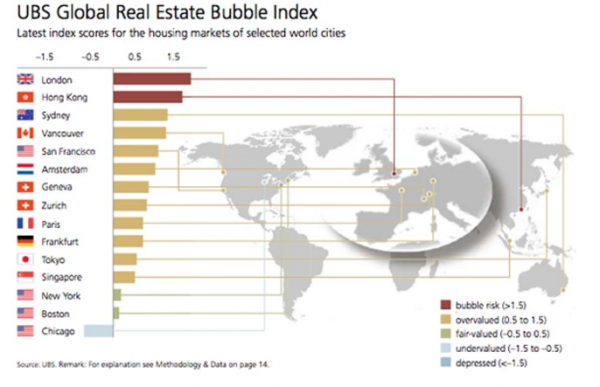

Two years ago, when UBS looked at the world’s most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. UBS Global Real Estate Bubble Index - Click to enlarge What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank’s Global Real Estate Bubble Index, it found that eight of the world’s largest cities are now subject to a massive speculative housing bubble. And while perpetually low mortgage rates are clearly to blame for the rapid ascent of home prices, Chinese money laundering operations clearly seem to also be playing a role as their favorite markets of Vancouver, Toronto and Sydney all

Topics:

Tyler Durden considers the following as important: Australia, Business, China, Countrywide, Economic bubble, Economic history of the United States, economy, Featured, Finance, Financial crises, Great Recession, Hong Kong, Housing Bubble, Money, Mortgage loan, newsletter, Real estate, Real estate bubble, Real estate economics, Subprime mortgage crisis, UBS, UBS Global Real Estate Bubble, Zurich

This could be interesting, too:

investrends.ch writes Der Franken als letzter sicherer Hafen: Wenn die Welt am Dollar zweifelt

investrends.ch writes ODDO BHF holt UBS-Managerin Simone Westerfeld als stellvertretende CEO

investrends.ch writes Hedgefonds-Branche erlebt Gründungsboom – Kapital erreicht Rekordhöhe

investrends.ch writes UBS: Schweizer Pensionskassen bleiben risikobewusst – doch sie können die Rendite halten

| Two years ago, when UBS looked at the world’s most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk. |

UBS Global Real Estate Bubble Index |

What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank’s Global Real Estate Bubble Index, it found that eight of the world’s largest cities are now subject to a massive speculative housing bubble. And while perpetually low mortgage rates are clearly to blame for the rapid ascent of home prices, Chinese money laundering operations clearly seem to also be playing a role as their favorite markets of Vancouver, Toronto and Sydney all made this year’s list.

|

|

As UBS points out, artificially low interest rates in Europe, for example, have kept mortgage payments below their 10-year average despite real prices surging 30% since 2007.

|

Index for the past three years |

Of course, at some point even artificially low interest rates can’t offset 10%-20% annual real home price increases, which imply a doubling of prices every 4-7 years.

|

Housing Prices |

| Meanwhile, the U.S. has managed to avoid UBS’s bubble territory, and a repeat of the 2007 housing crisis, for now…even though markets like San Francisco and Los Angeles look set to give it another try… |

US UBS Global Real Estate Bubble Index, 1981 - 2017 |

Tags: Australia,Business,China,Countrywide,Economic bubble,Economic history of the United States,economy,Featured,Finance,Financial crises,Great Recession,Hong Kong,housing bubble,money,Mortgage loan,newsletter,Real Estate,Real estate bubble,Real estate economics,Subprime mortgage crisis,UBS,UBS Global Real Estate Bubble,Zurich