In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its...

Read More »Yanking the Bank of Japan’s Chain

Mathematical Certainties Based on the simple reflection that arithmetic is more than just an abstraction, we offer a modest observation. The social safety nets of industrialized economies, including the United States, have frayed at the edges. Soon the safety net’s fabric will snap. This recognition is not an opinion. Rather, it’s a matter of basic arithmetic. The economy cannot sustain the government obligations...

Read More »UberPop service cancelled in Zurich

Swiss taxi drivers regularly protest Uber services. (© KEYSTONE / SALVATORE DI NOLFI) Car-and-driver provider Uber has decided to drop its UberPop service in Zurich following controversy over its legality. The change does not apply to Basel or Geneva. The change takes effect on Thursday at midday. Zurich UberPop drivers will have three months to get permits that will allow them to chauffeur passengers for pay under the...

Read More »Emerging Markets: What has Changed

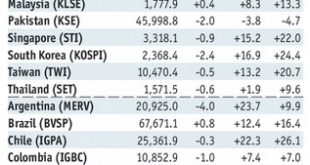

Summary: Tensions on the Korean peninsula are still rising. Hong Kong boosted its 2017 growth forecast. S&P affirmed Israel’s A+ rating but moved the outlook from stable to positive. The corruption investigation against Israeli Prime Minister Netanyahu has intensified. South Africa’s parliament voted down the no confidence motion against President Zuma. Argentina officials are taking steps to support the peso. ...

Read More »Meet the little orange men of Switzerland

Crossing the roads can be a peculiarity in itself! Join Diccon Bewes on the streets of Bern and marvel at the oddities of the Swiss traffic light system. (Diccon Bewes for swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »France: Le déficit chronique de la balance des paiements.

Lire aussi La libre-circulation des biens, des services, des revenus, des capitaux et des personnes , appelée les 4 L, est mesurée entre autres par la balance des paiements. Celle-ci décrit selon la Banque de France: « les échanges économiques entre la France et les autres pays. Elle apporte une grille de lecture de référence sur la situation de notre pays dans une économie mondialisée. Elle apporte un éclairage sur la...

Read More »Real GDP: The Staggering Costs

How do we measure what has been lost over the last ten years? There is no single way to calculate it, let alone a correct solution. There are so many sides to an economy that choosing one risks overstating that facet at the expense of another. It’s somewhat of an impossible task already given the staggering dimensions. If someone had told you in 2006 that the Federal Reserve as well as all its central bank cohorts...

Read More »Prepare for Another Market Face Pounding

“Better than Goldilocks” “Markets make opinions,” goes the old Wall Street adage. Indeed, this sounds like a nifty thing to say. But what does it really mean? The bears discover Mrs. Locks in their bed and it seems they are less than happy. [PT] Perhaps this means that after a long period of rising stocks prices otherwise intelligent people conceive of clever explanations for why the good times will carry on. ...

Read More »FX Daily, August 11: Geopolitical Tensions Remain Elevated into the Weekend

Swiss Franc The euro is up by 0.19% to 1.1348 CHF EUR/CHF and USD/CHF, August 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The downward pressure on US yields, with the 10-year slipping to 2.18%, nearly a two-month low, coupled drop in equities helped underpin the Japanese yen. The dollar traded below JPY109 for the first time since the middle of June. The greenback...

Read More »Would you take a pilotless plane?

Commercial aircraft already take off and land using their on-board computers (Keystone) Pilotless cargo and passenger planes could be in use within eight years and save airlines billions, according to a report by Swiss bank UBS. But customers remain wary of the new technology despite potential fare reductions. “In the not-too-distant future, we would expect to see a situation where flights are pilotless or the number of...

Read More » SNB & CHF

SNB & CHF