See the introduction and the video for the terms gold basis, co-basis, backwardation and contango Goldfinger Strikes, Sort Of This week, we saw a tweet from a prominent goldbug. He said, “Russia added another 9 tons of gold to its reserves in March. The hits just keep coming.” How many errors in this short quip? We count six, exactly one error for every two words. One, we call this the fallacy of the famous market actor. Russia is famous. Its purchase of 9 times is therefore imbued with meaning, that the sale of those same 9 tons is not given. Because the sellers are not famous. Two, the concept of stocks to flows measures the abundance of a commodity. It is not a measure in terms absolute tonnage, which would be

Topics:

Keith Weiner considers the following as important: 6) Gold,Bitcoin,Austrian Economics, Chart Update, dollar price, Featured, gold basis, Gold co-basis, gold price, gold silver ratio, newslettersent, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango

Goldfinger Strikes, Sort OfThis week, we saw a tweet from a prominent goldbug. He said, “Russia added another 9 tons of gold to its reserves in March. The hits just keep coming.” How many errors in this short quip? We count six, exactly one error for every two words. One, we call this the fallacy of the famous market actor. Russia is famous. Its purchase of 9 times is therefore imbued with meaning, that the sale of those same 9 tons is not given. Because the sellers are not famous. Two, the concept of stocks to flows measures the abundance of a commodity. It is not a measure in terms absolute tonnage, which would be useless. It looks at how much of the good is accumulated. Virtually all of the gold ever mined in human history is still in human hands. Russia’s purchase is merely the shifting of a very small percentage of total stocks from one corner of the market to another. Hell, 9 tons is a small fraction of 2017 mine output let alone 5,000 years of accumulated mining output. Three, this goldbug speaks often of a change in the monetary order, hopefully and presumably one based on gold. But this bit about Russia shows the ambiguity of most gold bugs. Buy gold because of new monetary order and because its price will go up. Huh? If the dollar is collapsing, what meaning does the price of gold measured in dollars mean? Conversely, if one is promoting a new monetary order, why promote Russian gold buying to promote a quick trade to make a buck? Four, this purchase by Russia is bullish (remember, it’s not a sale by smarter people to the dumb money of central banks). Is all news bullish? 2011-2016 would suggest it isn’t. Five, a gold standard is not about central banks buying gold. Or loading up on gold. Or having “enough”. There is no amount of gold that could ever conceivably be enough for the Russian central bank to have, to defend a gold price peg. All rubles (and dollars, pounds, etc) did not begin life as gold deposits. They cannot retroactively be declared to be gold-redeemable. |

|

USD/RUBFinally, the ruble is not exactly in a rising trend. So whatever “hits” he means, it is not a “hit” to the US dollar. Which the goldbugs want to hear, in the dualist world of gold going up vs. seeking out good news about the dollar going down because it’s good for gold. |

USD/RUB, weekly May 2015 - Apr 2018 |

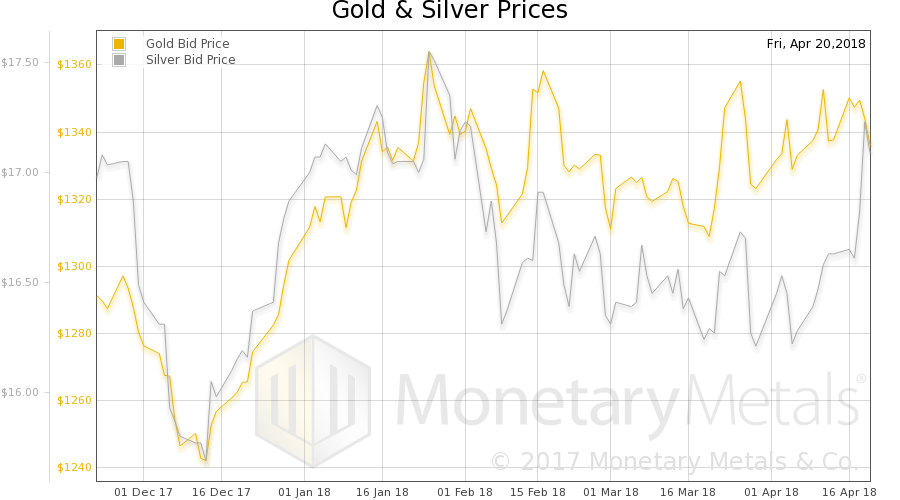

Fundamental DevelopmentsThat said, gold fell ten bucks, but silver rose about half a buck. Silver bugs have begun to (more aggressively) say that the rally’s back on. We will look at the fundamentals, but first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

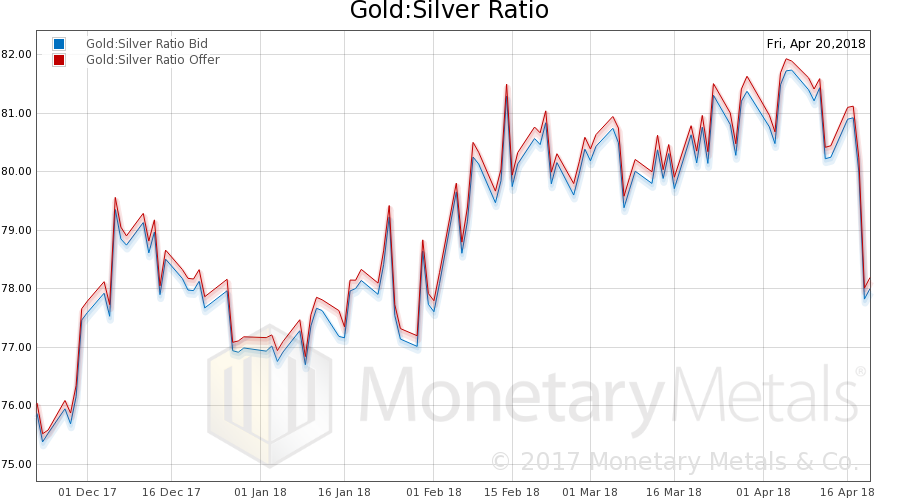

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). There was a big drop in the ratio. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

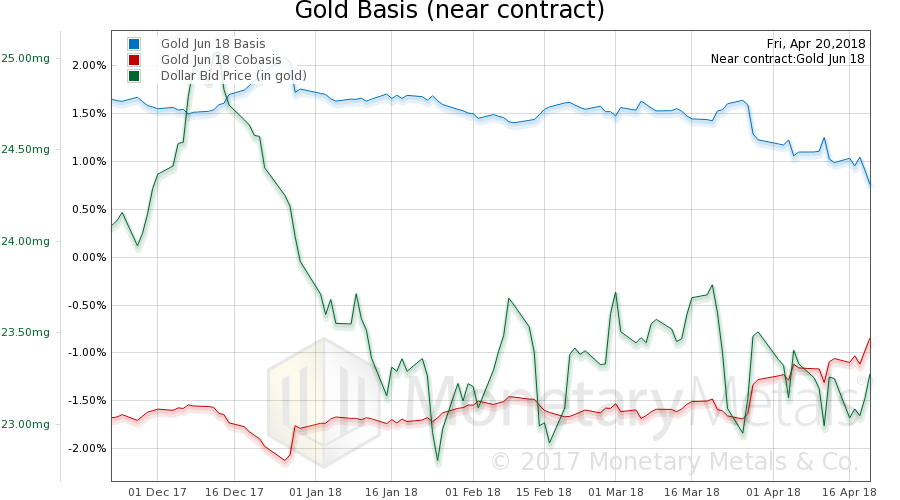

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. There was a small increase in the scarcity of gold (i.e., the co-basis, red line), as its price fell. The Monetary Metals Gold Fundamental Price fell $2 this week to $1,507. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

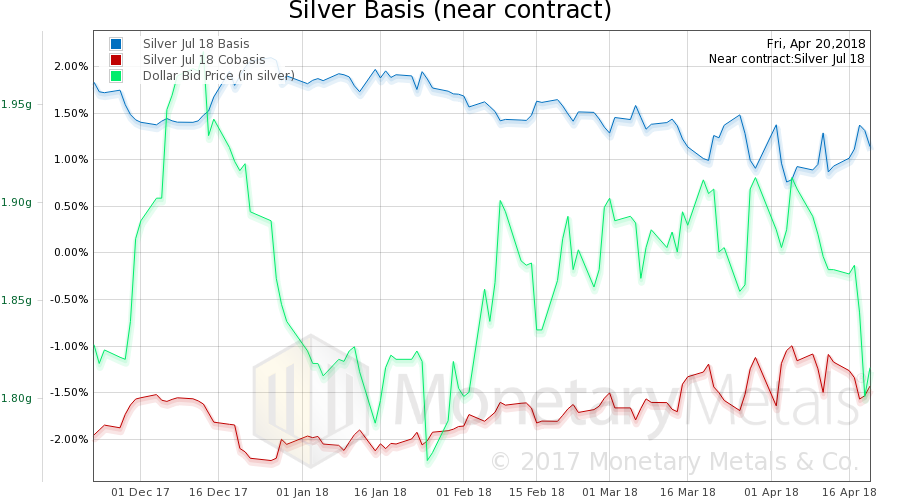

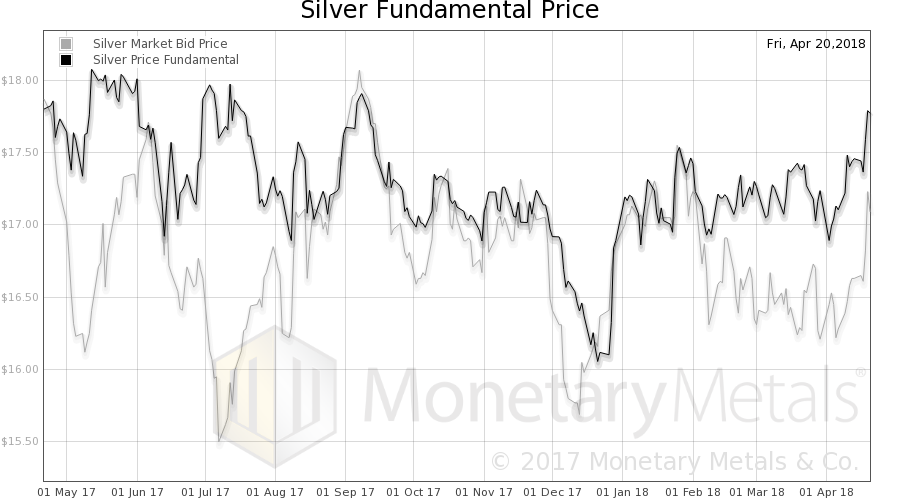

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. Silver’s scarcity fell, however unlike in gold, the price of silver was up considerably. Much of this buying was buying of metal, rather than buying of futures contracts as typically seen in recent years. The Monetary Metals Silver Fundamental Price rose 31 cents to $17.77. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Silver Fundamental PriceHere is a chart of the silver fundamental price for the last year. Has the silver fundamental price broken out? We would want to see more evidence before pronouncing this. Heck, not even the market price has so far surpassed its level from January. |

Silver Fundamental Price(see more posts on silver price, )© 2018 Monetary Metals |

Addendum by PT:

Note that large speculators recently held the biggest net short position in silver futures since at least 1990 (very likely it was actually an all time record). In other words, if silver were to begin trending up, it would presumably have quite a bit of room to run.

Charts by: BigCharts, Monetary Metals

Chart and image captions by P

Tags: Chart Update,dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price