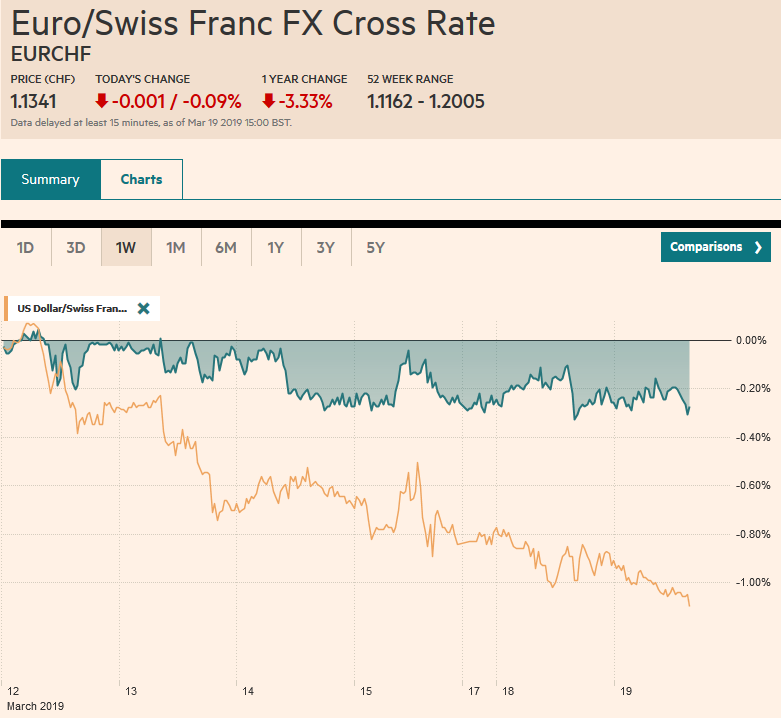

Swiss Franc The Euro has fallen by 0.09% at 1.1341 EUR/CHF and USD/CHF, March 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets remain subdued. Many Asian equity markets eased after a strong two-day advance. European equities are slightly firmer. The S&P 500 closed at new five-month highs yesterday. Benchmark 10-year yields are mostly a little softer. Australian 10-year bond yield fell five basis points, and the discount to the US widened to a new high since the early 1980s. The minutes from the Reserve Bank of Australia underscore the importance of this week’s employment data. The dollar has a heavier bias today but is confined to

Topics:

Marc Chandler considers the following as important: $INR, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.09% at 1.1341 |

EUR/CHF and USD/CHF, March 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The capital markets remain subdued. Many Asian equity markets eased after a strong two-day advance. European equities are slightly firmer. The S&P 500 closed at new five-month highs yesterday. Benchmark 10-year yields are mostly a little softer. Australian 10-year bond yield fell five basis points, and the discount to the US widened to a new high since the early 1980s. The minutes from the Reserve Bank of Australia underscore the importance of this week’s employment data. The dollar has a heavier bias today but is confined to well-worn ranges. In emerging markets, the high-flying Indian rupee succumbed to a bout of profit-taking, while Hungary and Poland are leading the emerging market complex higher today. |

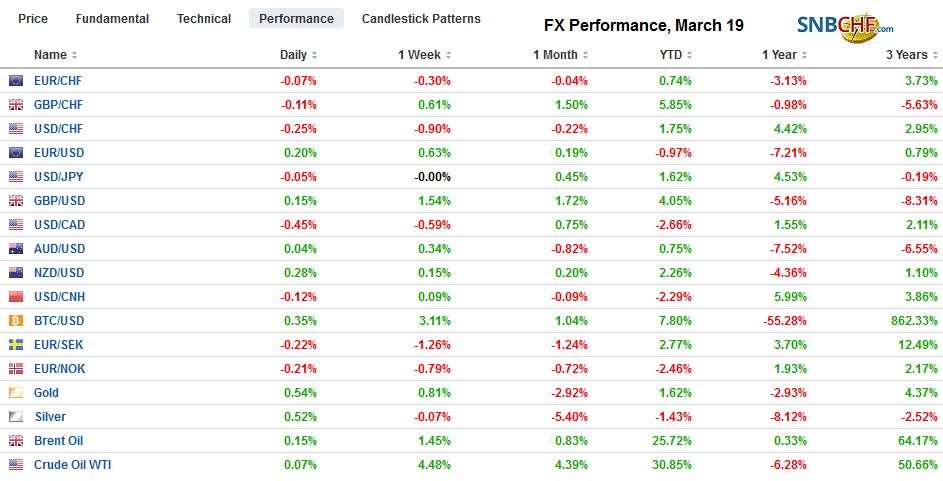

FX Performance, March 19 |

Asia Pacific

Minutes from the Reserve Bank of Australia’s March 5 meeting did not show a central bank that was on the verge of cutting interest rates. It underscored the importance of the labor market and recognized uncertainty over the outlook for consumption given the risk of further decline in house prices. The central bank recognized the pressure for funding that has lifted money market rates. There are steps shy of a rate cut that the RBA can do to relieve that pressure. Australia reports February employment data on Thursday. Job creation slowed over the course of 2018. The 12-month moving average eased from around 36k at the beginning of last year to almost 22k. The median forecast in the Bloomberg survey called for a 15k increase. The unemployment rate is expected to be steady at 5%.

Pressure on the Hong Kong dollar remains. The Hong Kong Monetary Authority intervened for the third time this month yesterday as the US dollar threatened to push above HKD7.85. The intervention (HKD2.01 bln yesterday), bring the intervention in this operation to HKD7.4 bln or almost $1 bln. The intervention works because it reduces the liquidity for the Hong Kong dollar and pushes up interest rates. However, the intervention thus far is seen as relatively modest and not aggressive enough to snug liquidity. One-month rates in HK are nearly 100 bp below US rates. Some observers see the rally in Chinese mainland shares as a cause of the Hong Kong dollar’s woes, but interest rate differentials alone can explain its weakness. Moreover, without having a view on the direction of Chinese stocks, HKMA will probably have to continue to show its hand. Indeed, intervention needs to turn more aggressive it official are to succeed in lifting the HKD off its floor.

The Australian dollar is trading about a 10-tick range around $0.7100, where an expiring A$656 mln option is struck. Short-term technical indicators look constructive. Yesterday’s high of $0.7120 was its best level since March 1. Support is pegged at $0.7080. The dollar has once against been turned back from the JPY112.00 area that it has approached before the weekend and today tested JPY111.15. There are chunky options struck between JPY111.35 and JPY111.50 for a cumulative $1.8 bln that expire today. The dollar tested the JPY110.80 support area after the disappointing US employment data. The dollar initially extended its losses against the Indian rupee to INR68.35, its lowest level since last August before reversing higher to almost INR68.90 to snap the six-session advance.

Europe

Prime Minister May’s plan to hold a third vote on the Withdrawal Bill was effectively blocked by Speaker Bercow. Citing precedent from 1604, he claimed that the Prime Minister could not keep submitting the same bill for consideration. He said it must be “fundamentally different.” Just like Attorney General Cox’s judgment about the backstop became pivotal in the protracted process, Bercow’s move was also a judgment call, which reasonable can differ. May’s brinkmanship strategy was showing signs of progress. The Withdrawal Bill lost by a historic margin of 230 votes the first time and 149 votes the second time.

Where does Brexit stand now? Reports suggest May will request a 9-12 month delay, though she will likely be pressed about how the UK will spend that period. Meanwhile, there is some talk that the EU could consider changing the Withdrawal Bill exit to July 1, which Bercow would likely recognize as a sufficient change to have the vote again on the Withdrawal Bill one more time before the end of the month.

The UK reported better than expected jobs growth. In the three months through January, the UK created 222k jobs, about 100k more than economists expected. The unemployment rate edged down to 3.9% form 4.0%. Average weekly earnings remained steady at 3.4% (three months year-over-year). The otherwise favorable report was marred by the claimant count, which rose in February by 27k, which was surpassed only once last year.

The German ZEW had something for everyone. The current assessment fell to 11.1 from 15. It a greater decline than expected and it is the sixth consecutive monthly decline. On the other hand, the expectations component moved higher for the fifth consecutive month. The -3.6 reading compares with -13.4 in February and minus nearly 25 last November. We suspect the worst is behind Germany but the pace of the recovery is not yet clear.

Near $1.1350, the euro is trading near its best level in 2.5 weeks, completely recouping ECB-inspired losses. It may struggle to significantly extend yesterday’s gains that saw $1.1360. A 1.2 bln euro $1.13 option that expires today may not be in play. Sterling also looks to be going nowhere quickly. There are expiring options for around GBP940 mln at $1.3290-$1.3300, which may be sufficient to cap the upside.

America

The FOMC meeting concludes tomorrow and between the softer inflation readings, disappointing job growth and the soggy manufacturing output reinforces ideas that the central bank is out of the picture for the coming months. Many economists share former NY Fed President Dudley’s belief that the economy is likely to regain momentum with increasing price pressures that may bring the Fed back into play in H2. The market disagrees. The January 2020 fed funds futures contract implies an average effective yield of 2.31%. The current average effective rate is 2.40%.

With the US 10-year yield slightly below 2.60%,the lower end of where it has traded over the past 15 months or so many observers conclude that is warning of an economic downturn somehow we are told in contradiction to the equity market that has stormed back and the S&P 500 reached its best level since last October. We suggest that there are two main explanatory models of prices. One links it to the macroeconomic data. That is the one on which the consensus narrative dwells. However, there is an alternative model. It is based on liquidity. It says, for example, the low 10-year yield might not reflect growth or inflation outlooks but the fact that around a sixth of all debt has a negative yield. The German 10-year Bund is yielding less than 10 bp. The 10-year Japanese government bond offers minus five basis points yield. One pays to borrow from Spain out for four years. The French yield curve is negative out six years.

The US reports January factory and durable goods orders. It is the last piece of macro data ahead of the FOMC decision tomorrow. We have learned from the preliminary release that durable goods orders rose for the third consecutive month in January (0.4%). Under-appreciated is the fact that it is the longest advance since 2014. There is some talk that given the outsized role of large ticket items, like airplane and airplane equipment, the impact from Boeing’s problems could seep into the data in the coming months.

The Trudeau government in Canada will submit what could be its last budget today. Trudeau’s Liberal Party is slipping in the polls ahead of the national election later this year. A cabinet reshuffle yesterday does not appear to have stemmed the problem. Wernick, at the center of the controversy, resigned yesterday from his post as Clerk of the Privy Council. He is the fourth senior official to resign. Separately, Canada reported a surge of foreign buying of Canada’s stocks and bonds in January after large-scale liquidation at the end of last year. Foreign investors sold C$20.4 bln of Canadian assets in December the most since 2007. They returned with vengeance in January, buying C$28.4 bln of Canada’s stocks and bonds the most since May 2017.

The Canadian dollar is inside yesterday’s range, which was inside the pre-weekend range. The US dollar is caught between the 20-day moving average just below CAD1.33 and the recent high near CAD1.3370. Meanwhile, the dollar has eased to almost MXN19.00. It has not closed above there since late January. The low for the year is near MXN19.88. The Dollar Index is slipping through last week’s lows. Trendline support from the January low is found near 96.25, and the February low was a little above 95.80.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$INR,$JPY,Featured,newsletter