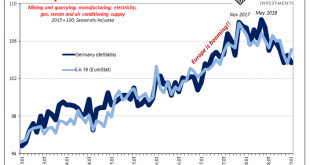

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it. Starting with Europe first, Germany’s deStatis had earlier reported factory orders and production levels in January 2019 while...

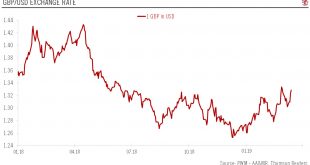

Read More »FX Daily, March 19: Third Vote on Withdrawal Bill Scuppered Until after EU Summit

Swiss Franc The Euro has fallen by 0.09% at 1.1341 EUR/CHF and USD/CHF, March 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets remain subdued. Many Asian equity markets eased after a strong two-day advance. European equities are slightly firmer. The S&P 500 closed at new five-month highs yesterday. Benchmark 10-year yields are mostly a...

Read More »Parliament sets conditions on further EU payments

Justice Minister Karin Keller-Sutter and Foreign Affairs Minister Ignazio Cassis listen to the debate in the House of Representatives on Monday (Keystone) Switzerland should only make another billion-franc “cohesion” payment to the European Union if the EU doesn’t discriminate against Switzerland, parliament has agreed. The House of Representatives on Monday approved the CHF1.3 billion ($1.3 billion) that will help...

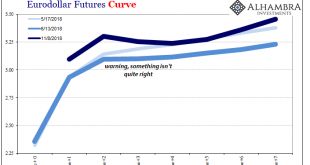

Read More »Chart(s) of the Week: Reviewing Curve Warnings

Quick review: stocks hit a bit of a rough patch right during the height of inflation hysteria. At the end of January 2018, just as the US unemployment rate had finally achieved the very center of attention, global markets were rocked by instability. Unexpectedly, of course. Over the next several weeks, share prices sagged and people blamed it on a number of things: Korean War, the unemployment rate itself (the economy...

Read More »Keynes Was a Vicious Bastard, Report 17 Mar

My goal is to make you mad. Not at me (though I expect to ruffle a few feathers with this one). At the evil being wrought in the name of fighting inflation and maximizing employment. And at the aggressive indifference to this evil, exhibited by the capitalists, the gold bugs, and the otherwise-free-marketers. So, today I am going to do something I have never done. I am going to rant! I am even going to use vulgar...

Read More »FX Daily, March 18: Equities Advance, Dollar Slips, Key Events Awaited

Swiss Franc The Euro has risen by 0.06% at 1.1348 EUR/CHF and USD/CHF, March 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The eventful week has begun off slowly. After Wall Street’s best week in four months underpinned Asian’ equities, where all the markets but Thailand, advanced, led by the nearly 2.5% rally in Shanghai. Note that New Zealand’s...

Read More »Red Cross develops war video games – with rules

The idea that the International Committee of the Red Cross (ICRC) is developing military shooter video games may be a surprise to many. But the aim is not to kill everything that moves; it’s a training tool to teach people that there are rules, even in wartime. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and...

Read More »Red Cross develops war video games – with rules

The idea that the International Committee of the Red Cross (ICRC) is developing military shooter video games may be a surprise to many. But the aim is not to kill everything that moves; it’s a training tool to teach people that there are rules, even in wartime. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos...

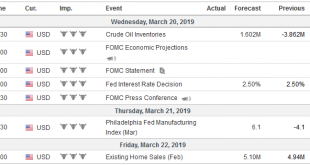

Read More »FX Weekly Preview: Three Highlights in the Week Ahead

Three events next week will shape the investment climate. The Federal Reserve meets and will update its forecasts and guidance. The British House of Commons may vote for a third time on the Withdrawal Bill before Prime Minister May heads of the EU Summit to ask for an extension of the UK leaving the EU. The eurozone sees the flash March PMI, with great hope that the green shoots of spring will be evident. There is...

Read More »Brexit update: UK parliament opts for an extension

After an eventful week in parliament, the Brexit ball is set to keep rolling as MPs move to extend the 29 March deadline. The British Parliament concluded a series of votes on Brexit this week with an intention to extend the 29 March Brexit deadline. What remains unclear at this point is whether the UK will seek a short (two months) or a longer extension (two years). It is also not clear what this extension would be...

Read More » SNB & CHF

SNB & CHF