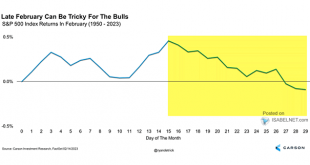

Inside This Week's Bull Bear Report CFNAI Index Suggests Economy Is Slowing How We Are Trading It Research Report - CAPE-5, A Better Measure Youtube - Before The Bell Market Statistics Stock Screens Portfolio Trades This Week February Weakness And The Outlook For March Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. Over the previous week, the market fell sharply following...

Read More »CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90s, if you were buying...

Read More »CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90s, if you were buying...

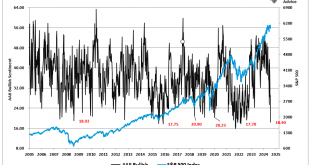

Read More »Retail Investors Are Suddenly Bearish

The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this is only the sixth time since 1987 that bearish sentiment has been above 60%. Furthermore, the five-week change in the index...

Read More »Retail Investors Are Suddenly Bearish

The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this is only the sixth time since 1987 that bearish sentiment has been above 60%. Furthermore, the five-week change in the index...

Read More »Understanding Required Minimum Distributions (RMDs) and Their Tax Implications

Required Minimum Distributions (RMDs) are an essential part of managing your retirement accounts and income in retirement. While they provide a way to access your savings, RMDs can have significant tax implications if not handled properly. Understanding how RMDs work, which accounts they affect, and strategies to minimize their tax impact can help you optimize your retirement plan and protect your hard-earned savings. What Are Required Minimum Distributions...

Read More »Understanding Required Minimum Distributions (RMDs) and Their Tax Implications

Required Minimum Distributions (RMDs) are an essential part of managing your retirement accounts and income in retirement. While they provide a way to access your savings, RMDs can have significant tax implications if not handled properly. Understanding how RMDs work, which accounts they affect, and strategies to minimize their tax impact can help you optimize your retirement plan and protect your hard-earned savings. What Are Required Minimum Distributions...

Read More »Consumers Are Losing Confidence

Consumer Confidence, as surveyed by the Conference Board and University of Michigan, shows consumers are starting to lose economic confidence. Given that consumer spending drives the economy and influences inflation, confidence and the means to spend can significantly impact markets. Based on recent job data, the means (i.e., wages) to consume appear to be in good shape. However, consumer savings are historically low, while credit card balances are high. Recently,...

Read More »Consumers Are Losing Confidence

Consumer Confidence, as surveyed by the Conference Board and University of Michigan, shows consumers are starting to lose economic confidence. Given that consumer spending drives the economy and influences inflation, confidence and the means to spend can significantly impact markets. Based on recent job data, the means (i.e., wages) to consume appear to be in good shape. However, consumer savings are historically low, while credit card balances are high. Recently,...

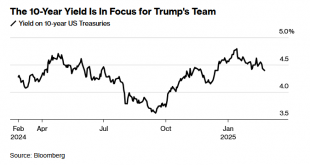

Read More »The Trump 2.0 Put: Got Bonds?

During Donald Trump's first term, some investors bought into the Trump 1.0 Put. The trade was based on the market's belief that Trump believed the stock market's performance was a referendum on his presidency. Accordingly, investors thought that Trump would do everything he could to backstop the stock market if it fell. Thus, some investors thought it worthwhile to sell puts, collect the proceeds, and sit back comfortably, not fearing losses. According to a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org