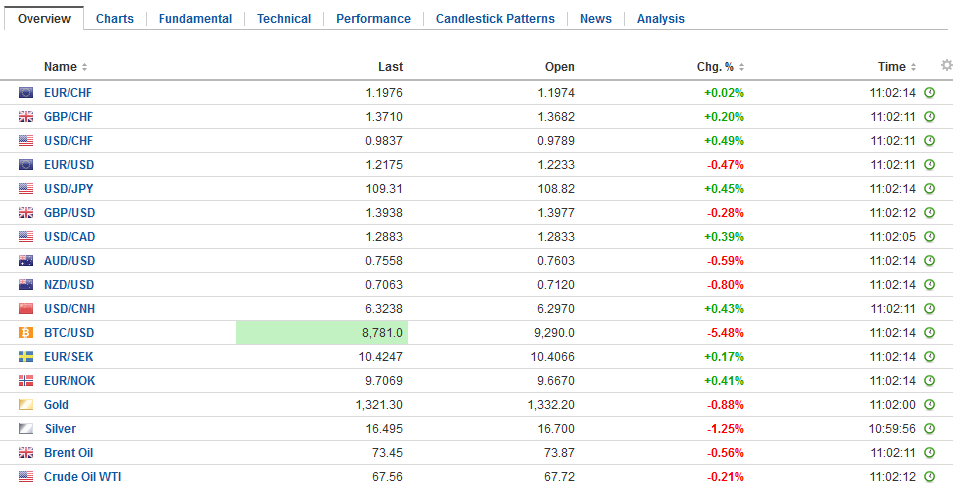

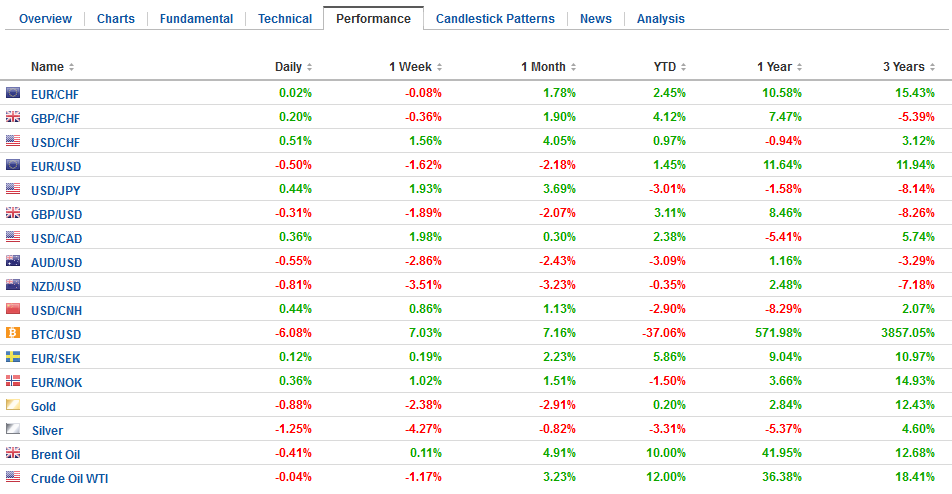

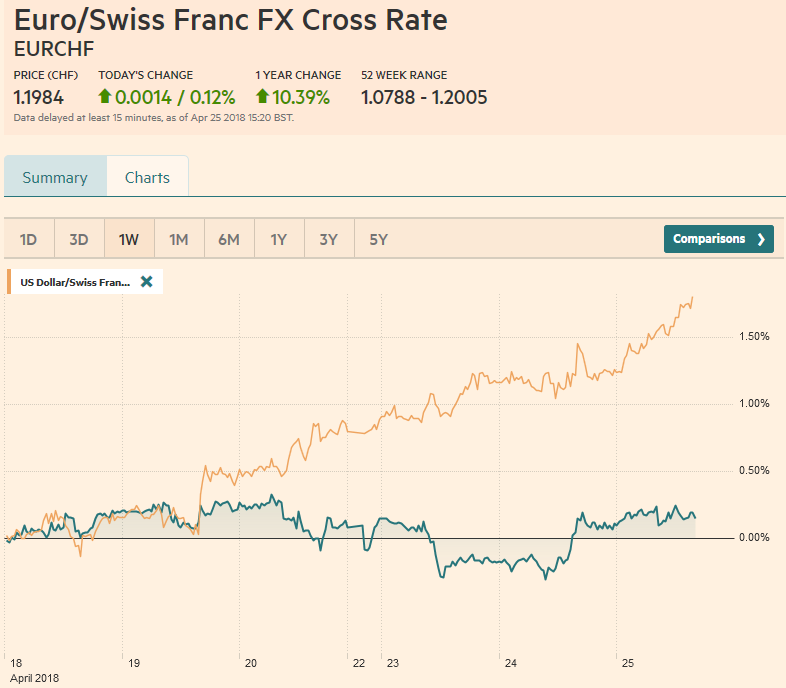

Swiss Franc The Euro has risen by 0.12% to 1.1984 CHF. EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP/CHF The Swiss Franc has been weakening recently as global investors appear to be moving away from the safe haven of the Swiss banking system. The US Federal Reserve have continued to increase interest rates during last year and have already hiked rates during 2018 with further rate hikes expected later on this year. With the Swiss interest rate so low this has encouraged investors to sell the Swiss Franc in favour of the US Dollar hence the weakening over the last few weeks particularly vs the Pound. The Swiss Franc has also hit 1.20 vs the

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR, Featured, GBP, JPY, newslettersent, SPY, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.12% to 1.1984 CHF. |

EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

GBP/CHFThe Swiss Franc has been weakening recently as global investors appear to be moving away from the safe haven of the Swiss banking system. The US Federal Reserve have continued to increase interest rates during last year and have already hiked rates during 2018 with further rate hikes expected later on this year. With the Swiss interest rate so low this has encouraged investors to sell the Swiss Franc in favour of the US Dollar hence the weakening over the last few weeks particularly vs the Pound. The Swiss Franc has also hit 1.20 vs the Euro which is the same price when the Swiss bank removed the peg between the CHF and the Euro three years ago. The currency’s drop is of concern as it has so far dropped by 2.5% vs the single currency since the start of the year. Indeed, with the CHF typically used as a safe haven currency the Syrian issue would usually have had a strengthening effect on the Swiss Franc highlighting how poor it is performing at the moment. With the European Central Bank due to end their QE programme towards the end of this year the Swiss National Bank has refused to confirm that it will follow suit and SNB Chairman Thomas Jordan has said that ending its own policy is not on the agenda. Turning the focus back to what is happening in the UK the Bank of England are potentially looking to hike interest rates in the near future with strong odds that we could see a rate hike coming on 10th May when the Bank of England hold their latest monetary policy meeting. I think we could see a rate hike and even if we don’t I think the overall tone will be that one will be coming and this is why I think we could see GBPCHF exchange rates hit above 1.40 next month. |

GBP/CHF, April 25(see more posts on gbp-chf, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar reversed lower yesterday after US yields softened and equities tumbled. However, the greenback has bounced back, and has extended its gains against the major currencies except the euro and sterling. The on-the-run and generic US 10-year yields are edging above 3%. Despite a soft reception to yesterday’s $32 bln sale of two-year notes, the yield is holding just below 2.50%. The 2-10 year yield curve, who’s flattening has caused consternation among investors and pundits, is at 52 bp, which is where it was at the end of last year. Equities are heavy after yesterday’s sharp losses on Wall Street. Dow Jones Industrials were down for fifth consecutive session, and the S&P 500 post its biggest loss in two weeks. The NASDAQ extended its losing streak to four sessions. There is some disagreement over the cause. One camp attributes the equity losses to the rise in yields. The other sees less optimistic guidance by Caterpillar and 3M yesterday as the proximate cause, and ideas that expectations for strong earnings and been largely discounted. |

FX Daily Rates, April 25 |

| The MSCI Asia Pacific Index fell 0.5%. It is the third loss in the past four sessions. Technology shares continues to lead the way. The benchmark sits at a two and a half week low. One of the flow stories we have been tracking is the foreign sale of Korean shares. The selling accelerated to $791 mln today, nearly twice the pace seen in the previous two sessions. Of the $2.8 bln liquidated this year so far, $1.65 bln has taken place this week.

The Dow Jones Stoxx 600 is off 0.9% in late morning turnover in Europe. Financials, energy, materials and industrials are all off more than 1%. Consumer staples are trying to buck the trend. Yesterday the benchmark traded at its best level since early February and today’s drop brings it back to April 17 levels. |

FX Performance, April 25 |

Eurozone

European bond yields are being dragged higher by the rising Treasuries. Core bond yields are up 1-2 bp in Europe, and that puts the 10-year Gilt yield at two-month highs (~1.55%) and the 10-year Bund at its highest yield (65 bp) since March 12.

The news stream is light, but the lull will not persist long. Tomorrow the ECB meeting concludes and Friday the BOJ meeting ends. Several countries, including the US and UK will report the first look at Q1 GDP ahead of the weekend.

China

The US dollar is slightly firmer against the Chinese yuan. With US Treasury Secretary Mnuchin reportedly headed to China shortly for trade talks, the trade tensions have eased on the margins. Meanwhile, the steady stream of announcement from Chinese officials continues. For the first time in three years, China has boosted the QDII (qualified domestic institutional investors) quota to the equivalent of $98.33 bln from $89.99 bln. Earlier this month, officials more than doubled the quota for two other programs for portfolio investment abroad.

The relaxation of limits on capital outflows suggests Chinese officials are not as worried as they were previously about the vicious cycle of capital outflows, weaker yuan, and weaker equities. Separately, Chinese data indicate that foreign investors boost their holdings of onshore bonds by CNY162 bln in Q1 and hold CNY1.4 trillion. In June, the MSCI Emerging Markets Index will include A-shares for the first time, and bond benchmarks are gradually including mainland bonds.

Italy

While Italy’s negotiations to form a new government took a new turn as the Five-Star Movement has given up on the Northern League as a partner and is now in talks with the center-left PD. The PD itself is split. A wing following Renzi, who resigned as Prime Minister when his constitutional reform lost, and resigned as head of the party after the election in early March, disavows the M5S, while the other wing is more pragmatic.

Japan

Japanese politics are also very much in the news. Prime Minister Abe continues to suffer in the polls, and, going home with out a concession from the US did not help matters. However, it is the local scandals that continue to ensnare Abe. Today, Vice Finance Minister Fukuda resigned over sexual harassment allegations. In order to stem the hemorrhaging, and allow the government to return to its agenda, there has been some suggestion of a snap election for the lower house.

This seems to be an uncharacteristically dramatic move. In our reading of Japanese political tea leaves, while there may be alternatives of Abe in the wings, there does not seem to be an alternative to Abenomics. We have long seen Abenomics as traditional LDP policy–fiscal and monetary stimulus and a weaker yen bias–but on steroids. And as will likely be seen this week, the dissent from Governor Kuroda at the BOJ will come from those who want to ease more rather than as previously from those of resist the aggressive and unorthodox easing.

United States

Neither the US nor Canada have data on tap today. The spot fx moves leaves the option expiry calendar light as well. The most notable nearby option is for 977 mln euros struck at $1.2220. There is a 4.3 bln euro option struck at $1.22 that expires tomorrow.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,$TLT,Featured,newslettersent,SPY