“Trade Cheaters” It is worse than “voodoo economics,” says former Treasury Secretary Larry Summers. It is the “economic equivalent of creationism.” Wait a minute – Larry Summers is wrong about almost everything. Could he be right about this? Summers is referring to the paper written by two members of Trump’s trade team: his pick for secretary of commerce, billionaire investor Wilbur Ross, and the director of Trump’s new National Trade Council, Ph.D. economist Peter Navarro. It calls for a turn away from free trade and toward managed trade – or what is vaguely described as “fair” trade. Colleague Karim Rahemtulla, on an investment scouting trip in India and China, sends this note: “I met with a factory owner in China. He pays his workers 2,000 renminbi a month, about US0. He thinks it’s too expensive and is now opening factories in Vietnam and Cambodia, where he can pay half of what he’s paying just outside Shanghai. In India, I saw two ads in the newspaper. One was for call center workers with a college degree as a requirement. The pay range was between 9,000 rupees (US2) and 15,000 rupees (US0) a month. The other ad was for a chartered accountant with three years’ experience for the Nehru Foundation – a big Indian NGO. The pay for that was 29,000 rupees per month, about US6.

Topics:

Bill Bonner considers the following as important: Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

“Trade Cheaters”It is worse than “voodoo economics,” says former Treasury Secretary Larry Summers. It is the “economic equivalent of creationism.” Wait a minute – Larry Summers is wrong about almost everything. Could he be right about this? Summers is referring to the paper written by two members of Trump’s trade team: his pick for secretary of commerce, billionaire investor Wilbur Ross, and the director of Trump’s new National Trade Council, Ph.D. economist Peter Navarro. It calls for a turn away from free trade and toward managed trade – or what is vaguely described as “fair” trade. Colleague Karim Rahemtulla, on an investment scouting trip in India and China, sends this note:

|

Larry Summers, the man who is usually wrong about almost everything. As we have always argued, the economy is much safer when he sleeps, so his tendency to fall asleep on all sorts of occasions should definitely be welcomed. Believe it or not though, in very rare instances Larry is actually right about something. For example, the politically incorrect comments that got him fired from his post as Harvard president definitely shouldn’t have been dismissed out of hand. Is it possible that he is actually right about something again? Photo credit: Chip Somodevilla - Click to enlarge |

| What kind of “fairness” is it that denies a job to a man in Calcutta to pay a man in San Jose 10 times as much for the same work?

Ross and Navarro call China a “trade cheater.” Imagine a town with a bar on every corner. One of these gin joints gets an idea of how to increase his customer base: Offer free drinks! There’s a “cheater” for sure – and a moral conundrum for a nitwit. What should a serious drinker do? Turn up his nose… turn away his face… and take his business to another place in the name of fairness? |

|

Bad EngineersIf the new Trump administration follows the advice laid out in the Ross-Navarro plan, it will almost certainly lead to disaster. Of course, there will probably be a disaster anyway. But as it is, you can’t fault the hotel mogul, reality TV star, and president-elect. He didn’t build this railroad; it won’t be his doing when it goes off the rails. But Ross and Navarro are bad engineers. They’re twisting the tracks! Specifically, they’re advising the new administration to abandon free trade in favor of crony trade – deals designed to reward or punish certain industries or countries depending on which direction the political winds and lobbyists’ money are blowing. As far as we know, all human economic progress has been made by a combination of technological advances, specialization, and an elaboration of the division of labor made possible by property rights, honest money, and free-market capitalism. Anything that stands in the way of these things – for instance, crony trade deals – reduces output, wealth, and choice. But alert readers are right: Just as free immigration can be incompatible with a zombie welfare system (it attracts immigrants who become parasites), free trade can cause problems in a fake financial system (it causes imbalances that threaten the world economy). |

Trump’s trade guru Peter Navarro, who’s been busy reviving the “yellow peril” meme for quite some time. He misdiagnoses what is actually wrong and consequently recommends solutions that will only make the situation worse and lower standards of living. This is not a political question – it is simply a question of economics. Does anybody remember what happened after the introduction of the Smoot-Hawley tariffs? What makes people like Navarro think that restricting trade in 2017 will lead to a better outcome than it did in 1930? When Navarro and others talk about so-called “fair trade”, we feel reminded of medieval “just price” theories (which medieval scholars themselves ultimately ended up rejecting). As Mises noted on this idea of “fairness”: “When the nonphilosopher calls a price just, what he means is that the preservation of this price improves or at least does not impair his own revenues and station in society. He calls unjust any price that jeopardizes his own wealth and station”. Screenshot via DeathByChina / YouTube |

Out of HandAn honest money system has feedback loops that keep things from getting out of hand. Under the Bretton Woods system, for instance, a nation that imported more than it exported soon found its gold reserves – and therefore its money supply – shrinking. A recession was sure to follow. But the post-1971 fake money system has no such natural limits. Americans bought products from overseas with the feds’ fake dollars. Foreigners – particularly the Chinese – took these dollars and used them to build out their economies and compete with U.S. manufacturers to provide cheap products for credit-fueled U.S. consumers. As we reported recently, America’s trade deficit with China (the dollar value of imports we buy from China unmatched by exports to China) now runs at $1 billion a day. And since 1980, when trade with the Middle Kingdom really got going, we have accumulated a trade deficit of about $10 trillion with China. That is the money that built the factories that now undercut American manufacturers, that created a $225 trillion pile of global dry debt… and that corrupted and corroded the whole world’s financial system.. Still, we wonder if Ross and Navarro really know what they are doing. They say they aim to reduce America’s trade deficit. That is to say they want the U.S. to export more and import less, thus keeping more dollars at home. Do they realize that our whole world economy is built on fake money, giant U.S. trade imbalances, and a mountain of debt? Take away the trade imbalances and the whole system collapses. The fake dollars go overseas, then come back home and buy U.S. Treasuries, lowering yields (yields move inversely to prices). If the fake money stays home, Treasury yields – and the government’s borrowing costs – go up and the whole shebang comes down. Interest rates rise. Stocks fall. The economy goes into recession and probably depression. China is devastated. And jobs disappear everywhere: in Mexico, China and the U.S. Is that what they really want? |

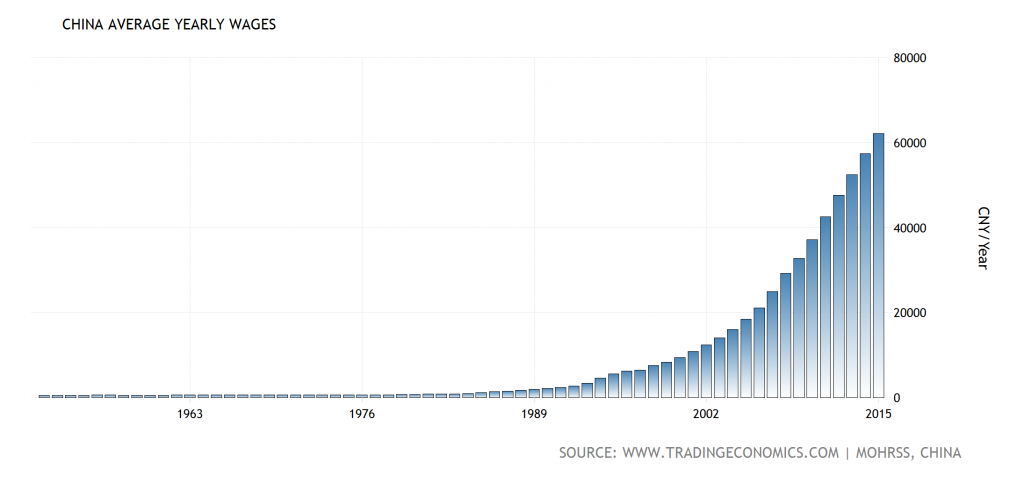

China Average Yearly WagesWages in China have soared and continue to do so – “wage competition” will soon be a thing of the past. In many ways this competition is a mirage anyway. The height of the wages that can be paid to workers is entirely dependent on the capital invested per worker. No law or government decree can possibly alter this fact. This is inter alia why all so-called pro-labor legislation (such as minimum wages) and government interference with free trade is a sham that harms society at large. Wages and prices in the global marketplace would adjust much faster if not for the remaining restrictions on the mobility of labor and capital. While such restrictions have decreased for quite some time, the trend unfortunately appears to be reversing of late. Many governments are e.g. busy destroying all vestiges of financial privacy (usually under the pretense of fighting terrorism) and are introducing capital controls through the back door in the process. Guess what: these surreptitious capital controls primarily affect the “little people”. Those who incessantly call for more regulations to curb the activities of “evil corporations” don’t seem to realize that they are ultimately harming those they are wishing to help. Meanwhile, advocates of protectionism fail to recognize that is not free trade that poses a problem – the problem that needs tackling is the unsound monetary system. |

Chart by: TrandingEconomics

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.

Tags: Featured,newslettersent,On Economy,On Politics