Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth. Borrowing to Consume Today,...

Read More »America’s Concealed Crisis: Fifty Years of Economic Decline, 1969 to 2019

If we consider the long term, it’s clear America’s economy and society have been declining for the average household for 50 years. What if the “prosperity” of the past 50 years is mostly a statistical mirage for the bottom 80% of households? What if whatever real gains (adjusted for real-world loss of purchasing power) accrued only to the top of the wealth-power pyramid, those closest to financial and political power?...

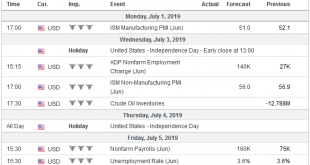

Read More »FX Daily, July 01: Trade Optimism Meet Reality of Disappointing PMI

Swiss Franc The Euro has risen by 0.52% at 1.1155 EUR/CHF and USD/CHF, July 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A new tariff truce between the US and China, coupled with the North Korean diplomacy and Russia-Saudi tentative agreement boosted investor confidence and sharp equity rallies. Japanese and Chinese equities rallied 2-3%. Most markets...

Read More »Swiss Retail Sales, May 2019: -1.6 percent Nominal and -1.7 percent Real

01.07.2019 – Turnover in the retail sector fell by 1.6% in nominal terms in May 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 1.7% in May 2019 compared with the previous year. Real growth...

Read More »FX Weekly Preview: Macro Update: Melodrama Subsides but Capriciousness Remains

Since President Trump declared the end of the tariff truce with China in early May, an important focus for investors was the G20 meeting. It was only as it drew near was a meeting between the two heads of state confirmed. What was billed as an extraordinary meeting reportedly lasted less than 90 minutes, and the results were broadly as expected. The press quotes US officials confirming that the talks are “back on track”...

Read More »Vitol overtakes Glencore as biggest company in Switzerland

In 2018 Vitol boasted growth of 26.8% for a total turnover of CHF226 billion Commodity trader Vitol has taken the top spot in the ranking of the largest companies in Switzerland by total turnover, relegating Zug-based Glencore to second place. According to the rankingexternal link published in the Handelszeitung on Thursday, in 2018 Vitol boasted growth of 26.8% for a total turnover of CHF226 billion ($231 billion)...

Read More »Following in Rome’s Footsteps: Moral Decay, Rising Inequality

Here is the moral decay of America’s ruling elites boiled down to a single word. There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, what’s mine is mine and what’s yours is mine, too. I’ve previously covered two other key...

Read More »Swiss government proposes overhaul of money-laundering laws

In 2018, Switzerland topped the Financial Secrecy Index, produced by the Tax Justice Network The Swiss government wants to revamp the laws against money laundering so that lawyers, notaries and other advisors are required to comply with due diligence obligations. The Federal Council (executive body) proposed on Wednesday a set of legal amendments external linkto meet international standards in the fight against money...

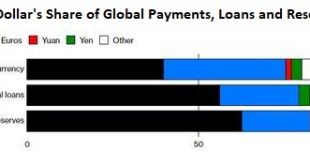

Read More »Could a Cryptocurrency Become a Global Reserve Currency?

Will bitcoin appear on this chart of global reserve currencies in the future? Could a non-state cryptocurrency like bitcoin become a global reserve currency? I first proposed the idea back in November 2013, long before bitcoin’s rise to $19,000, decline to $3,200, recent ascent to $13,000 and current retrace. The idea is intriguing on a number of levels. In terms of retaining value though thick and thin, the ultimate...

Read More »Swiss mortgages and bank profits rise as jobs scale down

The Swiss banking industry continues to turn in a profit despite low interest rates. Swiss commercial banks achieved higher profits last year, mortgage loans tipped the CHF1 trillion ($1.02 trillion) mark and costs were saved by reducing headcounts. These are the findings of an annual report from the Swiss National bank (SNB). The SNBexternal link’s “Banks in Switzerlandexternal link” annual report shows combined Swiss...

Read More » SNB & CHF

SNB & CHF