Oil prices have recovered more than 50% of the decline since the mid-September peak. The next retracement objectives are found near a barrel for Brent and .5 for WTI basis the continuation futures contract. The immediate consideration is that supplies have tightened. OPEC compliance to its agreement has exceeded targets, and Venezuelan output has been halved over the past two years to levels not seen in a more than a decade. Speculation that the US could re-impose sanction on OPEC’s third largest producer, Iran, as early as May 12, is also cited as a factor. Estimates of the impact of this speculation range from around to around a barrel. Saudi Arabia and Israel are encouraging the US to take a hard line

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Featured, newsletter, Oil, U.S. Crude Oil Inventories, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Oil prices have recovered more than 50% of the decline since the mid-September peak. The next retracement objectives are found near $82 a barrel for Brent and $76.5 for WTI basis the continuation futures contract.

The immediate consideration is that supplies have tightened. OPEC compliance to its agreement has exceeded targets, and Venezuelan output has been halved over the past two years to levels not seen in a more than a decade. Speculation that the US could re-impose sanction on OPEC’s third largest producer, Iran, as early as May 12, is also cited as a factor. Estimates of the impact of this speculation range from around $1 to around $3 a barrel.

Saudi Arabia and Israel are encouraging the US to take a hard line with Iran, which seems to be consistent with many of Trump’s new national security and foreign policy advisers. Europe is taking a less aggressive line. They are interested in strengthening rather than scrapping the deal. Broadening the prohibitions to include missile tests or other conventional forces could be part of a new agreement.

United StatesThe modus operandi of the Trump Administration seems to make a bold demand and then walk back to more modest position. From a trade war is easy to granting exemptions, and being “cautiously optimistic” of a trade agreement with China provides a timely example of this pattern. Trump had threatened several times to leave NAFTA, and a deal early next month would no longer be surprising. Nevertheless, the US could renew sanctions on Iran. However, the risk is that they would be less effective; more an irritant than a body blow. Europe might not go along with them. This could be an example of why unilateralism is a better way to characterize this thrust of policy instead of isolationism. Also, unlike during the earlier sanction, there is a now an oil futures contract denominated in yuan. The majority of Iranian oil exports go to Asia (60%), and most of these go to China. In addition, reports suggest Russia and India are willing to barter with Iran. While most oil discussions focus on supply, demand cannot be ignored. The International Energy Agency is conservative with a forecast that global oil demand will rise 1.5 mln barrels a day this year to 99.3 mln. OPEC estimates demand growth a little more (1.6 mln bpd) and the US EIA is boldest with a 1.8 mln bpd increase projected. Also, going forward, oil-related demand may shift toward petrochemicals and away from motor fuels. |

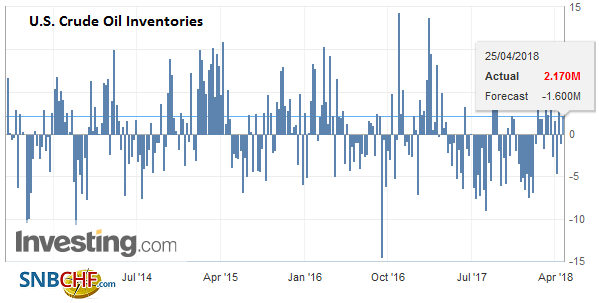

U.S. Crude Oil Inventories, April 2018(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

Asian demand has been particularly strong. This is the result of regional economic growth, but also the creation of new refining capacity in China and Vietnam. At the same time, the increased demand for petrochemicals means impacts refiners. Naphtha is made in the refining process, but other feedstocks, such as ethane and liquefied petroleum gas are made outside the traditional refiners.

Of the 6.9 mln barrel increase in demand that IEA projects by 2023, refiners may handle only 70%. US shale lends itself to ethane production, and several new projects are broken ground in the Gulf Coast. Another challenge for refiners is that many use the heavy sour crude (e.g., Venezuela), and the refining capacity for US shale is considerably more limited.

Brent for June deliverer is advancing for the sixth consecutive session. It briefly traded above $75 a barrel for the first time in two years. The high from 2015 is found $75.50-$75.70. Above there is $7720 objective. The technical condition is stretched. Brent has advanced in seven of the last ten weeks, during which time it has gained about $10 a barrel.

Light sweet crude (WTI) for June delivery is advancing for a third consecutive session today. It has also moved in seven of the past ten weeks coming into this week’s activity. The June contract has a rising trendline drawn off the mid-February and mid-March lows and the early April lows. It is found just below $64 at the start of next week. Initial support is likely near $66.60 and then $65.70.

The correlation between oil and US equities is not stable. We looked at the 60-day correlation on the level of the S&P 500 and the level of the front-month oil futures contract. From last August through late March, the two moved in the same direction often. The correlation coefficient was between about 0.85 and 0.95 for that six-month period. The correlation was negative for most of Q2 and the first half of Q3 17. The correlation is negative now for the first time in eight months.

Running the correlations on the percentage change of each to determine if the returns are correlated shows a different picture. On this basis, the correlation is not only positive (0.39), but it is the highest since December 2016.

Meanwhile, speculators have amassed a huge net long position in the futures market. As of April 17, the net long non-commercial position stood at 728k contracts, a little below the record high set in early February near 739k contacts. When oil peaked in mid-2014, speculators had a net long position of about 460k contracts. The gross long position o 850k contracts are also slightly off the record from late January near 866k contracts. The gross short position of 122k contracts is just above the low set earlier this year near 115k contracts, which is the least since late August 2014.

Tags: #USD,Featured,newsletter,OIL,U.S. Crude Oil Inventories