Swiss Franc The Euro has risen by 0.46% to 1.068 EUR/CHF and USD/CHF, July 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities began the week on a firm note in the Asia Pacific region. The Nikkei gained more than 2%, and the profit-taking seen in China ahead of the weekend was a one-day phenomenon. The Shanghai Composite rose 1.8%, and the Shenzhen Composite surged 3.5%. Taiwan and South Korea markets...

Read More »Podcast Episode #093: Keith Weiner

CEO, Monetary Metals, Scottsdale, AZ

Read More »Podcast Episode #093: Keith Weiner

CEO, Monetary Metals, Scottsdale, AZ

Read More »Credit Suisse settles U.S. shareholder lawsuit

Keystone / Walter Bieri Major Swiss bank Credit Suisse has agreed to pay $15.5 million (CHF14.6 million) to settle a dispute with shareholders in the United States, according to court filings on Friday. The plaintiffs, led by four pension funds, accused Credit Suisse of defrauding shareholders about its risk appetite and management before taking $1 billion of writedowns on souring debt. The bank had boasted at the time of “comprehensive” risk controls and “binding”...

Read More »Coronavirus: no significant slowdown in new cases in Switzerland

© Yulan | Dreamstime.com In the seven days to 10 July 2020, the reported number of new SARS-CoV-2 infections recorded in Switzerland was 589, a similar number to the week before, when 615 new cases were recorded. Over the weeks prior to this there were 251 and 172 new cases, according to worldinfometer.com. Much of the recent rise in infections is due to clusters of infections found among people going to nightclubs and bars. Late last week Switzerland’s Covid-19...

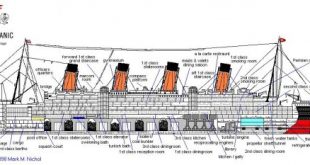

Read More »The Sinking Titanic’s Great Pumps Finally Fail

The greater fools still partying in the first-class lounge are in denial that even the greatest, most technologically advanced ship can sink. On April 14, 1912, the liner Titanic, considered unsinkable due to its watertight compartments and other features, struck a glancing blow against a massive iceberg on that moonless, weirdly calm night. In the early hours of April 15, the great ship broke in half and sank, ending the lives of the majority of its passengers and...

Read More »EM Preview for the Week Ahead

This is likely to be one of the most eventful weeks we’ve had in a while. Not only do three major central banks meet, but four EM central banks also meet, and we get important June and July data from the US, the first Q2 GDP reading from China, an OPEC+ meeting, and an EU summit. This comes as markets are grappling with still-rising virus numbers in the US and resurgent numbers in many other countries that call into question the durability of the economic recovery....

Read More »Game Over Spending

Coming and Going Like a Wildfire Second quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace. The Dow booked its best quarter in 33 years. The S&P 500 posted its best performance since 1998. And the NASDAQ had its biggest increase since 1999… jumping...

Read More »The Great Society: A Libertarian Critique

The Great Society is the lineal descendant and the intensification of those other pretentiously named policies of twentieth-century America: the Square Deal, the New Freedom, the New Era, the New Deal, the Fair Deal, and the New Frontier. All of these assorted Deals constituted a basic and fundamental shift in American life—a shift from a relatively laissez-faire economy and minimal state to a society in which the state is unquestionably king.1 In the previous...

Read More »Jeff Snider – How Is US Labor Force Changing? (RCS Ep. 41)

Interview original date: April 25th, 2020 Labor force participation expanding. The labor force is not what it used to be. In a typical recession the labor force doesn't really change, it continue to grow, it doesn't contract. That changed in 2008, the labor force then started to contract. Discuss about the survey of labor participation.

Read More » SNB & CHF

SNB & CHF