One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90s, if you were buying...

Read More »CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90s, if you were buying...

Read More »Estimates By Analysts Have Gone Parabolic

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing exuberance on Wall Street. As noted last week, correlations between all asset classes, whether international or emerging markets, gold or bitcoin, have all gone to one. Unsurprisingly, rationalizations justify illogic when too much money is chasing too few assets. Therefore, it should not be...

Read More »The Impact Of Tariffs Is Not As Bearish As Predicted

There are many media-driven narratives about the impact of tariffs on the economy and the markets. Most of them are incredibly bearish, predicting the absolute worst possible outcomes. For fun, I asked ChatGPT what the expected impact of Trump's tariffs will likely be. Here is the answer: "One of the immediate consequences of increased tariffs is higher consumer prices. Tariffs function as an import tax, and companies that rely on foreign goods often pass these...

Read More »Bull Bear Report – Technical Update

I could not produce our weekly Bull Bear Report this past weekend as I presented at Michael Campbell's Moneytalks Conference in Vancouver. However, I wanted to use today's technical update to review some of the statistical analysis we produce each week in that commentary. Such is mainly the case given last Monday's "tariff" shock and Friday's employment report. (Subscribe for free to the weekly Bull Bear Report.) It was a second volatile week of trading, which was...

Read More »Forecasting Error Puts Fed On Wrong Side Again

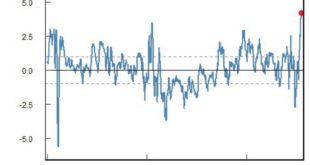

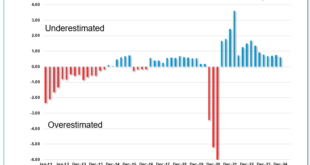

The Federal Reserve's record of forecasting has frequently led it to respond too late to changes in economic and financial conditions. In the most recent FOMC meeting, the Federal Reserve changed its statement to support a pause in the current interest rate-cutting cycle. As noted by Forbes: "The policy-setting Federal Open Market Committee agreed unanimously to hold the target federal funds rate at 4.25% to 4.5%, the U.S. central bank announced Wednesday...

Read More »Tariffs Roil Markets

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. Such was not unexpected, as contained in the Trump tariff Executive Order {SEE HERE}. Specifically, that order stated: "[Sec 2, SubSection (h)]: Sec. 2. (a) All articles that are products of Canada as defined by the Federal Register notice described in subsection (e) of this section (Federal Register notice), and except for those products...

Read More »Permabull? Hardly.

I never thought someone would label me a "Permabull." This is particularly true of the numerous articles I wrote over the years about the risks of excess valuations, monetary interventions, and artificially suppressed interest rates. However, here we are. "Lance, you are just another permabull talking your book. When this market crashes you will still be telling people to buy all the way down." I get it. We have been bullish over the last couple of years, but...

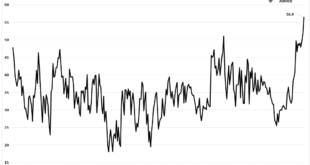

Read More »Portfolio Rebalancing And Valuations. Two Risks We Are Watching.

While analysts are currently very optimistic about the market, the combined risk of high valuations and the need to rebalance portfolios in the short term may pose an unanticipated threat. This is particularly the case given the current high degree of speculation and leverage in the market. It is fascinating how quickly people forget the painful beating of taking on excess risk and revert to the same thesis of why "this time is different." For example, I recently...

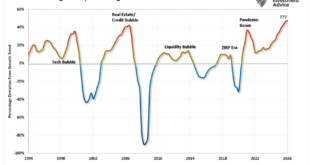

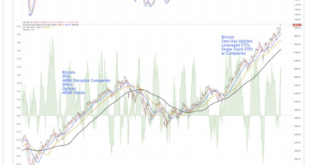

Read More »Leverage And Speculation Are At Extremes

Financial markets often move in cycles where enthusiasm drives prices higher, sometimes far beyond what fundamentals justify. As discussed in last week's #BullBearReport, leverage and speculation are at the heart of many such cycles. These two powerful forces support the amplification of gains during upswings but can accelerate losses in downturns. Today’s market environment shows growing signs of these behaviors, particularly in options trading and leveraged...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org