When planning for retirement, most people focus on savings, investments, and budgeting for daily living expenses. However, one critical component that often gets overlooked is an emergency fund. Having an emergency fund in retirement is essential for maintaining financial stability and peace of mind. Unexpected expenses, such as medical bills or home repairs, can derail even the most carefully constructed financial plan. This guide explains the importance of...

Read More »The Comprehensive Approach to Crafting a Future Financial Plan

Securing your financial future begins with a comprehensive plan. This guide explores the fundamentals of financial planning, building a holistic strategy, and effective retirement techniques. Readers will learn how to navigate financial statements, manage tax planning, and engage with a financial advisor for wealth planning. Whether dealing with a single audit or seeking to enhance your financial strategy, RIA Advisors offers the insights needed to address these...

Read More »Rosso’s Top 2025 Reads and Holiday Gift Idea.

As most know, books are my passion. For me, it's all about gifting knowledge for the holiday season. There's nothing more exciting to me than to peruse used book outlets and antique stores that sell ancient reads for pennies on the dollar. Also, new book releases excite me. My reading topic interests vary. However, most tend to be business or macroeconomic trend related. With that: Here are my top reads for 2025 and holiday gift idea for all the voracious...

Read More »What a Financial Advisor? Consider these Seven Concepts.

So, you need a financial advisor, but do you truly understand the full extent of the benefits? Consider these Magnificent Seven Concepts: Concept One: Financial Advisors are NOT Portfolio Managers. Most consumers believe that financial advisors are primarily investment selectors and asset managers. While these duties are valid, they are not at the top of an advisor’s list or priorities. Many financial advisors outsource these duties to third-party experts...

Read More »Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year. To wit: “It has been two years since forecasters felt this good about the economic outlook. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey. That was the lowest probability...

Read More »Immigration And Its Impact On Employment

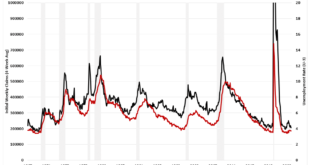

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC: The job market looks solid on paper. According to government data, U.S. employers added 2.7...

Read More »Blackout Of Buybacks Threatens Bullish Run

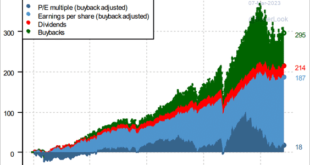

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote. “The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The decomposition of returns for the...

Read More »Digital Currency And Gold As Speculative Warnings

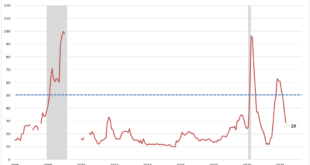

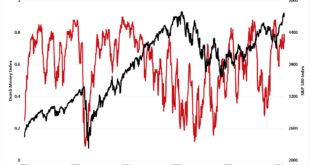

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites. “Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P...

Read More »Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies. From a portfolio management perspective, we must understand what happens during election years concerning the stock market and investor returns. Since 1833, the S&P 500 index has...

Read More »Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows. “New...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org