Swiss Franc The Euro has risen by 0.22% to 1.1646 CHF. EUR/CHF and USD/CHF, November 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sterling is trading in the lower end of yesterday’s range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26....

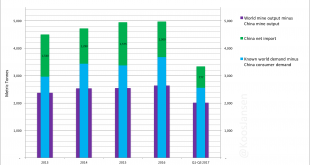

Read More »China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day. The Chinese appear to be price sensitive regarding gold, as was mentioned in the most recent World Gold Council Demand Trends report, and can also be...

Read More »Where are Europe’s Fault Lines?

Beneath the surface of modern maps, numerous old fault lines still exist. A political earthquake or two might reveal the fractures for all to see. Correspondent Mark G. and I have long discussed the potential relevancy of old boundaries, alliances and structures in Europe’s future alignments.Examples include the Holy Roman Empire and the Hanseatic League, among others. In the long view, Europe has cycled between periods...

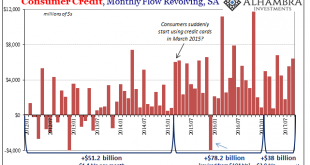

Read More »Consumer Credit Both Accelerating and Decelerating Toward The Same Thing

Federal Reserve revisions to the Consumer Credit series have created some discontinuities in the data. Changes were applied cumulatively to December 2015 alone, rather than revising downward the whole data series prior to that month. The Fed therefore estimates $3.531 trillion in outstanding consumer credit (seasonally-adjusted) in November 2015, and then just $3.417 trillion the following month. Of that $114.3 billion...

Read More »Swiss Producer and Import Price Index in October 2017: +1.2 YoY, +0.5 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

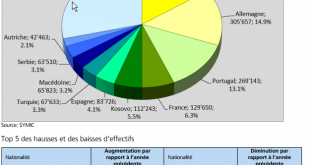

Read More »Switzerland Less Attractive to European Migrants

Fewer people are moving to Switzerland from elsewhere in Europe. Between January and September this year, immigration from European Union states was down by 26%, compared to the same period last year. (RTS/swissinfo.chexternal link) For example, according to Swiss Public Television, RTS, 7,891 Portuguese arrived in Switzerland while 7,912 left, citing various reasons for their departure. Some said it was too expensive...

Read More »FX Daily, November 13: Sterling Trounced by Growing Political Challenges

Swiss Franc The Euro has fallen by 0.03% to 1.1607 CHF. EUR/CHF and USD/CHF, November 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has begun the new week on firm footing, without the help of either higher interest rates or increased confidence that Congress will agree on a tax plan. Indeed, over the weekend the Chair of the House Ways and Means...

Read More »MACRO ANALYTICS – 01 27 17 – The Great Rotation – w/Charles Hugh Smith

ABSTRACT:

Read More »Stories making the Swiss Sunday papers

Bolivian President Evo Morales will visit Switzerland in December to sign an agreement about a major South American rail project (Keystone) - Click to enlarge The following stories were reported in Switzerland’s Sunday press on November 12, 2017. A major South American rail deal The SonntagsBlick newspaper reports that Bolivian President Evo Morales will head to Switzerland on December 14 to sign a...

Read More »Internet Shutdowns Show Physical Gold Is Ultimate Protection

– Internet shutdowns (116 in two years) show physical gold is ultimate protection – Number of internet shutdowns increased in 2017 as 30 countries hit by shutdowns – Democratic India experienced 54 internet shutdowns in last two years; Brazil 2– EU country Estonia, a technologically advanced nation, experienced a shutdown – Gallup poll shows Americans more worried about cybercrime than violent crime – Governments use...

Read More » SNB & CHF

SNB & CHF