This Great Graphic was composed on Bloomberg. It shows the recent price action of the Dollar Index. There seems to be a head and shoulders bottoming pattern that has been traced out over the last few weeks. The right shoulder was carved last week, and today, the Dollar Index is pushing through the neckline, which is found by connecting the bounces after the shoulders were formed. One of the important contributions of...

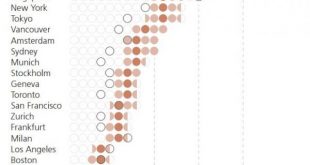

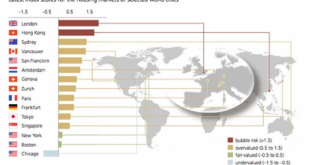

Read More »Here Are The Cities Of The World Where “The Rent Is Too Damn High”

In ancient times, like as far back as the 1990s, housing prices grew roughly inline with inflation rates because they were generally set by supply and demand forces determined by a market where buyers mostly just bought houses so they could live in them. Back in those ancient days, a more practical group of world citizens saw their homes as a place to raise a family rather that just another asset class that should be...

Read More »Swiss 2018 health premiums unveiled. Brace yourself.

© Ognjen Stevanovic | Dreamstime Yesterday, the Swiss government released health insurance premiums for 2018. There are price hikes across the board, particularly in French-speaking Switzerland. Next year, the price of standard compulsory insurance for an adult with a CHF 300 deductible will rise 4% on average. The cost varies by canton. Prices rises range from 1.6% to 6.4%. Health premiums for children will rise by...

Read More »Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese...

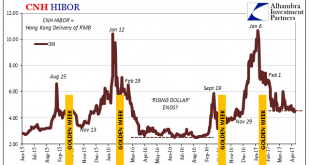

Read More »Location Transformation or HIBORMania

The Communist Chinese established their independence on September 21, 1949. The grand ceremony commemorating the political change was held in Tiananmen Square on October 1 that year. The following day, October 2, the Resolution on the National Day of the People’s Republic of China was passed making October 1to be China’s National holiday. It typically kicks off the second of China’s Golden Week holidays. The first...

Read More »Basel boy conquers YouTube

Switzerland has its own YouTube star. Lionel Battegay's quirky videos, filmed on the streets of his native Basel, attract up to 100, 000 viewers. He asks young people questions about Swiss history and politics, with sometimes hilarious results. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos...

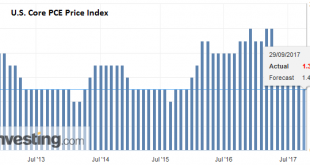

Read More »Evolving Thoughts on Inflation

In early 2005, Greenspan said that the fact that long-term rates were lower despite the Fed’s campaign to raise short-term rates was a “conundrum.” Many rushed to offer the Fed Chair an explanation of the conundrum, which given past cycles may not have been such an enigma in the first place. Be it as it may, at last week’s press conference, Yellen admitted that the decline in inflation was a “mystery.” She said, “I...

Read More »The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world’s most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. UBS Global Real Estate Bubble Index - Click to enlarge What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank’s Global Real Estate Bubble Index, it found that eight of the world’s...

Read More »Survey offers clues to why Swiss rejected last Sunday’s pension reform

© Michelle Meiklejohn – Dreamstime - Click to enlarge A survey by Tamedia offers clues to why 52.7% of Swiss voters rejected the pension reform plan that was put to a vote last Sunday. 20% of those voting “no” thought it was a pseudo reform that didn’t go far enough, while 26% felt it left too much of a burden on younger taxpayers. In 1981, when the life expectancy of an average Swiss woman was 79.2 years, the average...

Read More »Emerging Markets: What has Changed

Summary India Prime Minister Modi announced an INR163.2 bln program to deliver electricity to all households. Poland’s President Duda is trying to reach a compromise on judicial reforms. Fitch raised the outlook on Russia’s BBB- rating from stable to positive. Saudi Arabia announced it will remove the ban on women driving. South Africa’s biggest labor organization stepped up its opposition to President Zuma. Turkey is...

Read More » SNB & CHF

SNB & CHF