The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year. To wit: “It has been two years since forecasters felt this good about the economic outlook. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey. That was the lowest probability...

Read More »Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC: The job market looks solid on paper. According to government data, U.S. employers added 2.7...

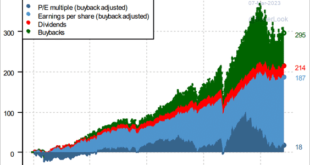

Read More »Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote. “The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The decomposition of returns for the...

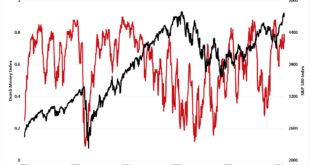

Read More »Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites. “Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P...

Read More »Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies. From a portfolio management perspective, we must understand what happens during election years concerning the stock market and investor returns. Since 1833, the S&P 500 index has...

Read More »Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows. “New...

Read More »Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Our guest this week is Ed Steer, expert gold and market analyst and author of the Gold & Silver Digest. We invited Ed onto GoldCore TV to get his take on what is concerning him most in financial markets, movements in SLV and sanctions against Russia. He also draws our attention to central bank purchases of gold. Ed’s interview serves as a reminder that those who currently do own gold and silver are just the tip of the iceberg when it comes to the number of people...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

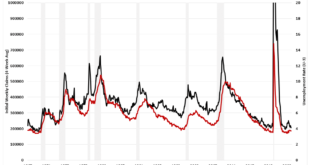

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

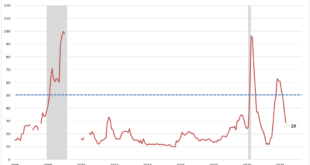

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org