Summary Moody’s moved the outlook on Vietnam’s B1 rating from stable to positive. Nigeria’s central bank introduced a new FX window for portfolio investors. Moody’s moved the outlook on Romania’s Baa3 rating from positive to stable. Central Bank of Russia accelerated its easing cycle. Central Bank of Turkey delivered a hawkish surprise. Brazil’s lower house easily approved the labor reforms, but popular resistance is...

Read More »‘Dollar’ ‘Improvement’

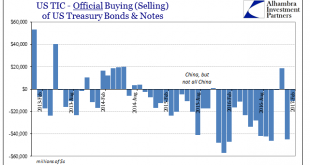

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment. They are, however, still selling. In February 2017, the latest month available, the foreign official sector disposed of another $10.7 billion (net) after -$44.9...

Read More »KOF Economic Barometer April: Is Easing

In April, the KOF Economic Barometer does not continue its upward tendency, which started at the beginning of 2017, but has declined slightly. However, despite the decline, the indicator is still well above its long-term average. It still indicates a more dynamic economic development than at the beginning of 2017. The recovery of the Swiss economy is likely to continue, albeit with a little less momentum than indicated...

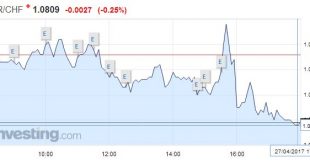

Read More »FX Daily, April 28: Markets Limp into Month End

Swiss Franc EUR/CHF - Euro Swiss Franc, April 28(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate could hit 1.30 very soon as the market gets closer to this important level of resistance that could easily break through in the coming weeks. The overall expectations for the pound to strengthen on the back of a strong UK election for the Conservatives remain, the Franc should...

Read More »Sweden’s Gold Reserves: 10,000 gold bars (pet rocks) shrouded in Official Secrecy

In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the...

Read More »PBoC: Mechanical Tightening PBoC is China Central Bank

The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March. The central bank also increased the rate on its Medium Term Lending Facility (MLF) which has been a main source of RMB liquidity...

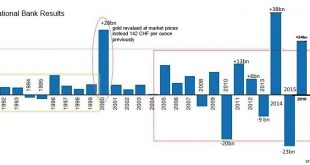

Read More »Interim results of the Swiss National Bank as at 31 March 2017

From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange...

Read More »SNB posts 7.9 billion CHF Profit in Q1

From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange...

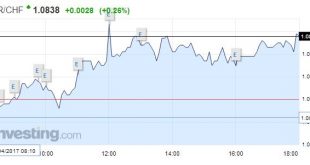

Read More »FX Daily, April 27: Several Developments ahead of the ECB meeting

Swiss Franc EUR/CHF - Euro Swiss Franc, April 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday. Also, after a misdirection over pulling out of...

Read More »Draghi Does Nothing and Talks about It

Summary: Draghi confirms rate on hold and maintains easing bias. Growth risks are becoming more balanced. Inflation has yet to get on a sustained upward path. As widely expected, the ECB left its key rates and asset purchase plan intact. It reiterated its forward guidance that rates will remain at present levels or lower. Draghi was more confident about the economy, suggesting that the downside risks had...

Read More » SNB & CHF

SNB & CHF