note that the CDU leadership contest begins at the end of the week, and the winner is likely to be the party’s candidate to succeed Merkel as Chancellor.

The euro is trading sideways in yesterday’s trough when the single currency traded to almost $1.2130 after finishing last week near $1.2220. There is an option for around 880 mln euro at $1.22 that expires today. Note that the five-day moving average is slipping below the 20-day average for the first time in two months. Our next downside target is near $1.2065. Sterling is performing better today, but it stalled just above $1.36, where a key retracement of the recent decline is found. The intraday technicals warn the session high may be in place. If it is not, the next hurdle is seen around $1.3635. Initial support is seen by $1.3525-$1.3550.

America

The political ramifications of last week’s events in Washington continue to ripple across the country. The House has approved an article of impeachment while invoking the 25th amendment to remove the President seems like a non-starter. Nor will Trump resign. Meanwhile, many companies have either frozen their political contributions or specifically targeting the members that continued to reject the election results. This seems unprecedented.

On Thursday, Biden is expected to lay out his fiscal intentions. It is likely that the Heroes Act ($3.4 trillion) that the House of Representatives approved last May but was blocked in the Senate will be the basis of the inspiration with the bipartisan deal reached at the end of last year, being a down payment.

Meanwhile, although tapering the Fed’s purchases are far from imminent, a range of opinions have been heard from Fed officials in recent days. Evans, Harkin, Kaplan, and Bostic seem to be open to it later this year if the economy shows a strong rebound in H2. Clarida and Mester played down the prospects. Given Clarida’s role, his view may be more reflective of the Fed’s leadership. Look for more insight today as no few than six Fed officials speak today, including George and Rosengren, on the economic outlook.

The economic diaries of the US, Canada, and Mexico are light today. The US JOLTS report is on tap, and Mexico reports weekly reserve figures. Neither typically moves markets. The greenback rose to CAD1.2835 yesterday but has not traded above CAD1.28 today. Initial support is seen near CAD1.2730 and then CAD1.2700. A move above CAD1.2830 targets CAD1.2885, possibly on the way toward CAD1.2960. The US dollar settled above MXN20.00 for the last three sessions. It is straddling the area in the European morning amid the broader consolidation. We like the US dollar higher in the near-term and look for a retest on the MXN20.25 area and see risk closer to MXN20.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Currency Movement,Featured,federal-reserve,Italy,Japan,newsletter,Politics