The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year. To wit: “It has been two years since forecasters felt this good about the economic outlook. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey. That was the lowest probability...

Read More »Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC: The job market looks solid on paper. According to government data, U.S. employers added 2.7...

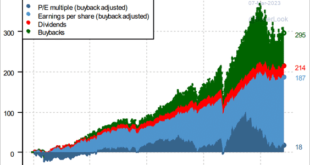

Read More »Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote. “The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The decomposition of returns for the...

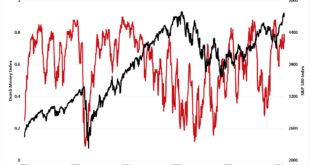

Read More »Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites. “Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P...

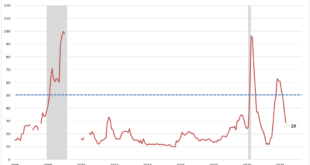

Read More »Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies. From a portfolio management perspective, we must understand what happens during election years concerning the stock market and investor returns. Since 1833, the S&P 500 index has...

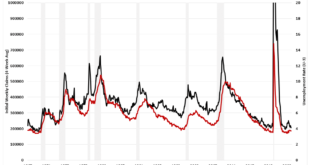

Read More »Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows. “New...

Read More »2023 Retirement Plan Contribution Limits

Worried about saving enough for retirement? You can put away more next year. The IRS has just announced the new retirement plan contribution limits for 2023. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases to $22,500, up from $20,500. For individuals 50 and older, the catch-up contribution limit goes to $7,500, up from $6,500. So, if you qualify for catch-up...

Read More »Medicare Part B Premiums Will Go Down in 2023

In a world where the price of everything is going up, Medicare recipients get a price cut beginning January 1, 2023. The Centers for Medicare and Medicaid Services (CMS) just announced that the monthly premium for Medicare Part B, which covers doctor visits, diagnostic tests, and other outpatient services, is decreasing $5.20 per month to $164.90. That’s good news in light of the 14.5% increase in Part B premiums in 2022, the largest dollar increase in the history...

Read More »Employees Want Paychecks for Life: Pros and Cons of Guaranteed Lifetime Income

Annuities and similar products may help address retirement readiness in an aging workforce People are living longer, which means they may need their retirement savings to last decades. As a result, nearly half (48%) of participants are concerned about outliving their retirement savings. Many Americans don’t know how to transform their savings into retirement income. Guaranteed income offerings can help ease this concern by providing consistent, predictable payments...

Read More »How Could Inflation Impact Corporate Retirement Plans?

Increasing prices may put pressure on employers and delay workers from retiring Inflation is the increase in the general price of goods and services, which can decrease the purchasing power of American workers. So how does this recent upward trend affect your workplace benefits, employees and retirement plan? Salaries, Flexibility and Savings When inflation goes up, the same paycheck doesn’t stretch as far. With the increased costs of food & beverage,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org