Nachdem ich mich systematisch mit den verschiedenen Teilproblemen beschäftigt habe, bin ich nun überzeugt, eine machbare, vertretbare und rasche Lösung für das Corona-Problem gefunden zu haben. Ziel 1: Übersterblichkeit verhindern Die Verantwortlichen sollten besonders gefährdete Personen (ältere Personen mit einer oder mehreren Vorerkrankungen, Personen mit geschwächtem Immunsystem) empfehlen (nicht befehlen!), a) in den nächsten Wochen...

Read More »FX Daily, March 27: Nervousness Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.48% to 1.0573 EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Officials appear to have persuaded investors that they have put into place measures that will cushion the economic blow and ensure that the financial system continues to function. After seemingly goading officials into action, investors are choosing not to resist. Moreover, there is a...

Read More »USD/CHF Price Analysis: Dollar easing further from monthly tops, approaching 0.9600 figure vs. CHF

USD/CHF is trading down for the fourth consecutive day. The level to beat for bears is the 0.9600 support. USD/CHF daily chart USD/CHF is easing from the monthly highs as the spot drops below the main SMAs on the daily chart. The US dollar is down against most currencies this Thursday. USD/CHF daily chart - Click to enlarge USD/CHF four-hour chart The spot is pulling back down while nearing the 0.9600 figure below the 200 SMA on the four-hour chart. Bears could...

Read More »Coronavirus: a test to see if you’ve had it is in the pipeline

© Anyaivanova | Dreamstime.com Coronavirus testing has been rationed in Switzerland, reserving it for high risk more severe cases, although doctors retain discretion to have anyone tested. It is likely those that have been infected and have recovered will have immunity and no longer be able to act as carriers of the disease. However, without an antibody test, all those who didn’t qualify for a test, will have no way of confirming whether or not they have had it. This...

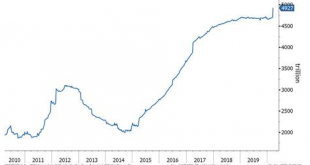

Read More »ECB Approaching its Bazooka Moment

The ECB appears to be moving closer to activating Outright Monetary Transactions (OMT). Despite being part of Draghi’s “whatever it takes” moment, OMT has never been used. If the Fed’s open-ended QE is seen as dollar-negative, then OMT should be seen as euro-negative. ECB Balance Sheet Total Assets, 2010-2019 - Click to enlarge RECENT DEVELOPMENTS At the regularly scheduled March 12 meeting, the ECB delivered a package of easing measures that were in hindsight...

Read More »Central Bankers Are Running Out of Options

Corona fears have shifted the world’s central banks into hyperdrive. Talk more, do more, lend more—and buy everything that moves. One after the other, the major central banks took to the barricades, manned the canons, fired their bazookas, and every other military metaphor you can think of. Nobody stopped to think whether the policies that they quickly and loudly announced would work. Nobody investigated whether they could be prevented from reaching their...

Read More »FX Daily, March 26: Rumor Bought, Fact Sold

Swiss Franc The Euro has fallen by 0.03% to 1.0623 EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Speculation that the US Senate would pass the large stimulus bill worth around 10% of US GDP is thought to have fueled a bounce in equities in recent days. The bill was approved and will now go to the House, where a vote is expected tomorrow. If the rumor was bought, the fact has been...

Read More »Was mache ich wenn ich 1’000’000 CHF Nettovermögen erreiche? ???♂️

Diese Frage stelle ich mir tatsächlich sehr selten, aber Bekannte und Freunde fragen gerne mal. Was machst du wenn du die 1‘000‘000 CHF Nettovermögen erreichst? Kaufst du dir dann zur Feier etwas? Meine Antwort ist immer etwas ernüchternd, es geht normal weiter wie bisher, es ist nur eine Zahl. Die Million ist nur eine Zahl Ich glaube das ist etwas, das man wirklich erst erleben muss, um zu begreifen, dass es nur eine Zahl ist. Vor Jahren dachte ich mir, wenn ich...

Read More »FINMA unterstützt das Liquiditätspaket des Bundesrats und rollt weitere Massnahmen aus

Die Eidgenössische Finanzmarktaufsicht FINMA begrüsst ausdrücklich das heute vom Bundesrat verabschiedete Massnahmenpaket des Bundes. Dieses sieht eine rasche und unbürokratische Versorgung der Realwirtschaft mit Liquidität via die Banken vor. Um die bestehende Robustheit der Schweizer Finanzinstitute beizubehalten, ruft die FINMA diese zu einer umsichtigen Ausschüttungspolitik auf. Schliesslich gewährt die FINMA den Banken eine temporäre Ausnahme bei der Berechnung...

Read More »Corona-Krise: SNB stellt Banken zusätzliche Liquidität zur Verfügung

Die SNB greift den Banken mit einer NB-COVID-19-Refinanzierungsfazilität unter die Arme. (Bild: Shutterstock.com/Marekusz) Der Bund, die Nationalbank (SNB und die Eidgenössische Finanzmarktaufsicht (FINMA) haben infolge der schweren Belastung der Schweizer Wirtschaft durch die Corona-Pandemie gemeinsam mit den Banken ein Massnahmenpaket geschnürt. In diesem Rahmen führt die SNB die neue SNB-COVID-19-Refinanzierungsfazilität (CRF) ein. Wie es in einer Medienmitteilung...

Read More » SNB & CHF

SNB & CHF