Summary:

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its notes on September 19 that year the Swedish currency fell into desperate trouble. A week later, Finance Minister Felix Hamrin turned to famed economist Gustav Cassel for help. Cassel had been perhaps the world’s pre-eminent economic thinker, continuing a rich tradition for Sweden along the lines of Knut

Topics:

Jeffrey P. Snider considers the following as important: Bank of Canada, Canada, Consumer Prices, currencies, Deflation, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, Felix Hamrin, gustav cassel, inflation, Inflation target, Knut Wicksell, Markets, Monetary Policy, Money, newsletter, oil prices, price target, Sweden, The United States, william gavin

This could be interesting, too:

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its notes on September 19 that year the Swedish currency fell into desperate trouble. A week later, Finance Minister Felix Hamrin turned to famed economist Gustav Cassel for help. Cassel had been perhaps the world’s pre-eminent economic thinker, continuing a rich tradition for Sweden along the lines of Knut

Topics:

Jeffrey P. Snider considers the following as important: Bank of Canada, Canada, Consumer Prices, currencies, Deflation, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, Felix Hamrin, gustav cassel, inflation, Inflation target, Knut Wicksell, Markets, Monetary Policy, Money, newsletter, oil prices, price target, Sweden, The United States, william gavin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its notes on September 19 that year the Swedish currency fell into desperate trouble.

A week later, Finance Minister Felix Hamrin turned to famed economist Gustav Cassel for help. Cassel had been perhaps the world’s pre-eminent economic thinker, continuing a rich tradition for Sweden along the lines of Knut Wicksell and his theories on price stability. Hamrin knew there was no other choice for his country but to also default on its gold obligations, but what would that mean?

Initially, it was as open-ended as could be, a new policy that said nothing more than that the domestic purchasing power of the krona shall be preserved “by all means necessary.” It was the starting point of eight months of often heated debate within and among the Board of the Riksbank, Sweden’s central bank, as well as the Banking Committee of the Riksdag, Sweden’s national legislature.

Their efforts produced a five point plan: 1. Sweden would not consider re-establishing a gold standard or sterling peg for the time being, but that return to gold would be a long-term goal; 2. Deflation should be fought just as stridently as inflation; 3. Authorities should allow for some recovery in the price level from the fall in 1929-31; 4. Monetary policy would not be linked to a single factor or price index; 5. Domestic interest rates should be as low as possible while still achieving the goals of price stability.

In crafting new and emergency monetary policy this way, Sweden’s authorities allowed the central bank to become the first in world history to conduct operations on an inflation target. The Riksbank immediately began work on estimating consumer prices, a rudimentary but ultimately laudable CPI that was updated on a weekly basis. Though the Riksbank was not required nor was it desirable to follow this single index, it became clear that monetary policy gave it great emphasis.

By and large it worked. Consumer prices in Sweden at least until early 1937 fluctuated very little. It could have been that the end of collapse allowed conditions to sufficiently normalize in order for this scheme to work, or it could have been pure genius in action. Whatever the case, the scheme was altered in 1937 to maintain price stability as but one goal among others.

In the decades that followed, central banks would attempt to build on the work done in Sweden, but in almost every case there was great reluctance to go all the way to a full-blown price target. Almost every monetary authority in the 21st century has come to define price stability similarly but differently by an inflation target. A price target is a kind of inflation target whereas like the Riksbank’s in the thirties it is for one with zero inflation.

The last to actually attempt it was the Bank of Canada. In early 1990, that central bank announced a new monetary policy goal for zero inflation. By February 1991, the Canadian government agreed in principle to adopt the plan if first in stages. From 5% inflation in later 1990, the monetary authority would develop policies to decrease the rate to 2% by 1995, and then gradually from there to 0%.

The first stage was achieved. But in 1996, the government extended essentially a five-year waiver to the Bank wishing, it claimed, to see how the Canadian economy performed over a full cycle at instead 2% inflation. The extension has been repeated four times since, in 2001, 2006, 2011, and again last year. In this latest five-year exemption, the BoC was given permission to stop using the core inflation rate as their primary guide.

We don’t know, or at least I don’t, whether Canadian authorities were ever truly committed to a zero inflation regime. In early 1990, the CD Howe Institute sponsored a workshop to bring together economists to debate the wisdom, or folly, of what the BoC had only then proposed. One economist who attended, Assistant VP of the Cleveland Fed William Gavin, noted that there was quite a bit of support for the idea of price stability, just not at zero inflation.

Gavin, who wrote in defense of a hard, Swedish-type price target, gave three reasons why economists who were otherwise in favor of the general idea of consistency in consumer prices were greatly reluctant to define it as no increase. The first was tradition, meaning that price stability was for most of economic history taken care of by gold, or some other means of fixing money. Price or inflation targets were relatively new, and therefore there was some appropriate apprehension. The second, which I think ultimately closer to how Economics has developed in this manner, is one that I’ll save for below.

The last, which Gavin judged most important at the time, was the same general disinclination that had given the Swedes pause sixty years before.

…the most important reason why there is so little support for zero inflation is because the conventional macroeconomic model suggests that policymakers must slow real growth and cause unemployment in order to reduce inflation.To be tied to a regime of zero inflation, the central bank must be half the time (give or take) restraining the economy and to such a degree at zero that it borders on what economists fear the absolute most – deflation. The development of the 2% price target as the mainstream, modern definition of price stability is the imposition of the word “general” into these standards. In other words, zero inflation may be actual price stability at any given moment, but it risks being too close to the worst case, leaving too little time so that devastating deflation might develop before a sufficient monetary response might be offered. Therefore, a central bank will tolerate and even seek a little inflation so as to be a buffer against the worst case. In general prices that rise 2% a year without any big minuses are comparably more stable, it is believed, than prices that rise 0% for some years and perhaps -5% or worse occasionally (and considering the economic consequences of what -5% or worse might mean).

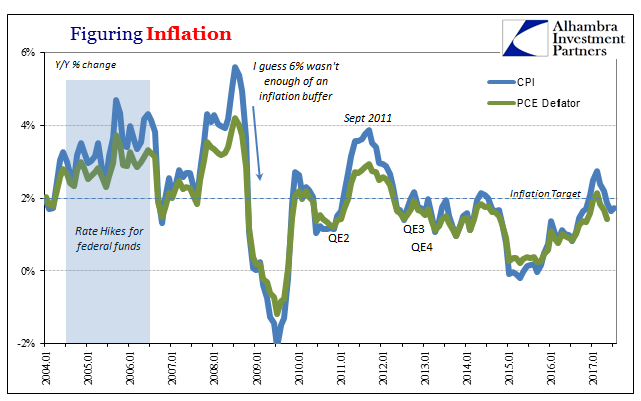

| So 2% in Canada, as elsewhere, has become the explicit target almost worldwide (notable exceptions exist, like 3% in China), with even the Federal Reserve adopting it in early 2012 and Japan in 2013 (though more so as a PR stunt to accompany QQE). It has become engrained in expectations particularly by the conventional description of the Great “Moderation”, and therefore that level is the benchmark for measuring deviations (not zero). But if you adopt this target, you actually have to meet this target. In the US, there were already problems by the middle 2000’s. Inflation tended to be high, spending much of the first decade of the 21st century above what was then only an implicit target (though pretty much everyone knew even the Greenspan Fed was using 2%). To make matters worse, the US CPI was in the summer of 2008 almost 6%, before it crashed with the rest of the economy. So much for the monetary buffer idea against deflation and collapse. |

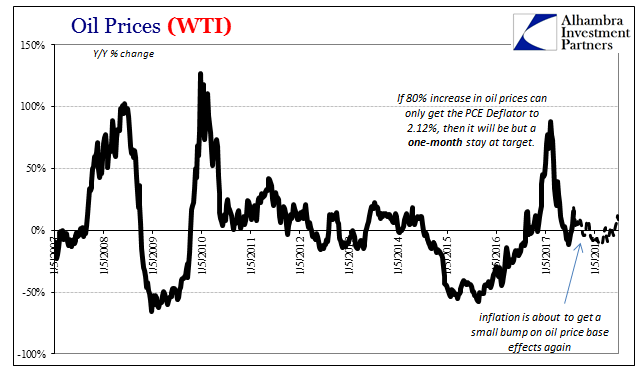

[caption id="attachment_122754" align="alignnone" width="545"] .[/caption] .[/caption] |

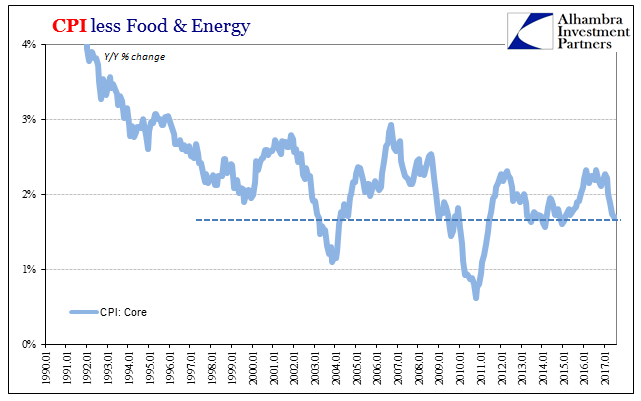

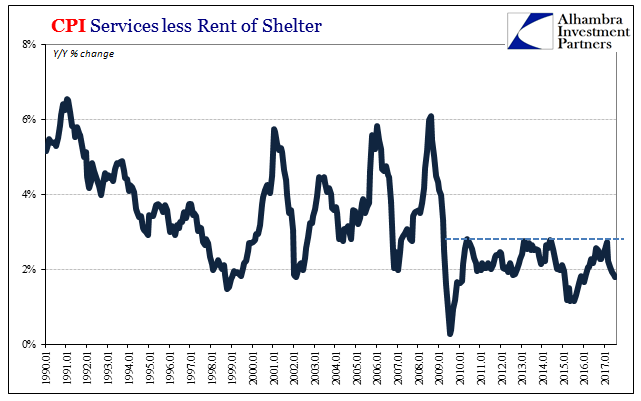

Outside of a brief reflation after the Great “Recession”, inflation rates have around the world tended to be below targets, often significantly below (as in 2015). This state has persisted despite huge monetary actions, or what were claimed to be monetary actions, by central banks in every location. Trillions upon trillions of bank reserves have been conjured by these monetary authorities, yet CPI’s and other inflation indices stubbornly do not react, favorably or otherwise. It’s as if there is some other monetary factor behind them.

It is Gavin’s second point that is useful in understanding why that might be. Having already written extensively before 1990 on the state of macroeconomics, he writes in reference to the Canadian inflation debate what I believe is as true of Economics today as ever before.

Second, nonmonetary models have dominated the frontier in macroeconomic research for almost two decades. These microfoundation models usually exclude the important reasons for having money. Because the quantity of money does not play an important role, following an inefficient monetary policy does little damage to these model economies. |

[caption id="attachment_122755" align="alignnone" width="545"] .[/caption] .[/caption] |

| To these economists, Keynesians at root, money is just money and it is what a central bank does, full stop. There was, and is, for economists (meaning statisticians who study models of economies rather than actual economies) no need to investigate the monetary parts and its true nature because there is nothing of interest for these economists. This was not, and is not, a small branch of the discipline, but rather the full reach of them. The economists who dominate each and every central bank today qualify as what William Gavin proposed in June 1990. In defense of the zero target, and in contrast to the veiled admonishment quoted above, he writes in common sense terms, “If one recognizes that the existence of money is inextricably tied to the functioning of market economies, then it is easy to see why disrupting the efficiency of the monetary system can cause great harm.” |

[caption id="attachment_122756" align="alignnone" width="545"] .[/caption] .[/caption] |

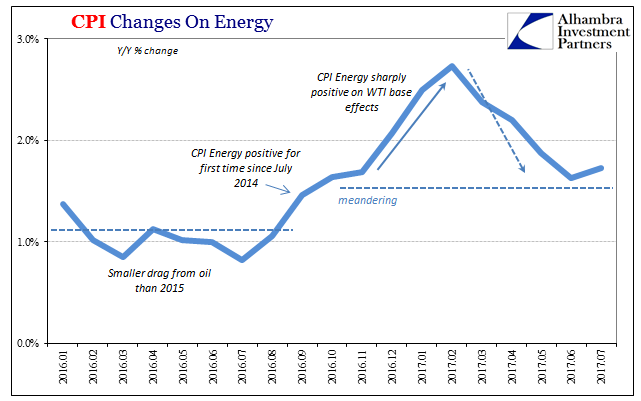

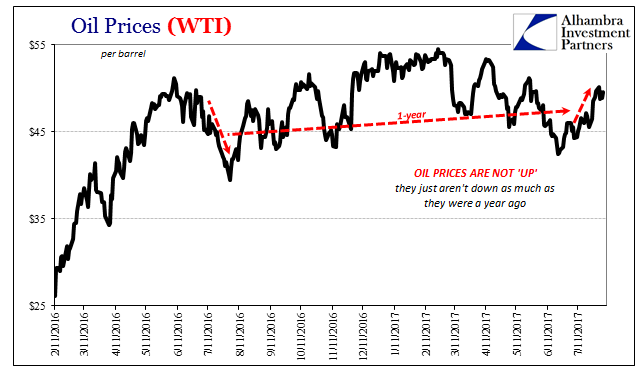

| On that note, the CPI accelerated by a very small amount in July 2017. According to the latest BLS calculations released today, it increased at a 1.73% annual rate last month compared to 1.63% in June. This was what might turn out to be the final “gift” of oil price base effects, and it was exceedingly small, less than many economists were estimating (many were expecting a rise to 1.8% or even 1.9% in July). |

[caption id="attachment_122757" align="alignnone" width="545"] .[/caption] .[/caption] |

[caption id="attachment_122758" align="alignnone" width="545"] .[/caption] .[/caption] |

|

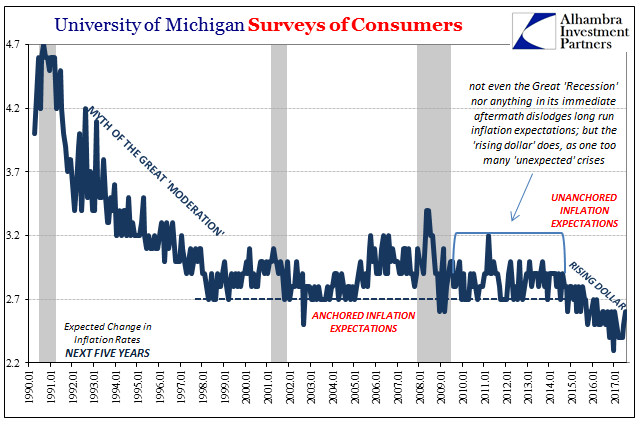

| Thus, the issue with the CPI or PCE Deflator is not strictly deflation or inflation, but where it is with respect to 2%. Over the last five and a half years, its tendency is clearly below that level despite massive supposedly monetary intervention. It has reached such proportions that inflation expectations have undergone a regime change, an expectation not so much about prices as the effectiveness of the monetary system, including central bank actions, and the consequences long-term for the economy. |

[caption id="attachment_122759" align="alignnone" width="545"] .[/caption] .[/caption] |

[caption id="attachment_122760" align="alignnone" width="545"] .[/caption] .[/caption] |

|

[caption id="attachment_122761" align="alignnone" width="545"] .[/caption] .[/caption] |

|

| Make no mistake, policymakers are worried about this though they are trying desperately not to show it. Being unable to enforce your explicit definition of price stability is a major defect. It states outright what William Gavin wrote about over a quarter century ago. Economists don’t know a thing about the monetary system, and now that it is malfunctioning they can’t figure out why inflation so persistently remains less than they demand – and the economy in stagnation despite ten years and a massive contraction. |

[caption id="attachment_122762" align="alignnone" width="545"] .[/caption] .[/caption] |

Tags: Bank of Canada,Canada,Consumer Prices,currencies,Deflation,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,Felix Hamrin,gustav cassel,inflation,inflation target,knut wicksell,Markets,Monetary Policy,money,newsletter,oil prices,price target,Sweden,william gavin