Our sovereign rating model suggests the US will lose its AAA/Aaa rating. With fiscal stimulus efforts continuing with this latest 4 bln package, the case for downgrades just keep getting stronger but the timing is unclear. How might markets react? We look back to 2011 for some clues. RECENT DEVELOPMENTS The White House and House Democrats struck a deal on a new aid package worth 4 bln. The extra 0 bln amounts to about 2.5% of GDP. The IMF estimated that the US budget deficit would be -15.4% of GDP. Another 2.5 percentage points would move the deficit closer to -20% of GDP this year and that is simply incompatible with a AAA rating. The IMF sees the deficit narrowing to -8.6% of GDP in 2021 but seems too optimistic. During the financial crisis,

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, developed markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Our sovereign rating model suggests the US will lose its AAA/Aaa rating. With fiscal stimulus efforts continuing with this latest $484 bln package, the case for downgrades just keep getting stronger but the timing is unclear. How might markets react? We look back to 2011 for some clues.

RECENT DEVELOPMENTS

The White House and House Democrats struck a deal on a new aid package worth $484 bln. The extra $500 bln amounts to about 2.5% of GDP. The IMF estimated that the US budget deficit would be -15.4% of GDP. Another 2.5 percentage points would move the deficit closer to -20% of GDP this year and that is simply incompatible with a AAA rating. The IMF sees the deficit narrowing to -8.6% of GDP in 2021 but seems too optimistic. During the financial crisis, the deficit doubled to -13.2% of GDP in 2009 and was -11% in 2010 and -9.7% in 2001.

S&P affirmed its AA+ rating with stable outlook in early April. It noted that the US rating was constrained by high government debt and large fiscal deficits, which are both likely to worsen this year due to the impact of the coronavirus pandemic. S&P added that those negative factors should moderate over the next three years, and that it expects fiscal and monetary stimulus to “ limit the economic downturn and set the stage for recovery in 2021” in justifying the stable outlook.

Fitch affirmed its AAA rating with stable outlook in late March. It noted that the US rating was supported by structural strengths that include high per capita income and a dynamic business environment. However, Fitch noted that large fiscal deficits and rising debt were already rising before the onset of the pandemic and are starting to erode those strengths. It added that risks of a near-term negative rating move have risen given the magnitudes of the economic and budgetary shocks.

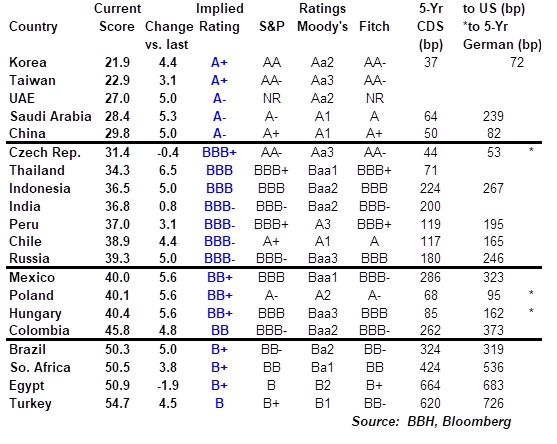

Our own sovereign rating model says otherwise. In the most recent update for Q2, the implied rating for the US fell sharply into AA- territory. It had been going back and forth between AAA and AA+ for several quarters but this crisis has pushed the implied rating down even further. This means that the US stands a decent chance of losing its Aaa and AAA ratings from Moody’s and Fitch. S&P already took its AAA rating away back in August 2011.

We have to stress that we are assuming that the ratings agencies have not changed their methodologies. Our own model was constructed on the long-standing metrics that help determine a country’s creditworthiness. With most countries blowing out their budget deficits and many engaging in Quantitative Easing, many lines have blurred. This bears watching, but the fact that Fitch recently downgraded the UK after its virus response (see below) suggests no change yet in the agencies’ way of thinking.

INVESTMENT OUTLOOK

Judging from 2011, US equity markets appear to be most at risk from a potential US downgrade. The S&P 500 began that year with a rally that took it up to near 1350 by mid-February before moving sideways. It came under some pressure in early April ahead of S&P moving the US outlook to negative on April 18 and then bounced to put in the high for 2011 near 1371 on May 2. The S&P 500 sold off further in late July and August after S&P moved the US to CreditWatch Negative on July 14 and then downgraded it to AA+. Equities did not put in a bottom for the year until October 4, after which the S&P 500 then rallied over the course of 2012 and beyond.

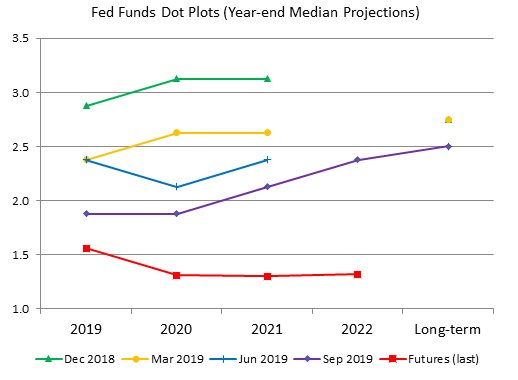

The impact of potential downgrades on the US Treasury market is not clear. US 10-year yields started 2011 just below 3.5%. The high for the year was put in at 3.77% in early February. There was a slight hiccup higher in early April before S&P moved the US outlook from stable to negative on April 18, but then yields continued to fall. Another hiccup was seen in early July before S&P moved to CreditWatch negative on July 14. After S&P downgraded the US on August 5, there was very little reaction by the 10-year US yield as it went on the make new lows to end the year below 2%.

Loss of AAA would have absolutely no implications for WGBI inclusion. As per its methodology, minimum ratings of A- and A3 by S&P and Moody’ are required for inclusion. However, exclusion does not occur until both ratings fall below BBB- and Baa3, respectively.

The 2011 downgrade also appears to have had limited impact on the US dollar. DXY started the year with a brief rally that took it up to around 82 in January before reversing. DXY softened as Q1 progressed and continue to lose ground in April as S&P moved its outlook to negative but then put in a low for the year on May 4. The move to CreditWatch Negative led to some near-term dollar losses in July that kept DXY depressed in August. As August ended, DXY mounted a rally that took it nearly 10% higher to end the year back to where it basically started the year. The greenback was largely rangebound in 2012 and 2013 before the current rally took hold in 2014.

Bottom line: we suspect an eventual loss of Aaa and AAA from both Moody’s and Fitch would likewise have limited market impact. Equities appear most at risk, followed by the dollar and US Treasuries. That said, a sample size of one is not much for investors to go on. Yet in terms of emerging from the pandemic, we continue to believe that the US has an advantage over the eurozone, UK, and Japan. The US entered this downturn in a much stronger position than these others, and we think its prospects for a recovery are likely better. As such, we are maintaining our strong dollar call for now.

A BRIEF HISTORY LESSON

Government shutdowns over the debt ceiling aren’t particularly rare. The current budget process was enacted in 1976. Since then, there have been 21 shutdowns of varying length. All have had to do with posturing by both major parties, but ultimately resulted in very little in terms of long-term consequences.

Yet the 2011 fight over the debt ceiling was the trigger for the first ever US downgrade. Even though a shutdown was avoided, the drama still led to the first ever downgrade for the US. The showdown took place as the new Republican House came into power in January 2011 after the November 2010 midterm elections. Tensions were high right from the start as many Republican lawmakers bristled at the budget deficits and national debt that came about from the financial crisis and the policy response.

S&P moved the outlook on its AAA from stable to negative in April 2011. It noted that “there is a material risk that U.S. policymakers might not reach an agreement on how to address medium– and long-term budgetary challenges by 2013; if an agreement is not reached and meaningful implementation is not begun by then, this would, in our view, render the U.S. fiscal profile meaningfully weaker than that of peer ‘AAA’ sovereigns.”

Brinksmanship can have its consequences. All three rating agencies moved the US outlook to negative during 2011. S&P moved the outlook to CreditWatch negative in July before downgrading the US to AA+ in August, the first ever downgrade. S&P cited Washington gridlock as well as the lack of an agreement to contain the growing debt load for its decision to downgrade. S&P also noted then that no country has regained AAA in less than nine years. Here it is almost nine years later and the prospects for regaining that AAA rating are more remote than ever.

Tags: Articles,developed markets,Featured,newsletter