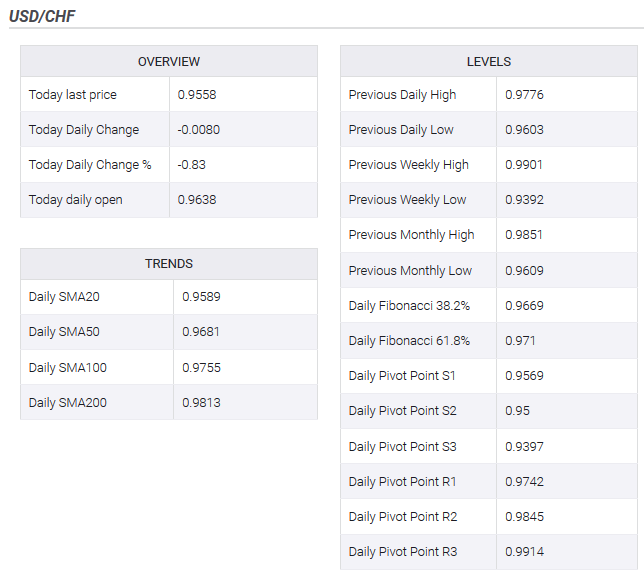

USD/CHF traded with a positive bias for the sixth consecutive session on Monday. Bulls are likely to wait for a sustained move beyond the very important 200-DMA. The USD/CHF pair built on last week’s goodish positive move of around 300 pips and continued gaining traction for the sixth straight session on Monday. The pair climbed to near two-week tops in the last hour, with bulls now looking to extend the momentum further beyond the 0.9800 round-figure mark. The mentioned handle nears the very important 200-day SMA, around the 0.9810 region, which if cleared might be seen as a fresh trigger for bullish traders. Meanwhile, technical indicators on the daily chart have just started moving into the positive territory and further reinforce prospects for an extension of

Topics:

Haresh Menghani considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF traded with a positive bias for the sixth consecutive session on Monday.

- Bulls are likely to wait for a sustained move beyond the very important 200-DMA.

| The USD/CHF pair built on last week’s goodish positive move of around 300 pips and continued gaining traction for the sixth straight session on Monday.

The pair climbed to near two-week tops in the last hour, with bulls now looking to extend the momentum further beyond the 0.9800 round-figure mark. The mentioned handle nears the very important 200-day SMA, around the 0.9810 region, which if cleared might be seen as a fresh trigger for bullish traders. Meanwhile, technical indicators on the daily chart have just started moving into the positive territory and further reinforce prospects for an extension of the positive move. Hence, some follow-through strength, towards challenging a near one-year-old descending trend-line resistance near the 0.9900 mark, now looks a distinct possibility. On the flip side, any meaningful pullback might still be seen as an opportunity to initiate some fresh bullish positions and should remain limited near the 0.9715-10 region. Failure to defend the mentioned support might prompt some aggressive technical selling and drag the pair further towards its next support near the 0.9625 region. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

Tags: Featured,newsletter

-637217795705356366.png)

-637211742211799359-150x73.png)