Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows. “New Yorker Lohanny Santos publicly vented her frustration after her attempts to go door-to-door with her CV in hand in the hope of finally landing a job were unsuccessful. It would appear that other young jobseekers could relate to Lohanny’s struggles. The USA and Canada rank fifth out of seven when it

Topics:

Lance Roberts considers the following as important: 9) Personal Investment, 9a.) Real Investment Advice, Bear Market, earnings, economy, Featured, Federal Reserve, financial markets, Financial Planning, Interest rates, Investing, newsletter, Recession, retirement income, S&P 500, S&P 500, stocks, valuations

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November.

Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows.

“New Yorker Lohanny Santos publicly vented her frustration after her attempts to go door-to-door with her CV in hand in the hope of finally landing a job were unsuccessful.

It would appear that other young jobseekers could relate to Lohanny’s struggles. The USA and Canada rank fifth out of seven when it comes to youth unemployment and third when it comes to total unemployment, according to World Bank data based on an International Labor Organization model for 2020, as per Statista.” – Business Insider

Even M.B.A.s are finding it difficult.

“Jenna Starr stuck a blue Post-it Note to her monitor a few months after getting her M.B.A. from Yale University last May. “Get yourself the job,” it read. It wasn’t until last week—when she received a long-awaited offer—that she could finally take it down.

For months, Starr has been one of a large number of 2023 M.B.A. graduates whose job searches have collided with a slowdown in hiring for well-paid, white-collar positions. Her search for a job in sustainability began before graduation, and she applied for more than 100 openings since, including in the field she used to work in—nonprofit fundraising.” – WSJ

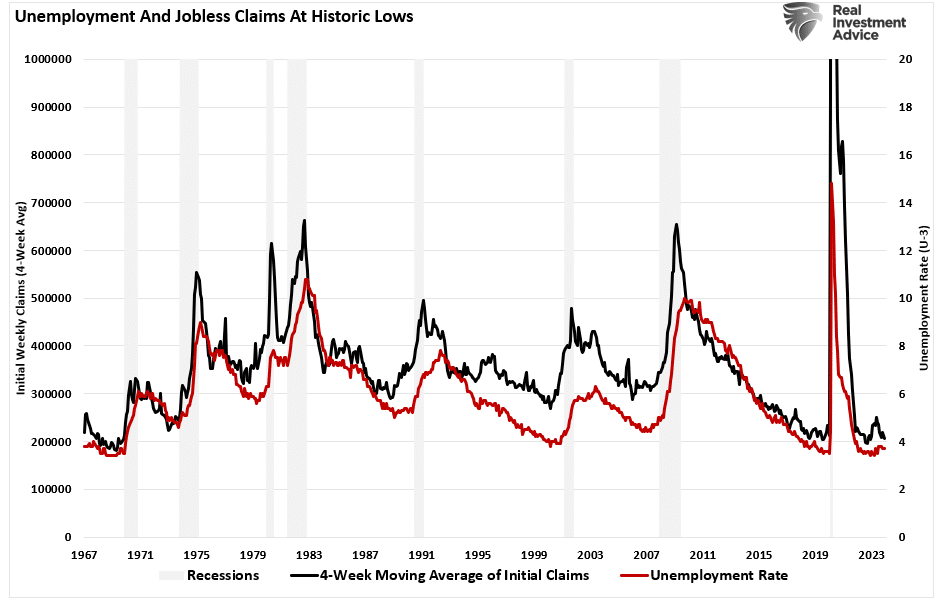

| These stories are not unique. If you Google “Can’t find a job,” you will get many article links. The question, of course, is why individuals with college degrees, no less, are having such a tough time finding employment. After all, aside from record-smashing employment reports, we also continue to see near-record low jobless claims and high numbers of job openings, as shown below. | |

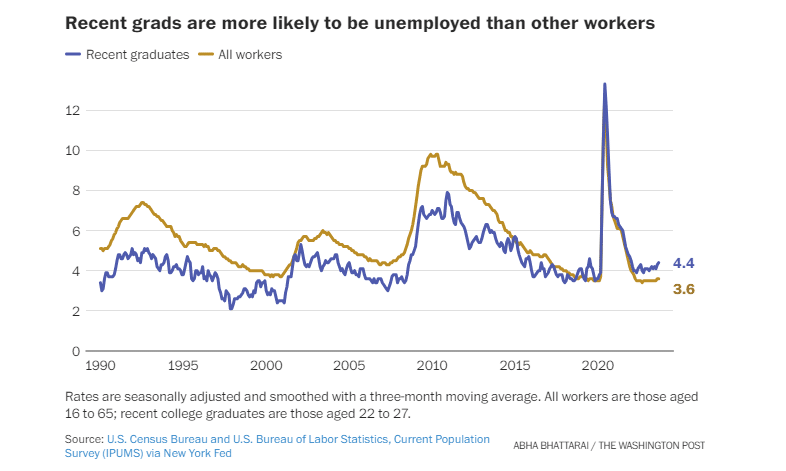

The Washington Post touched on part of the problem and why the unemployment rate for college graduates is higher than for all workers.

As the Washington Post summed up:

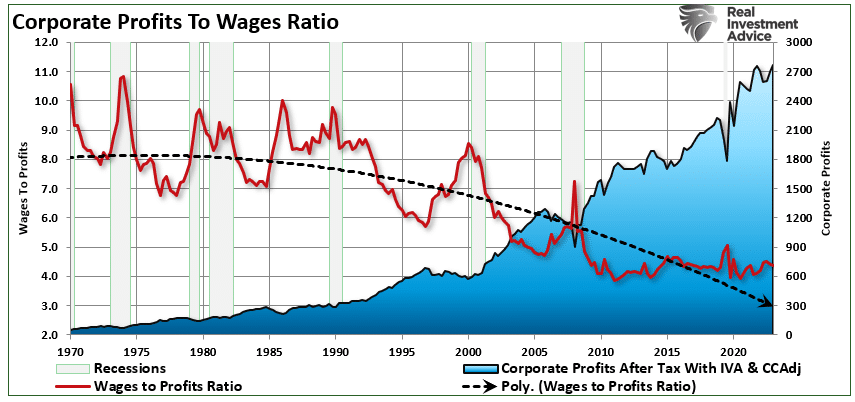

Of course, it isn’t just the shuttering of the economy and the shift to working from home causing the problem. It is also the shift in demand from consumers to more service-oriented conveniences, combined with the need by employers to maintain profitability. |

|

Fed Chair Powell Says The Quiet PartSince the turn of the century, the U.S. economy has shifted from a manufacturing-based economy to a service-oriented one. There are two primary reasons for this. The first is that the “cost of labor” in the U.S. to manufacture goods is too high. Domestic workers want high wages, benefits, paid vacations, personal time off, etc. On top of that are the numerous regulations on businesses from OSHA to Sarbanes-Oxley, FDA, EPA, and many others. All those additional costs are a factor in producing goods or services. Therefore, corporations needed to offshore production to countries with lower labor costs and higher production rates to manufacture goods competitively. During an interview with Greg Hays of Carrier Industries, the reasoning for moving a plant from Mexico to Indiana during the Trump Administration was most interesting.

Fed Chair Powell emphasized this point in a recent 60-Minutes Interview. To wit: “SCOTT PELLEY: Why was immigration important? FED CHAIR POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans. But that’s primarily because of the age difference. They tend to skew younger.“ The suppression of wages, increased productivity to reduce the amount of required labor, and offshoring has been a multi-decade process to increase corporate profitability. |

|

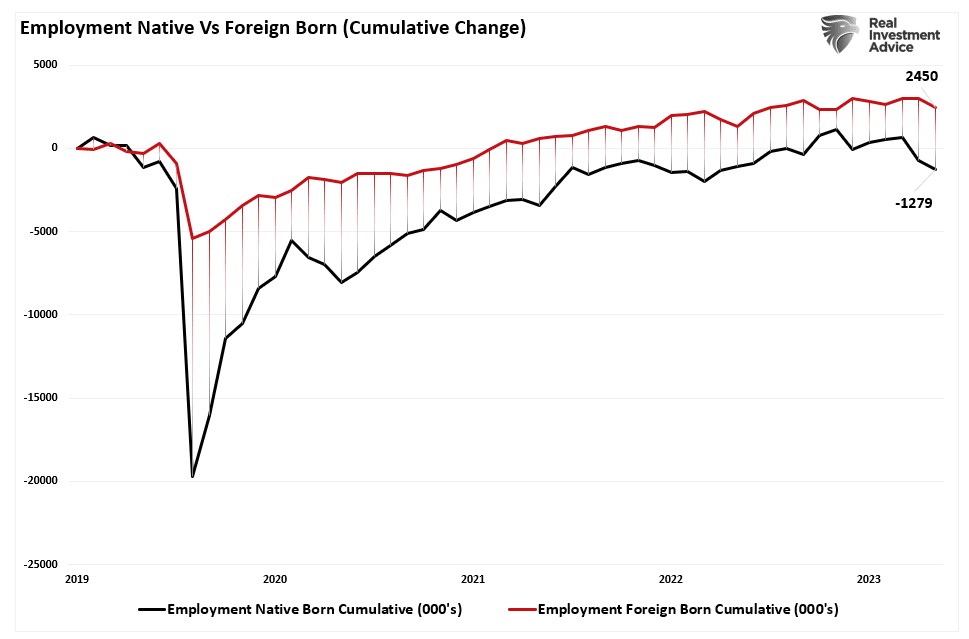

A Native ProblemFollowing the pandemic-related shutdown, corporations faced multiple threats to profitability from supply constraints, a shift to increased services, and a lack of labor. At the same time, mass immigration (both legal and illegal) provided a workforce willing to fill lower-wage paying jobs and work regardless of the shutdown. Since 2019, the cumulative employment change has favored foreign-born workers, who have gained almost 2.5 million jobs, while native-born workers have lost 1.3 million. Unsurprisingly, foreign-born workers also lost far fewer jobs during the pandemic shutdown. |

|

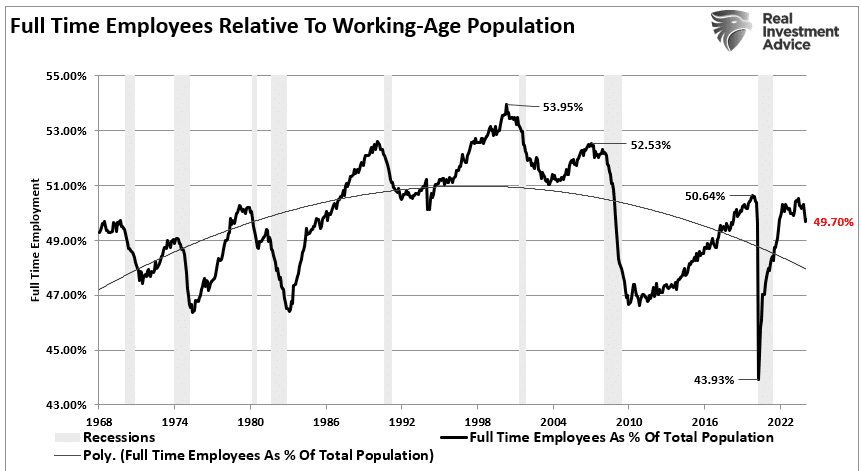

| Given that the bulk of employment continues to be in lower-wage paying service jobs (i.e., restaurants, retail, leisure, and hospitality) such is why part-time jobs have dominated full-time in recent reports. Relative to the working-age population, full-time employment has dropped sharply after failing to recover pre-pandemic levels. | |

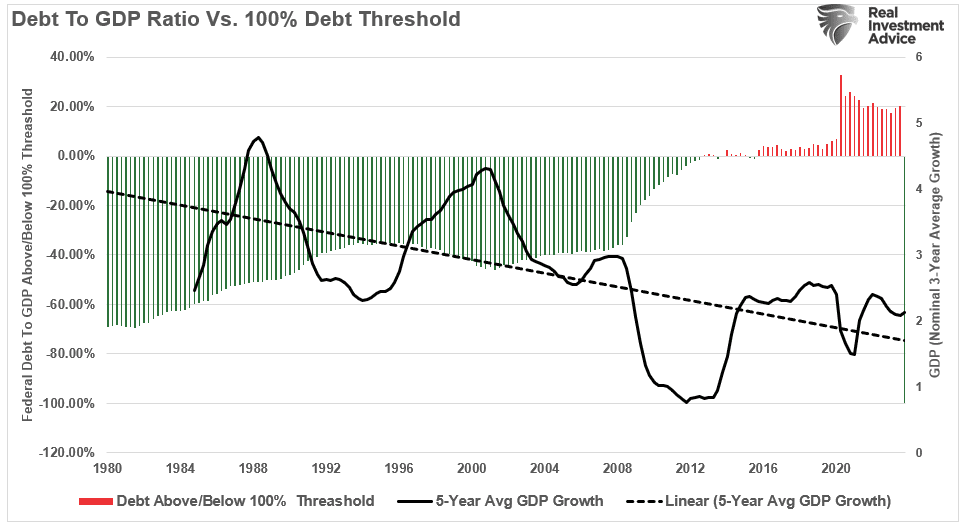

| However, as noted, full-time employment has declined since 2000 as services dominate labor-intensive processes such as manufacturing. This is because we “export” our “inflation” and import “deflation.” We do this to buy flat-screen televisions for $299 versus $3,999. Such is also why the economy continues to grow slower, requiring ever-increasing debt levels.

For recent college graduates, this all leads to a more dire outlook. |

|

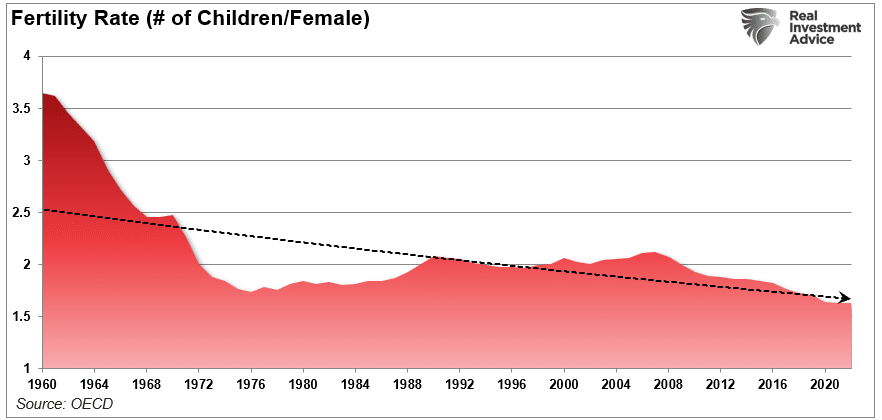

Immigration Is Needed, But It Has ConsequencesTo keep an economy growing, you must have population growth. In other words, “demographics are destiny.” As such, there are two ways to obtain more robust population growth rates – natural births and immigration. As shown below, the fertility rate in the United States is problematic in that we aren’t producing enough children to replace an aging workforce. |

|

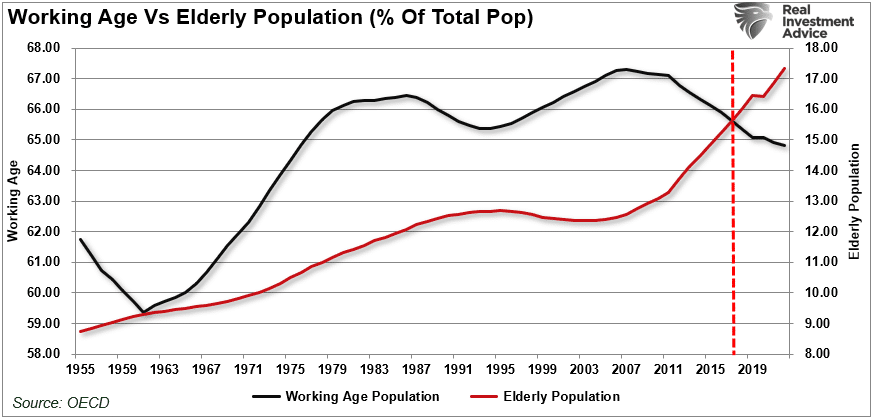

| Such is particularly problematic given the rapid aging of older adults versus a declining working-age population. Such means the underfunding of entitlements will continue to grow, requiring more debt issuance to fill the gap.

However, there is a vast difference between immigration policies that import highly skilled workers, capital, and education versus those that don’t. Merit-based immigration policies bring workers who earn higher salaries, create businesses, employ labor, and create tax revenues and other economic contributions. However, current policies are creating a rush of lower-skilled, uneducated labor that will work for cheaper wages, produce less revenue, and are subsidized by tax-payers through welfare programs. As noted above, these workers tend to fill the jobs in the service areas of the economy, thereby displacing native-born workers. Such was a point made by the WSJ: |

“Before the pandemic, foreign-born adults were almost as likely as the overall population to hold at least a bachelor’s degree. This was mainly because of higher educational attainment among immigrants from Asia, Africa, and Europe, which offset lower levels of schooling among people from Mexico and Central America.”

Post-pandemic, this has not been the case, which is impacting native-born employment. This is not a new issue, but one addressed by Bill Clinton in the 1995 State of the Union Address:

“The jobs they hold might otherwise be held by citizens or legal immigrants; the public services they use impose burdens on our taxpayers.”

Such is the natural consequence of a change in the economy’s demands and the need for corporations to maintain profitability in an ultimately deflationary environment.

Conclusion

While there is much debate over immigration, most of the arguments do not differentiate between legal and illegal immigration. There are certainly arguments that can be made on both sides. However, what is less debatable is the impact that immigration is having on employment. Of course, as native-born workers continue to demand higher wages, benefits, and other tax-funded support, those costs must be passed on by the companies creating those products and services. At the same time, consumers are demanding lower prices.

That imbalance between input costs and selling price drives companies to aggressively seek options to reduce the highest cost to any business – labor. Such was discussed in our article on the cost and consequences of the demand for increased minimum wages.

- Reductions in employment would initially be concentrated at firms where higher prices quickly reduce sales.

- Over a longer period, however, more firms would replace low-wage workers with higher-wage workers, machines, and other substitutes.

- As employers pass some of those costs on to consumers, consumers purchase fewer goods and services.

- Consequently, the employers produce fewer goods and services.

- When the cost of employing low-wage workers rises, the cost of investing in machines and technology goes down.” – Congressional Budget Office.

Such is why full-time employment has declined since 2000 despite the surge in the Internet economy, robotics, and artificial intelligence. It is also why wage growth fails to grow fast enough to sustain the cost of living for the average American. These technological developments increased employee productivity, reducing the need for additional labor.

Unfortunately, these tales of college graduates expecting high-paying jobs will likely continue to find it increasingly complicated. Particularly as “Artificial Intelligence” becomes cheap enough to displace higher-paid employees.

The post Fed Chair Powell Just Said The Quiet Part Out Loud appeared first on RIA.

Tags: Bear Market,earnings,economy,Featured,Federal Reserve,Financial markets,Financial Planning,Interest rates,Investing,newsletter,recession,retirement income,S&P 500,stocks,valuations