Summary India Prime Minister Modi announced an INR163.2 bln program to deliver electricity to all households. Poland’s President Duda is trying to reach a compromise on judicial reforms. Fitch raised the outlook on Russia’s BBB- rating from stable to positive. Saudi Arabia announced it will remove the ban on women driving. South Africa’s biggest labor organization stepped up its opposition to President Zuma. Turkey is planning to hike taxes on a variety of sectors and products Argentina may allow short selling in the equity market. Brazil successfully completed several power and oil auctions. Stock Markets In the EM equity space as measured by MSCI, Russia (+1.8%), Peru (+1.3%), and Thailand (+0.6%) have

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

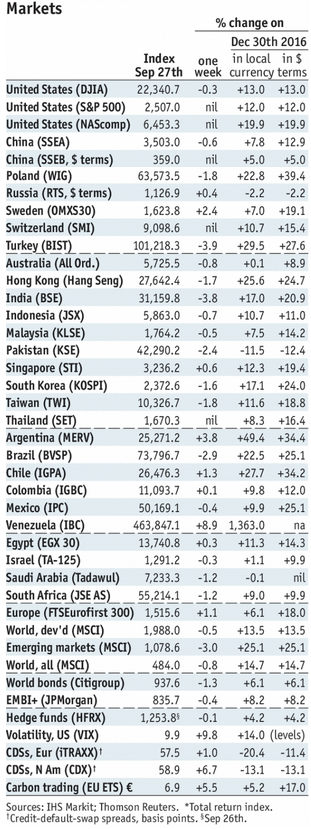

Stock MarketsIn the EM equity space as measured by MSCI, Russia (+1.8%), Peru (+1.3%), and Thailand (+0.6%) have outperformed this week, while Brazil (-2.8%), Mexico (-2.7%), and Hungary (-2.3%) have underperformed. To put this in better context, MSCI EM fell -1.9% this week while MSCI DM rose 0.1%. In the EM local currency bond space, Turkey (10-year yield -6 bp), Brazil (-3 bp), and Russia (-1 bp) have outperformed this week, while Argentina (10-year yield +33 bp), Indonesia (+18 bp), and Hungary (+15 bp) have underperformed. To put this in better context, the 10-year UST yield rose 7 bp to 2.32%. In the EM FX space, CZK (+0.3% vs. EUR), EGP (+0.1% vs. USD), and PKR (-0.1% vs. USD) have outperformed this week, while CLP (-2.4% vs. USD), MXN (-2.4% vs. USD), and TRY (-1.7% vs. USD) have underperformed. |

Stock Markets Emerging Markets, September 27 Source: economist.com - Click to enlarge |

IndiaIndia Prime Minister Modi announced an INR163.2 bln program to deliver electricity to all households. He said the program will help the poor get electricity connections at no cost, and added that the government is hoping to provide power to about 3,000 unelectrified villages. Power Minister Singh said India aims to complete electrification of all households by December 2018. PolandPoland’s President Duda is trying to reach a compromise on judicial reforms. Back in July, he vetoed legislation that sought to dismiss the entire Supreme Court and to allow parliament to choose the nation’s judges, bypassing the Judicial Council. Duda will reportedly propose retirement ages for the Supreme Court’s current judges (60 years for women, 65 years for men), rather than dismissing them. Duda also will propose keeping the current Judicial Council but will have the selection of new members done by a 3/5 vote in parliament. RussiaFitch raised the outlook on Russia’s BBB- rating from stable to positive. However, the agency noted that the possible extension of sanctions to target Russia’s state debt may prevent an actual upgrade. Still, the agency added that “Certainly the action that we took last Friday signals there is a very strong probability that Russia’s rating will be upgraded.” Our own ratings model has Russia at BBB- and so we disagree with Fitch’s move. Saudi ArabiaSaudi Arabia announced it will remove the ban on women driving. Women will be able to obtain driving licenses starting June 2018. This may seem like a minor development, but it shows that the nation’s efforts to modernize continue to move forward. South AfricaSouth Africa’s biggest labor organization stepped up its opposition to President Zuma. The Congress of South African Trade Unions (COSATU) urged workers to strike in protest of what it called “the cancer of corruption” in the country currently. COSATU was instrumental in ending Apartheid, and it was part of the so-called “Tripartite Alliance” (along with the ANC and South African Communist Party) that has basically led the country since. As such, the widening rift with the Zuma wing of the ANC is noteworthy. TurkeyTurkey is planning to hike taxes on a variety of sectors and products. Finance Minister Agbal said a corporate tax hike on the financial industry from 20% to 22% was likely. Taxes on passenger cars, gambling, soft drinks, and cigarette paper will also be hiked. With inflation already rising, the tax hikes are likely to add to the upward pressure. ArgentinaArgentina may allow short selling in the equity market. Press reports suggest that Argentina’s securities regulator is writing the rules that would allow short selling of local stocks and will present the plan soon. The proposal sets certain rules and limits, which include halting in short-selling if the stock drops more than 5% from the previous close. Short-selling would be done on the open market, and not bilaterally as it was done previously. BrazilBrazil successfully completed several power and oil auctions. The sales brought in nearly BRL16 bln in combined revenue this week. The government earned BRL12.1 bln from selling concessions to operate four hydroelectric plants previously run by state-owned utility Cemig. The government also got BRL3.8 bln from its 14th oil licensing round. The money will help the government with this year’s fiscal target, but the one-off nature is not the best way to do this. |

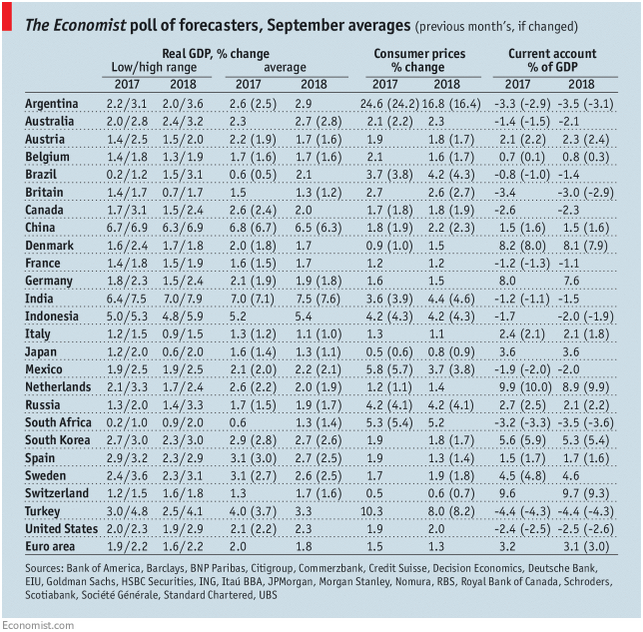

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, September 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin