There are three things the markets have going for them right now, and none of them have anything to do with the Federal Reserve. More and more conditions resemble the early thirties in that respect, meaning no respect for monetary powers. This isn’t to say we are repeating the Great Depression, only that the paths available to the system to use in order to climb out of this mess have similarly narrowed. That’s what’s ultimately going to matter the most, not what...

Read More »Global Supply of Gold and Silver Coins and Bars Evaporated In Safe Haven Rush

◆ GoldCore remain open for business unlike many dealers, mints and refineries (see News below) and we continue to buy bullion coins and bars and sell gold bars (1 kilo). The supply situation changes hour to hour. ◆ We, like the entire industry have experienced record demand in recent days and the global supply of gold and silver bullion coins (legal tender 1 oz) and gold bars (in 1 oz and 10 oz formats) has quickly evaporated. We continue to have gold bars (1 kilo)...

Read More »Making Sense Eurodollar University Episode 1

Jeff Snider, Head of Global Investment Research at Alhambra Investments, and Emil Kalinowski make sense of today's global monetary system.

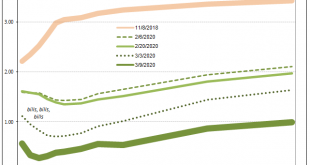

Read More »FX Daily, March 24: Relief Bounce On Tuesday, but Turn Around not Secure

Swiss Franc The Euro has risen by 0.27% to 1.0584 EUR/CHF and USD/CHF, March 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Bottom-picking, after officials step up efforts and some optimism creeps in, is helping lift spirits today. As one looks at the equity bounces, it is important to remember that among the biggest rallies take place in bear markets. Nearly all the bourses in Asia-Pacific rallied, led by a...

Read More »Handel – Schweiz mit grossem Leistungsbilanzüberschuss in Q4

Den Wert des Vorjahres übertraf er sogar um gut 11 Milliarden. Der Anstieg sei vor allem auf den grösseren Einnahmeüberschuss bei den Kapitaleinkommen und beim Warenhandel zurückzuführen, teilte die Schweizerische Nationalbank (SNB) am Montag mit. Insgesamt erhöhten sich die Einnahmen der Schweizer Volkswirtschaft von Oktober bis Dezember auf knapp 173,4 Milliarden Franken, während die Ausgaben gut 147,5 Milliarden Franken betrugen. Die Zahlen sind allerdings...

Read More »USD/CHF Price Analysis: US dollar eases from 2020 highs, stabilizes near 0.9800 figure

USD/CHF consolidates gains for the second consecutive day. The level to beat for bulls is the 0.9900 resistance. The parity level might be on the bulls’ radar. USD/CHF daily chart USD/CHF is retreating slightly this Monday while the currency pair is consolidating gains for the second consecutive day above the main SMAs. The Fed extended its Quantitative Easing program with an initial reaction down on the US dollar which was relatively limited on USD/CHF and across...

Read More »Big reductions in Swiss public transport services

A Zurich-bound train in St Gallen on Monday morning. (Keystone / Gian Ehrenzeller) Swiss public transport has been widely reduced as of Monday, with the Federal Railways cutting back on services as part of nationwide anti-coronavirus measures. The scaling back of Europe’s most-used rail network in an effort to combat the spread of Covid-19 was announced last week as part of wider measures to reduce social contact and slow down the pace of life in the country. As of...

Read More »As COVID-19 Drives People Into Isolation, Wall Street’s New ‘Virtual Workplace’ May Become The Norm

As governments take drastic measures to slow the spread of the Wuhan coronavirus pandemic, Wall Street – much like a plethora of other industries – has embraced the virtual workplace, according to Bloomberg. In Hong Kong, bankers have learned to win stock offerings by video chat, and Morgan Stanley is hosting a virtual meeting for a thousand-plus attendees. At Swiss giant UBS Group AG, wealth management executives have realized trips to see clients weren’t as...

Read More »Conference Call Replay

Here is the link for the replay of the conference call I hosted earlier today. I shared two ways in which this crisis is different from what we have seen in the last generation. Unlike the Great Financial Crisis, the tech bubble, and the S&L Crisis, the current crisis did not begin in the financial sector, but the real economy. Also, what follows from that is that this crisis is about liquidity, while the GFC was about counter-party risk. In the call, I covered...

Read More »Helicopter Money: Short-Term Relief Won’t Cure our Financial Disease

Gordon and I discuss these topics in this 37-minute video: The collateral supporting the global mountain of debt is crumbling as speculative bubbles deflate. A great many freebies are being tossed in the Helicopter Money basket. That households experiencing declines in income need immediate support is obvious, as is the need to throw credit lifelines to small businesses. But beyond those essentials, the open-ended nature of Helicopter Money has unleashed a frenzy of...

Read More » SNB & CHF

SNB & CHF